Technical analysis by afurs1 about Symbol METAX: Buy recommendation (10/31/2025)

afurs1

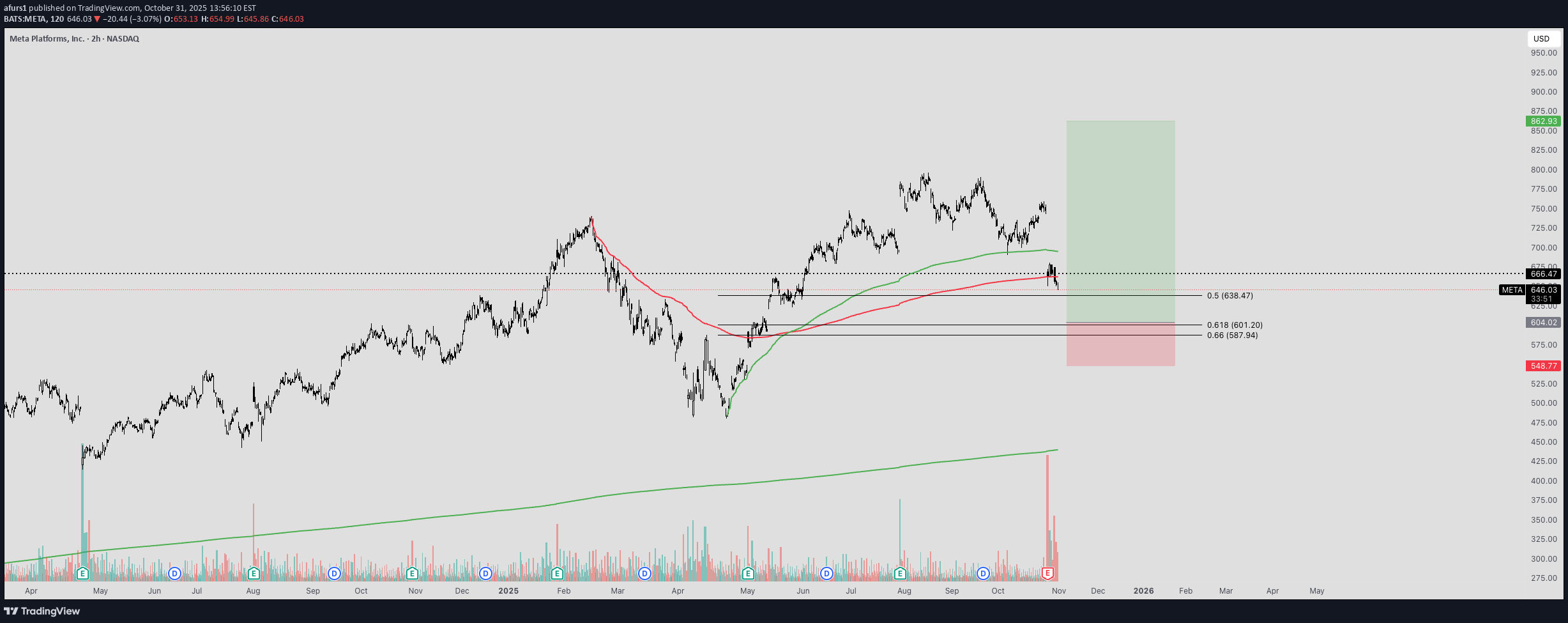

META: Next Long Term Buy

Following a disappointing earnings report, Meta (META) dropped more than 10% in post-market trading, decisively breaking through several key support levels. My primary support zones are typically derived from anchored VWAPs (Volume-Weighted Average Prices), which help identify where institutional buyers may step in to defend trend continuation. However, what’s becoming increasingly concerning is the decisive break below both major VWAPs — one anchored to the previous all-time high and another from the “tariff crash” lows. This type of price action reflects broad-based weakness and a shift in market structure, suggesting that META may be entering a deeper corrective phase. The loss of both VWAPs indicates that long-term buyers are no longer in control of the trend, and that liquidity pockets beneath recent price levels could become magnets for further downside. From a technical perspective, the current setup points toward a potential cascading move lower into the 0.618 Fibonacci retracement zone, which also aligns with multiple unfilled gaps on the chart. These confluence zones often act as high-probability areas for price stabilization or reversal, particularly when accompanied by a sentiment washout or capitulation event. Moving forward, I’ll be closely monitoring the sub-$600 area as a potential longer-term accumulation zone. This region not only coincides with that Fibonacci retracement but could also mark the completion of a higher-degree corrective structure within the broader uptrend. Once price stabilizes, I plan to develop a detailed Elliott Wave projection to map out the next impulsive leg higher — ideally one that reestablishes META’s leadership role among the large-cap tech names. In summary, while short-term weakness appears dominant, the upcoming retracement could offer an attractive buying opportunity for patient investors, provided the broader market context and technical structure begin to realign in favor of the bulls.The current correction can be viewed as a double combo (WXY) , meaning it is a combination of multiple measured moves to the downside. The initial wave is labeled as an ABC, where the trend based fib extension points towards a measured move of approx $716, followed by the broader WXY where the initial ABC correction sets the W pivot, following an X move retracement, and then a final move lower for Y. Interestingly enough, the trend based fibonacci is pointing to a similar price as the 618 zone.Another stacked confluence, the most traded zone of the tariff crash being in line with the retracement zone.Will be attentive tomorrow as we may have an opportunity to ladder in at the target zoneStarting to ladder into this position now that we are approaching target! Will make my largest purchase below $600 if it is givenNice bounce right at the 618 where i expectedCan tighten the stop now to a daily close below the prev low, making for a very low risk potentially high reward tradeReclaiming $668 would be a major sign of strength. I would view this drop as a deviation out of the fair value trading range based on the volume profile which could propel META back to the opposite end of the range near ATHLooking great, Ill be watching how this one progresses and update further context once more data is available.