FxPro

@t_FxPro

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

FxPro

- Stellar broke key resistance level 0.6690 - Likely to rise to resistance level 0.6800 Stellar cryptocurrency recently reversed down from the pivotal resistance level 0.2200 (former monthly low from November, as can be seen from the daily Stellar chart below). The resistance zone near the resistance level 0.2200 was strengthened by the 38.2% Fibonacci correction of the downward impulse from November. Given the strong multi-month downtrend, Stellar cryptocurrency can be expected to fall to the next round support level 0.2000 (low of the previous wave B).

FxPro

- Tron reversed from resistance zone - Likely to fall to support level 0.2700 Tron cryptocurrency earlier reversed from resistance zone between the resistance level 0.2865 (top of the previous minor correction 2 from the start of December, as can be seen from the daily Tron chart below). The downward reversal from the resistance level 0.2865 created the daily Japanese candlesticks reversal pattern Dark Cloud Cover – which started the active impulse wave iii. Given the clear daily downtrend, Tron cryptocurrency can be expected to fall to the next key support level 0.2700 (which stopped earlier waves 1 and i).

FxPro

- Google reversed from key support level 290.00 - Likely to rise to resistance level 320.00 Google recently reversed from the key support level 290.00 (former strong resistance from October and November) intersecting with the lower daily Bollinger Band and the 38.25 Fibonacci correction of the upward impulse 1 from October. The upward reversal from the support level 290.00 started the active impulse wave i of the higher impulse waves 3 and (C). Given the strong daily uptrend, Google can be expected to rise to the next resistance level 320.00 (target for the completion of the active impulse wave i).

FxPro

Gold Wave Analysis – 22 December 2025

- Gold broke key resistance level 4382.00 - Likely to rise to resistance level 4600.00 Gold recently broke sharply above the key resistance level 4382.00 (which stopped the previous intermediate impulse wave (3) in the middle of October). The breakout of the resistance level 4382.00 coincided with the breakout of the resistance trendline of the daily Ascending Triangle chart pattern from October. Given the overriding daily uptrend, Gold can be expected to rise to the next resistance level 4600.00 (target price for the completion of the active impulse wave 3).

FxPro

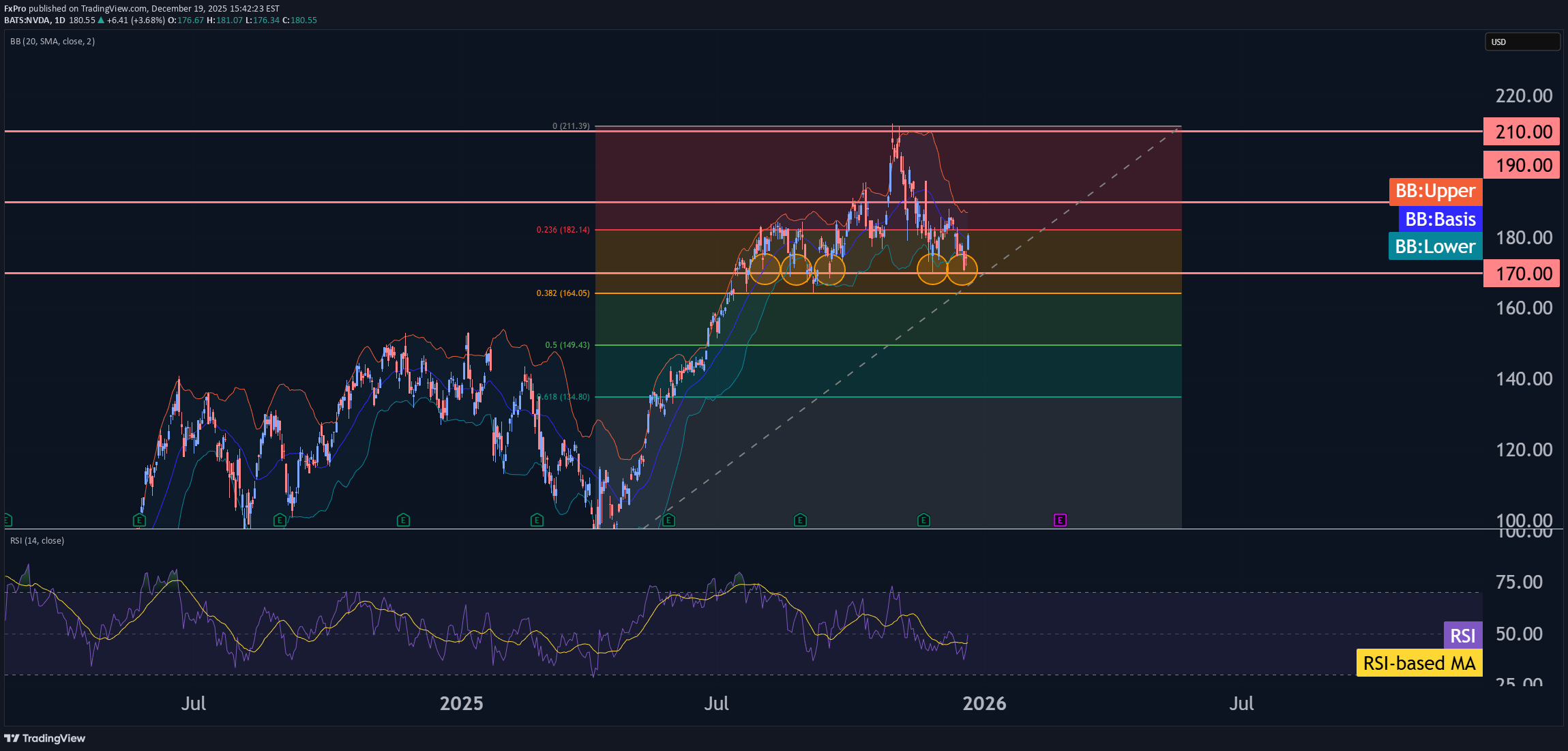

- Nvidia reversed from support area - Likely to rise to resistance level 190.00 Nvidia recently reversed from the support area between the long-term support level 170.00 (which has been reversing the price from July), 38.2% Fibonacci correction of the upward impulse from April and the lower daily Bollinger Band. The upward reversal from this support area started the active short-term impulse wave (iii). Given the clear daily uptrend, Nvidia can be expected to rise to the next resistance level 190.00 (which stopped earlier wave (iii)).

FxPro

- Bitcoin Cash broke resistance area - Likely to rise to resistance level 650.00 Bitcoin Cash cryptocurrency recently broke the resistance area between the round resistance level 600.00 (which stopped earlier waves B and 1) and the resistance trendline of the daily up channel from October. The breakout of the resistance area accelerated the active impulse waves 3 and (3). Bitcoin Cash cryptocurrency can be expected to rise to the next resistance level 650.00 (former multi-month high from September, which stopped earlier wave (1)).

FxPro

- Ethereum reversed from support area - Likely to rise to resistance level 3200.00 Ethereum cryptocurrency recently reversed from the support area between the strong support level 2800.00 (former resistance from June, which has been reversing the price from November) and the lower daily Bollinger Band. The upward reversal from this from the support area will likely form the daily Japanese candlesticks reversal pattern Morning Star – strong buy signal for Ethereum. Given the strength of the support level 2800.00 and the oversold daily Stochastic, Ethereum cryptocurrency can be expected to rise to the next resistance level 3200.00.

FxPro

- Dogecoin broke long-term support level 0.1365 - Likely to fall to support level 0.1155 Dogecoin cryptocurrency recently broke below the long-term support level 0.1365 (which has been reversing the price from April, as can be seen below). The breakout of the support level 0.1365 strengthened the bearish pressure on Dogecoin. Given the clear daily downtrend and the bearish sentiment seen across the crypto markets, Dogecoin cryptocurrency can be expected to fall to the next support level 0.1155.

FxPro

- Tesla broke key resistance level 460.00 - Likely to rise to resistance level 500.00 Tesla today opened with the sharp upward gap breaking above the key resistance level 460.00 (which has been reversing the price from October). The breakout of the resistance level 460.00 accelerated the active impulse wave iii of the intermediate impulse wave C from November. Given the strong daily uptrend, Tesla can be expected to rise to the next round resistance level 500.00 (likely price for the completion of wave iii).

FxPro

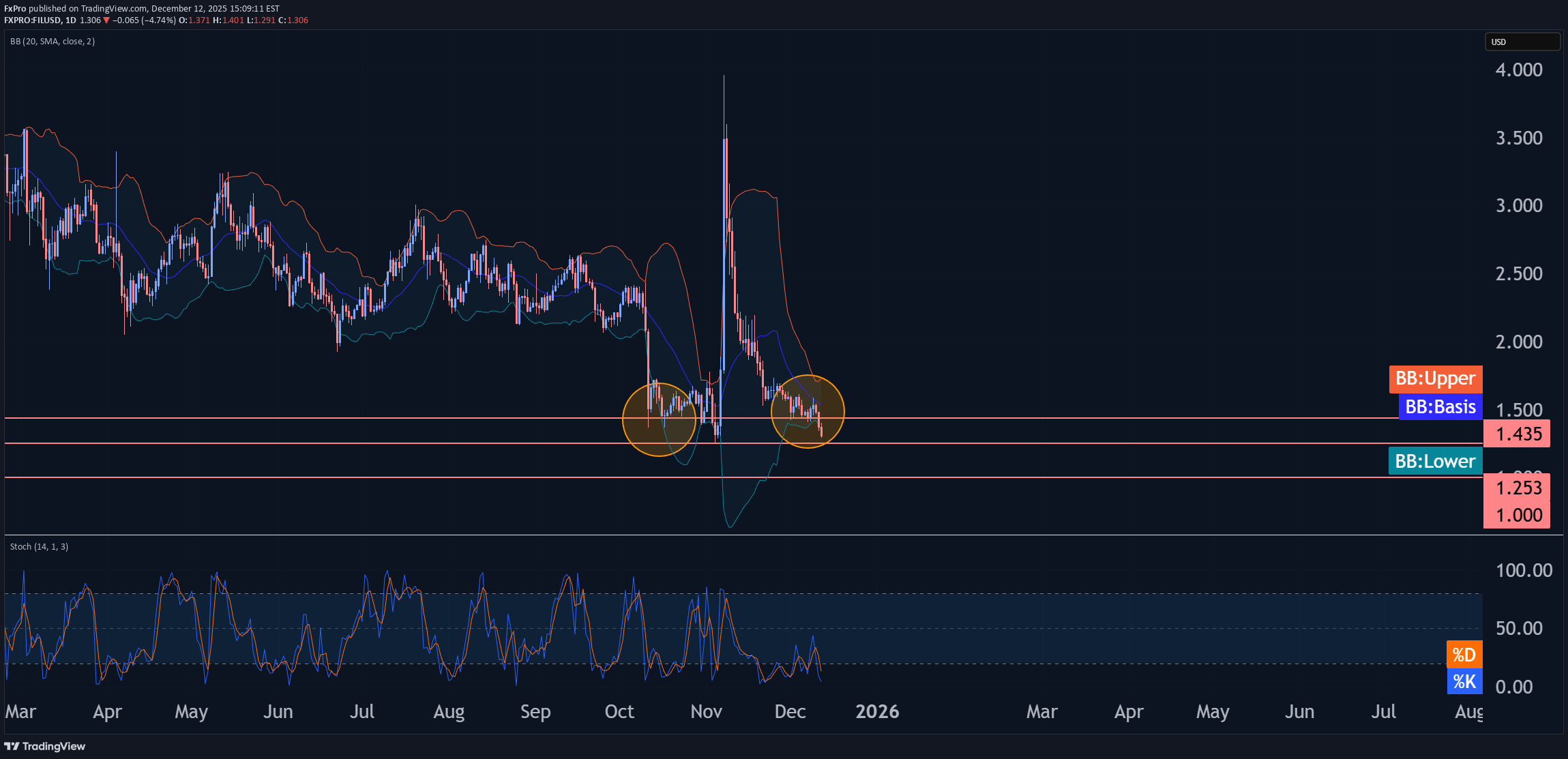

- Filecoin broke key support level 1.435 - Likely to fall to support level 1.000 Filecoin cryptocurrency recently broke below the key support level 1.435, which reversed the price twice from the start of December (this level also supported the coin during most of October). The breakout of the support level 1.435 accelerated the active impulse wave v of the higher downward impulse wave C from November. Given the overriding daily downtrend, Filecoin cryptocurrency can be expected to fall further to the next support level 1.253 (monthly low from November) – the breakout of which can lead to further losses to 1.0000.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.