Bithereum_io

@t_Bithereum_io

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

Bithereum_io

HIGHUSDT 12H

#HIGH is testing the descending resistance and the SMA50 on the 12H timeframe. In case of a breakout above both levels, the potential targets are: 🎯 $0.300 🎯 $0.332 🎯 $0.363 🎯 $0.408 🎯 $0.466 ❌ Invalidation: a 12H candle closing below the support zone. ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

LQTYUSDT 1D

#LQTY daily chart looks promising. RSI and MACD are showing potential bullish momentum. Price has broken above the daily SMA50 and the Ichimoku cloud, but the daily candle hasn’t closed yet. Volume has increased and price has reached the descending resistance. The structure is bullish. In case of a breakout above the descending resistance, the potential targets are: 🎯 $0.680 🎯 $0.742 🎯 $0.832 🎯 $0.946 🎯 $1.056 ⚠️ Always remember to protect your capital with a proper stop-loss and disciplined risk management.

Bithereum_io

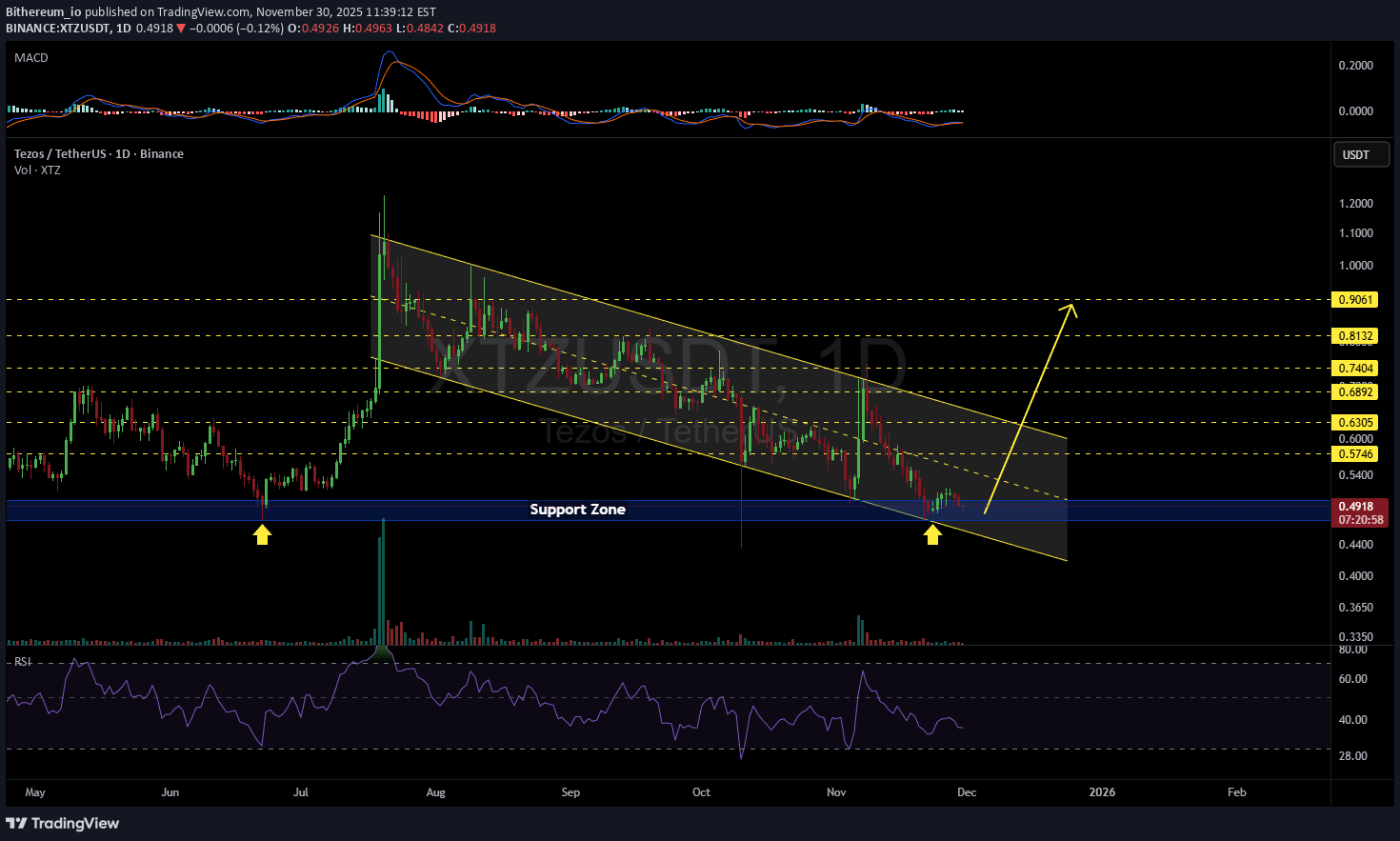

#XTZUSDT 1D

#XTZ is moving inside a descending channel on the daily timeframe and is currently sitting on the support zone. For the bullish scenario, it must bounce from this zone with strong volume. Do not enter here yet — volume is weak, and the RSI suggests there is still room for further downside. If a successful bounce occurs, we can look for the following short-term targets: 🎯 $0.5746 🎯 $0.6305 And if price breaks above the channel resistance, the next upside targets are: 🎯 $0.6892 🎯 $0.7404 🎯 $0.8132 🎯 $0.9061 ❌ Invalidation: a daily candle closing below the channel support. ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

TIAUSDT 1D

#TIA may be aiming for the $2 level. #TIA is moving inside a falling wedge pattern on the daily chart and has bounced off the wedge support. In case of a breakout above the wedge resistance and the daily SMA50, the targets are: 🎯 $0.929 🎯 $1.134 🎯 $1.301 🎯 $1.467 🎯 $1.703 🎯 $2.000 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

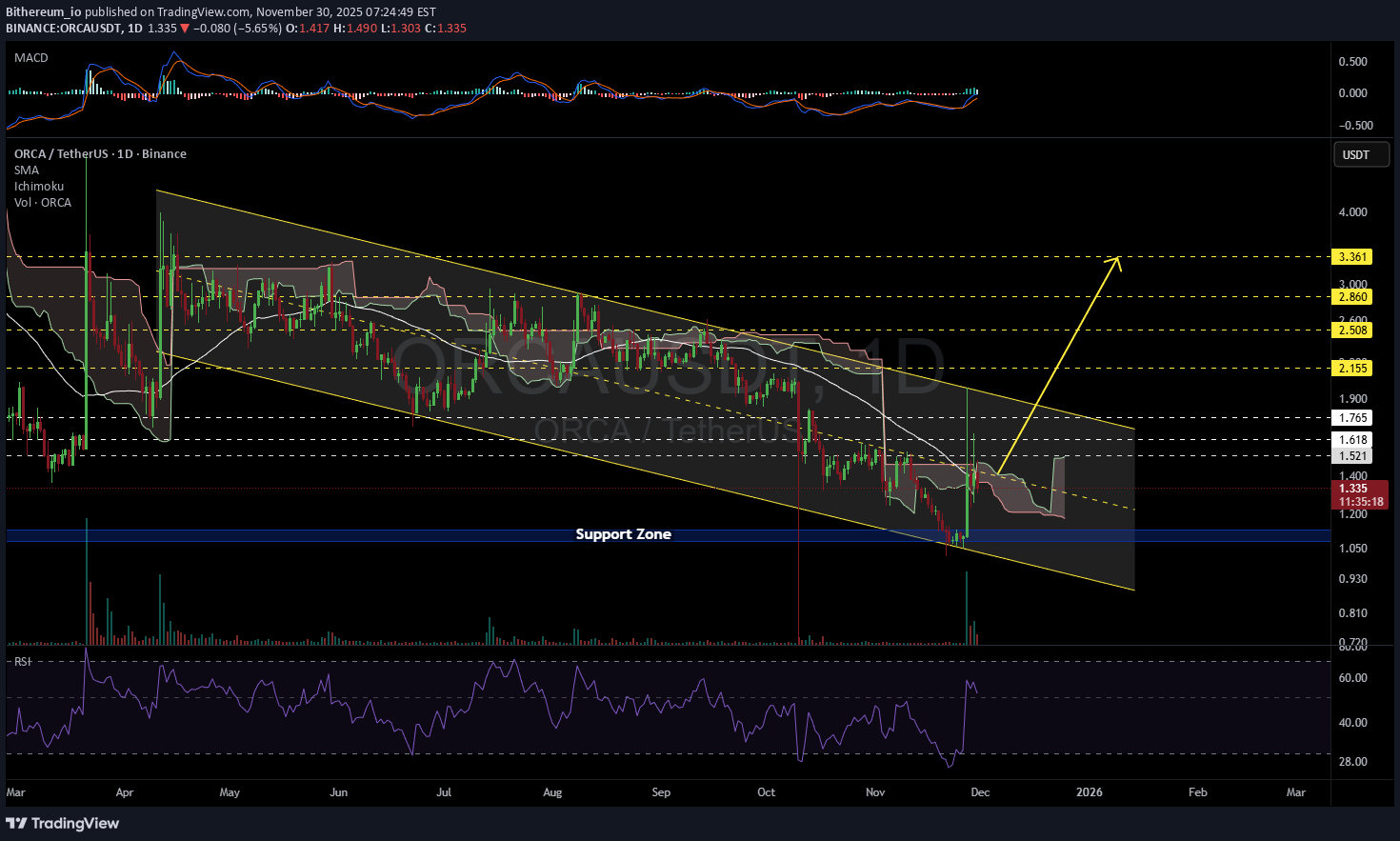

ORCAUSDT 1D

#ORCA is trading inside a well-defined descending channel on the daily timeframe. Price is now testing a multi-layer resistance cluster consisting of the daily SMA50, the channel midline, and the Ichimoku cloud, which together form a strong structural barrier. A breakout with confirmed daily closes above this cluster would signal bullish momentum and open the path toward the next targets: 🎯 $1.521 🎯 $1.618 🎯 $1.765 If buyers manage to push price above the channel’s upper boundary, the trend structure shifts from corrective to impulsive, exposing the mid-term targets at: 🎯 $2.155 🎯 $2.508 🎯 $2.860 🎯 $3.361 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

FIDAUSDT 2D

#FIDA is moving inside a falling wedge pattern on the 2-day timeframe. Consider buying only after a solid breakout above the wedge and the SMA50. If that breakout confirms, the potential upside targets are: 🎯 $0.0662 🎯 $0.0765 🎯 $0.0872 🎯 $0.0978 🎯 $0.1130 🎯 $0.1323 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

PORTALUSDT 12H

#PORTAL has broken above the descending resistance on the 12H timeframe, and the retest has completed successfully. Volume has also increased, which is a bullish sign. Targets are: 🎯 $0.0230 🎯 $0.0259 🎯 $0.0286 🎯 $0.0313 🎯 $0.0351 🎯 $0.0399 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

HNTUSDT 2D

#HNT is moving inside a falling wedge pattern on the 2-day timeframe. Consider buying a small bag here and on the support zone between $1.892 ~ $1.754. If price breaks above the wedge resistance and the 2-day SMA50, the potential targets are: 🎯 $2.401 🎯 $2.741 🎯 $3.046 🎯 $3.351 🎯 $3.785 🎯 $4.338 ❌ Invalidation: a 2-day candle closing below the wedge support. ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

TURBOUSDT 3D

#TURBO has bounced off the support zone perfectly with significant volume on the 3-day timeframe. RSI is showing potential for upward movement. In case of a breakout above the descending resistance, the potential upside targets are: 🎯 $0.002901 🎯 $0.003861 🎯 $0.004646 🎯 $0.005431 🎯 $0.006549 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Bithereum_io

COMPUSDT 1D

#COMP is moving inside a falling wedge pattern on the daily chart. Its first breakout attempt was rejected at the wedge resistance, and the second attempt was rejected at the daily SMA50. Consider buying a small bag near the support zone. If price breaks above both the wedge resistance and the SMA50, the potential upside targets are: 🎯 $40.61 🎯 $44.84 🎯 $49.06 🎯 $55.08 🎯 $62.75 ❌ Invalidation: a daily candle closing below the wedge support. ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.