WiseLeoTrading

@t_WiseLeoTrading

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

WiseLeoTrading

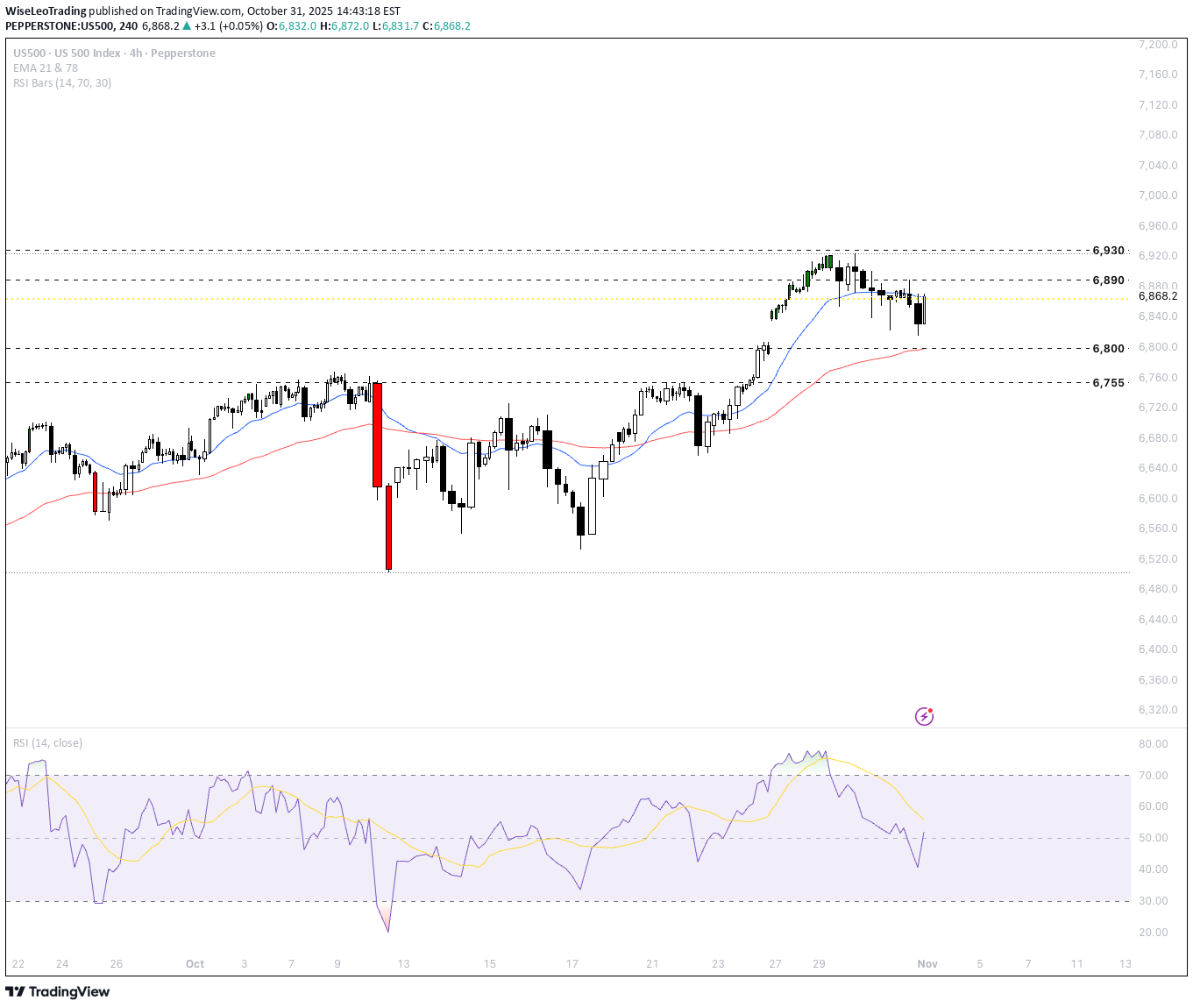

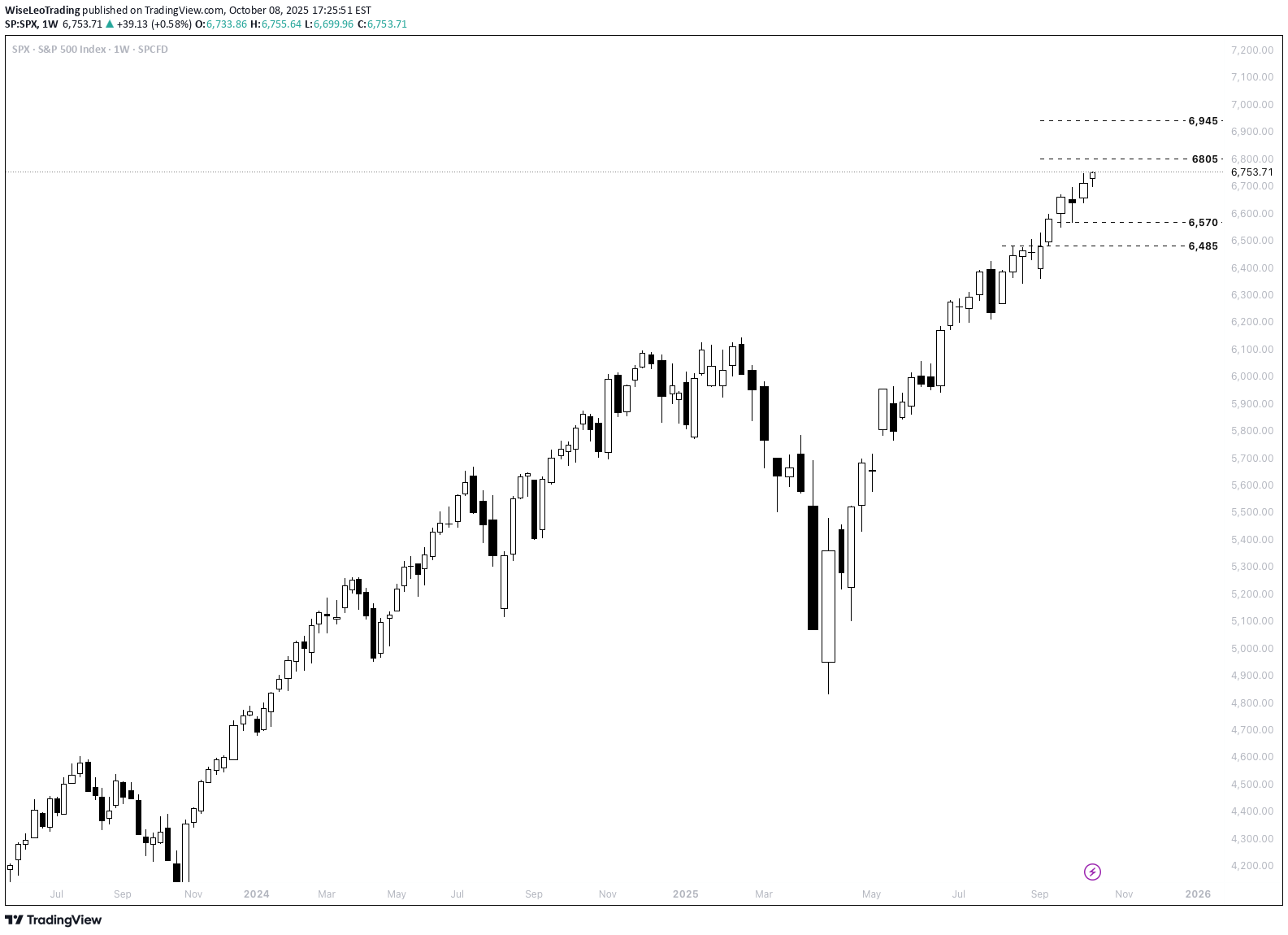

US500 Strong Bullish Momentum

Fundamental Analysis The current bullish trajectory of the US500, is overwhelmingly earnings driven. Robust Q3 corporate results, notably massive beats from tech and consumer giants like Apple with record iPhone sales and services, Amazon’s cloud revenue surge , have provided a decisive fundamental lift. This resilient performance has overshadowed macro uncertainties around Fed policy caution, trade tensions and cemented investor confidence in double digit earnings growth projections for 2026. The rally is characterized by solid breadth, extending beyond mega caps to sectors like Energy, suggesting a durable economic foundation. Technical Analysis The US500 exhibits strong bullish momentum, on track for its best monthly streak in years. The index is testing a critical resistance zone between 6,885 and 6,890, formed by the convergence of long-term trend lines. A confirmed weekly close decisively above 6,900 is necessary to validate a powerful breakout toward the psychological 7,000 level and signal an acceleration in the uptrend. Short term downside is currently contained by strong support levels, indicating that pullbacks are likely to be met with active dip buying. Outlook The overall outlook for the US500 is constructively bullish into year end. As positive earnings guidance reinforces investor sentiment, the path of least resistance remains higher. However, given the proximity to all time highs and critical technical resistance, short-term volatility and consolidation are likely as the market digests the risk of stretched valuations e.g. (Nvidia's high GDP ratio is a notable concern) before attempting a sustainable move toward the 7,000 mark. Analysis is by Terence Hove, Senior Financial Markets Strategist at Exness

WiseLeoTrading

Gold facing pressure ahead of US - China meeting

China's purchase of its first US soybean cargo this year, ahead of a meeting with the US, signals expectations for a constructive dialogue and a positive outcome on the sidelines of the APEC summit. Optimism over a potential trade breakthrough may continue to pressure gold prices. However, the ongoing data blackout leaves the Fed cautious, heightening volatility in the near term. XAUUSD failed to breach the EMA, but the higher swing low signaled diminishing bearish momentum. If XAUUSD holds above 3900, the price may retest the resistance at 4020. Conversely, if XAUUSD closes above 4020, the price may retest the next resistance at 4150 and reverse the trend. By Van Ha Trinh - Financial Market Strategist at Exness.

WiseLeoTrading

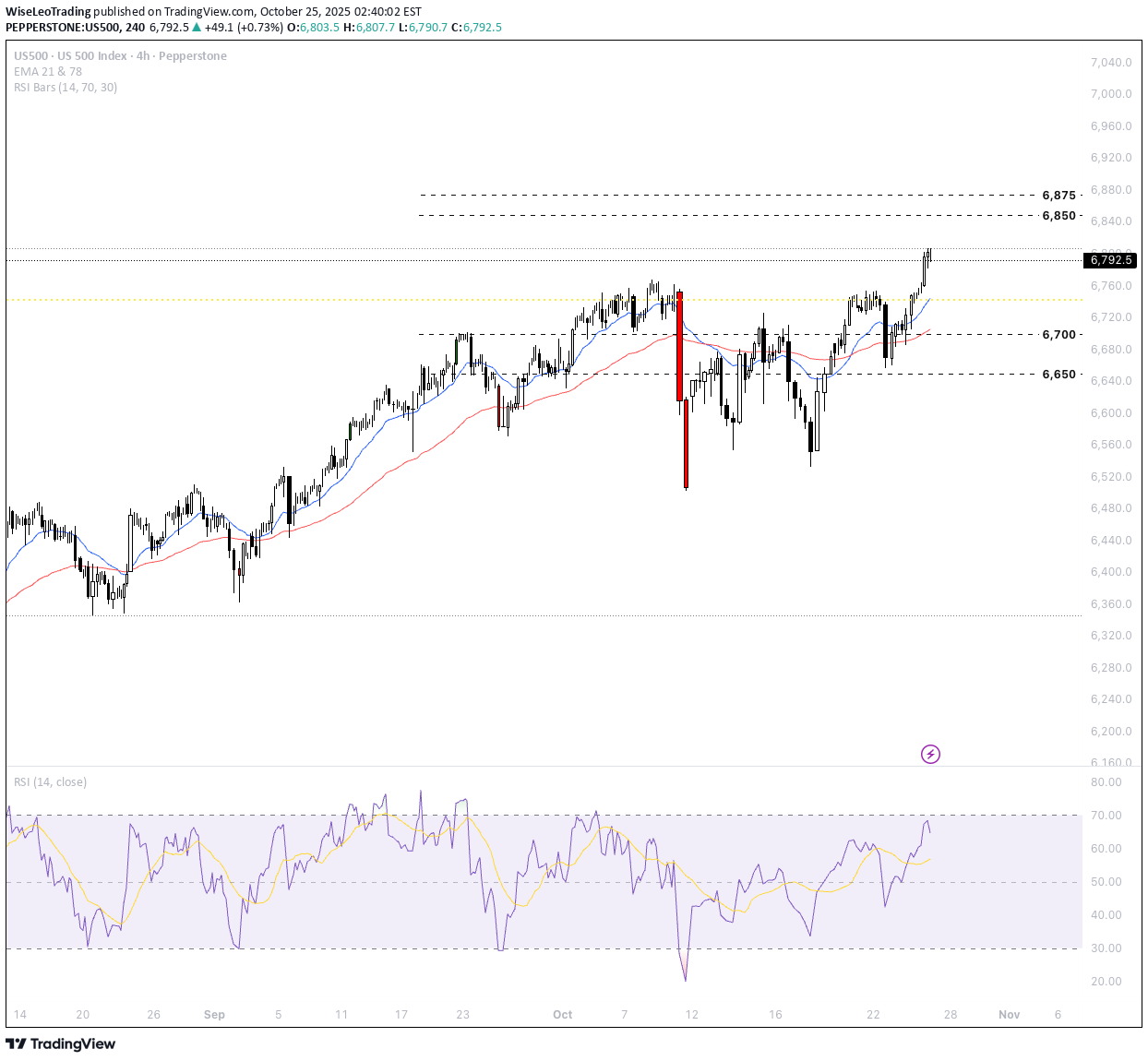

US500 Surges On Softer US CPI Data

Fundamental & Sentiment Analysis The US500 surged this week after the release of cooler than expected US CPI data. This bolstered expectations for further rate cuts by the Fed at its 28–29 Oct meeting. Investor sentiment turned sharply bullish, pushing the index to new record highs near 6,792 on Friday. The inflation report for September 2025 surprised markets to the downside: headline US CPI rose 0.3% (3.0% YoY) and core CPI rose 0.2% (3.0% YoY), both below forecasts. This moderation fueled optimism that inflation is cooling sustainably, raising the odds of a 25 basis point rate cut at the upcoming FOMC meeting. Following the CPI release, the US500 rose to 6,762 intraday, just shy of its all-time high. Technical Outlook The outlook for the coming week is moderately bullish, with potential consolidation at record highs. Momentum remains supported by softer inflation, dovish Fed expectations, and continued strong corporate earnings. However, technical analysts warn of short-term pullbacks as the index tests critical resistance levels. A correction toward 6,720 would be healthy before a move higher toward 7,000. The US stock market is positioned for further gains into year-end if inflation stays contained and the Fed confirms a sustained policy easing trajectory. Analysis is by Terence Hove, Senior Financial Markets Strategist at Exness

WiseLeoTrading

Gold facing pressure but still open for further surge

Following a recent rally, the gold price met significant profit-taking pressure. Prices reached a record high of 4381, signaling an easing of US-China trade tensions. China confirmed trade talks with the US will occur tomorrow in Malaysia alongside the ASEAN summit. However, both sides are escalating tensions pre-talks to gain bargaining power, potentially complicating a final agreement. Meanwhile, the prolonged US government shutdown, combined with a weakened Labor Market and a lack of data, has obscured the Labor Market's current situation. This uncertainty fueled market concern and drove investors toward safe-haven assets. Concurrently, expectations place the US CPI at 3.1% YoY, accelerating from 2.9%. This increase raises stagflation concerns in the US economy, further supporting the gold price. Technically, XAUUSD hovers slightly above the EMA78. Both EMAs are consolidating, signaling continued flattening momentum. However, the long-term trend remains to the upside, suggesting investors may buy the dips amid the remaining uncertainty.

WiseLeoTrading

US500 BREAKS 6,740:Bull Market Roars, But Inflation Shadows Peak

US500 Snapshot US500 is exhibiting a clear bullish trend, pushing to new all time highs above 6,740. Strong momentum is driven by robust corporate earnings, particularly from large cap technology stocks, and prevailing bullish investor sentiment. Key Drivers and Catalysts: Earnings Strength: Resilient corporate earnings, particularly within the "Magnificent 7" mega cap technology stocks, remain the primary engine for the index's upside. Sticky Inflation & Fed Policy : Persistent inflation in the services sector is injecting selective caution but reinforcing the appeal of strong, high growth companies. With expectations elevated for the US Fed to cut rates to protect a weakening US Jobs market further supporting the index. Political Policy Influence: The forward outlook is being shaped by economic policy prospects, notably potential tariffs and tax changes under President Trump's administration. Outlook: Key Risks & Levels: The general consensus among major financial institutions is for further growth towards year end, with targets ranging from the conservative 5,700 to the bullish 7,100. The prevailing scenario is a continuation of the upside toward the next major resistance level near 6,800. While continued earnings expansion and a relatively stable macro backdrop support single digit growth expectations, the outlook is tempered by key risks: High Valuations: Elevated index valuations could limit aggressive buying. Macro/Policy Risks: Moderate volatility is expected around upcoming inflation and interest rate data. Furthermore, ongoing uncertainties related to trade and policy (e.g., the tariff debate) pose a risk to sentiment. Analysis by Terence Hove, Senior Financial Markets Strategist at Exness

WiseLeoTrading

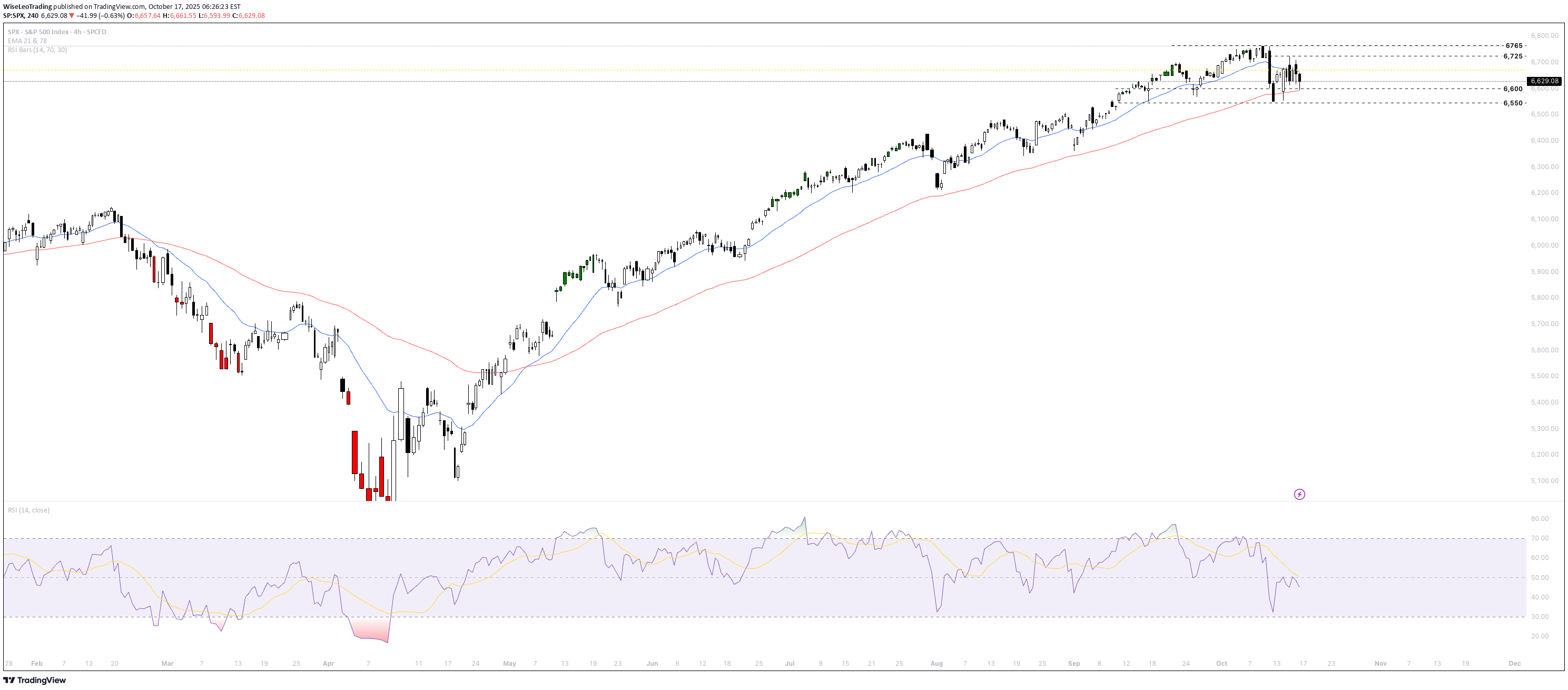

US500 Short term caution

Outlook While short term caution is warranted due to the recent decline and elevated volatility, the US500 remains in a long term uptrend supported by strong annual gains. Expectations of continued resilience from large cap stocks maintain a positive outlook going into year end. However, models suggest a cautious path for the near future, anticipating the index to correct, indicating potential headwinds. The critical support zone remains near 6,400. Fundamental Analysis US500 demonstrates robust long term health, up over 11% compared to one year ago. This performance is fundamentally driven by resilient large cap earnings and underlying strength in technology and consumer sectors. Major financial institutions, including JP Morgan, Goldman Sachs, and Citigroup, have recently raised their year end targets into the 6,000 – 6,900 range, citing expectations of continued strong earnings and potential tailwinds from monetary policy shifts and interest rate cuts. However, current sentiment has introduced short term caution due to recent macroeconomic developments and elevated volatility. Technical Analysis The index is currently trading around a key support of 6,600 points, reflecting a short term decline from the previous session. The short term trend is showing signs of a possible bearish correction or pullback, despite longer timeframes maintaining underlying bullish momentum. Volatility is notably elevated, with the VIX above 25.00, suggesting increased market uncertainty and potential for sharp swings. Immediate resistance is clearly defined near the recent high of 6,725. Immediate support is seen around 6,600 points. Short term bearishness is primarily attributed to technical factors like profit taking. Analysis by Terence Hove, Senior Financial Markets Strategist at Exness

WiseLeoTrading

US500 Outlook

Fundamental Analysis The US500 remains firmly supported by robust large-cap earnings and underlying resilience in the technology and consumer sectors. The index's significant one-year gain of 26% reflects strong corporate balance sheets and continued optimism for economic stability. Recent upward momentum is fueled by strong bank earnings and persistent hopes for Federal Reserve rate cuts. However, near-term sentiment is challenged by elevated volatility stemming from renewed US-China trade tensions and the ongoing government shutdown, alongside warnings that the market is "stretched" in valuation. Technical Analysis US 500 closed above 6,650, confirming a continued long term bullish momentum. However, short term technical sentiment is mixed as the index struggles to sustain rallies above its EMA21, which is acting as a cap. Immediate resistance is clustered near the recent all-time highs 6,765. Key support is identified at 6,600 down to the critical downside buffer at 6,550. A breach of the 6,550 support level could signal a definitive end to the current uptrend. Analysis by Terence Hove, Senior Financial Markets Strategist at Exness

WiseLeoTrading

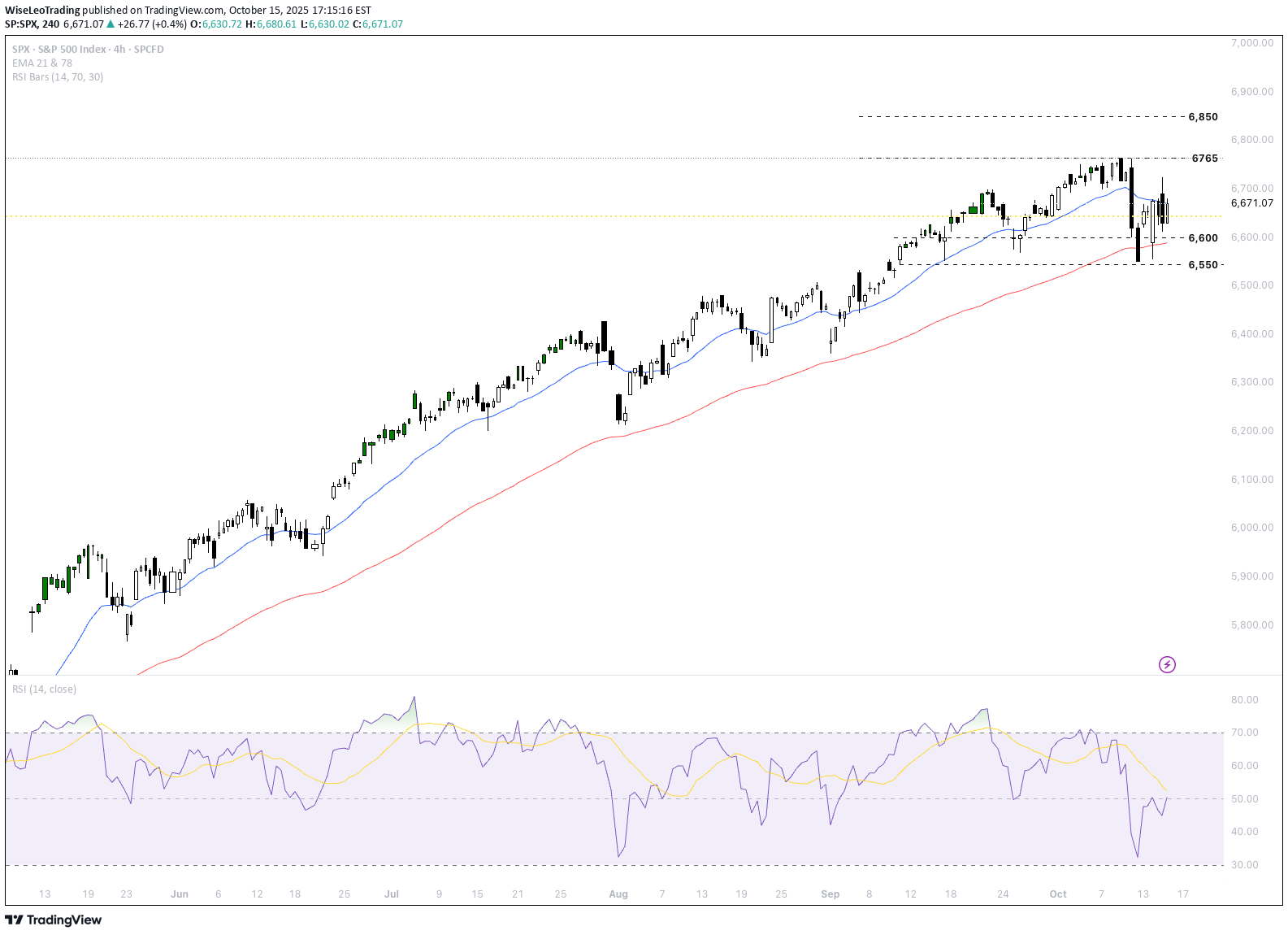

US500 Remains Fundamentally Constructive

Fundamental Analysis US500 remains fundamentally constructive, with robust year over year growth above 15% driven primarily by optimism in the technology and AI sectors. However, sentiment has cooled, leading to recent profit taking following fresh record highs. Key fundamental risks include worries over stretched valuations in tech and persistent uncertainty stemming from the ongoing US government shutdown and the resulting shortage of key economic data. Near term direction will be heavily influenced by the release of the University of Michigan sentiment index and the crucial September CPI, alongside the upcoming banking sector earnings. Technical Analysis The US500 is currently consolidating near 6,735 points after its recent peak. The dominant trend remains bullish, supported by the fact that all major Moving Averages (10 to 200 periods) are in "strong buy" territory. Momentum indicators like the RSI are approaching overbought levels, suggesting the rally needs a brief pause but have not yet signaled a reversal. Key technical levels to watch are: Immediate Resistance: 6,805 Stronger technical target for the medium term. Pivot Support: 6,700, Potential bounce zone/trend continuation threshold. Critical Support: 6,570, Key downside buffer; breach could signal a deeper correction. Analysis by Terence Hove, Senior Financial Markets Strategist at Exness

WiseLeoTrading

US500 Remains Bullish

US500 is currently near record levels. The index maintains robust overall performance, with monthly and yearly gains standing above +3.00% and +15%, respectively. This strength is fundamentally driven by broad based bullish sentiment, confidence in strong corporate results, and particularly the ongoing technology sector leadership and AI-related dealmaking, which recently propelled the index to new all-time highs. Fundamental Analysis The market's optimism is tempered by underlying caution. Persistent inflation in the services sector remains a key concern, fueling expectations that the Federal Reserve may be compelled to keep interest rates higher for longer, a factor that could limit short-term upside momentum. Despite this, the index's current technical posture remains positive. Technical Analysis From a technical perspective, the US500 is in a strong upward trend, but the index is showing signs of being overbought after its recent surge. The immediate key support level is noted at 6,570 points. Looking ahead expect the bullish momentum to continue in the medium term, targeting 6,805 as the next potential resistance milestone. Conversely, the index might enter a period of consolidation or retreat, with projections near 6,485 points and a possible longer-term below 6,000.

WiseLeoTrading

Gold reached another record high

Gold reached another record high and is on its way to reach 4000 USD/ounce, driven by government instability around the world, such as the US government shutdown, the collapse of the French government after only 14 hours, while protests in Indonesia, Bangladesh, Nepal, and now in Morocco. The US Senate failed to pass government funding yesterday with fewer than the required 60 votes. If the government postponement continues, it could threaten to fire over 750k federal workers and cost 0.1-0.2% of the US GDP for each week of postponement. Additionally, not only federal workers but also private workers face a bad situation when the hiring decision could be halted due to the interruption in consumption and the whole value chain. Meanwhile, the delay in releasing economic data such as NFP and Inflation could lead the Fed to make decisions based on old data that do not provide a clear picture of the current economic situation, especially the labor market, which is trending low now. If the Fed acts slowly, this could cause a recession or even stagflation if inflation keeps rising without statistics. Fed is expected to cut 0.5% further this year in this month's meeting and another in December. Regarding the market's reaction, we can see a spike in inflows to the gold ETF last week, with a total demand of 42.1 tons of gold, and it could be hiked further this week. Meanwhile, the COMEX also showed that the future net long position remained elevated at 806.35 tons Technically, XAUUSD is trading above both extending EMAs and an ascending channel. If XAUUSD stays below the resistance at 4000, the price may retest the support at 3900. Alternatively, falling below 3900 may fuel a retest of the channel‘s lower bound and EMA78.By Van Ha Trinh, Financial Market Strategist at ExnessThe gold continues to surge due to the political instability in France, with the collapse of the government only after 14 hours, marked by the resignation of the new PM. Meanwhile, the US government shutdown came to its 8th consecutive day with little information from the government. That's why markets continue to be concerned and find safe-haven assets like gold to avoid uncertainty surrounding the effect of the US economy without any update of essential data, which could affect the monetary policy, which could cause dire consequences for the economy. Meanwhile, Terther reports increasing its gold holding to back the XAUt—a gold tokenization that opens a new trading mechanism for investors backed by physical gold. The XAUt capitalization now reaches around 1 billion USD, with the potential to increase further. Technically, XAUUSD surpassed the Fibonacci Extension 161.8% at 4007 resistance and could increase further to test the Fibonacci Extension of 4216. Failure to close above 4007 will lead XAUUSD to retest the 3900 level. By Van Ha Trinh, Financial Market Strategist at Exness

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.