GoldenRule365

@t_GoldenRule365

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

GoldenRule365

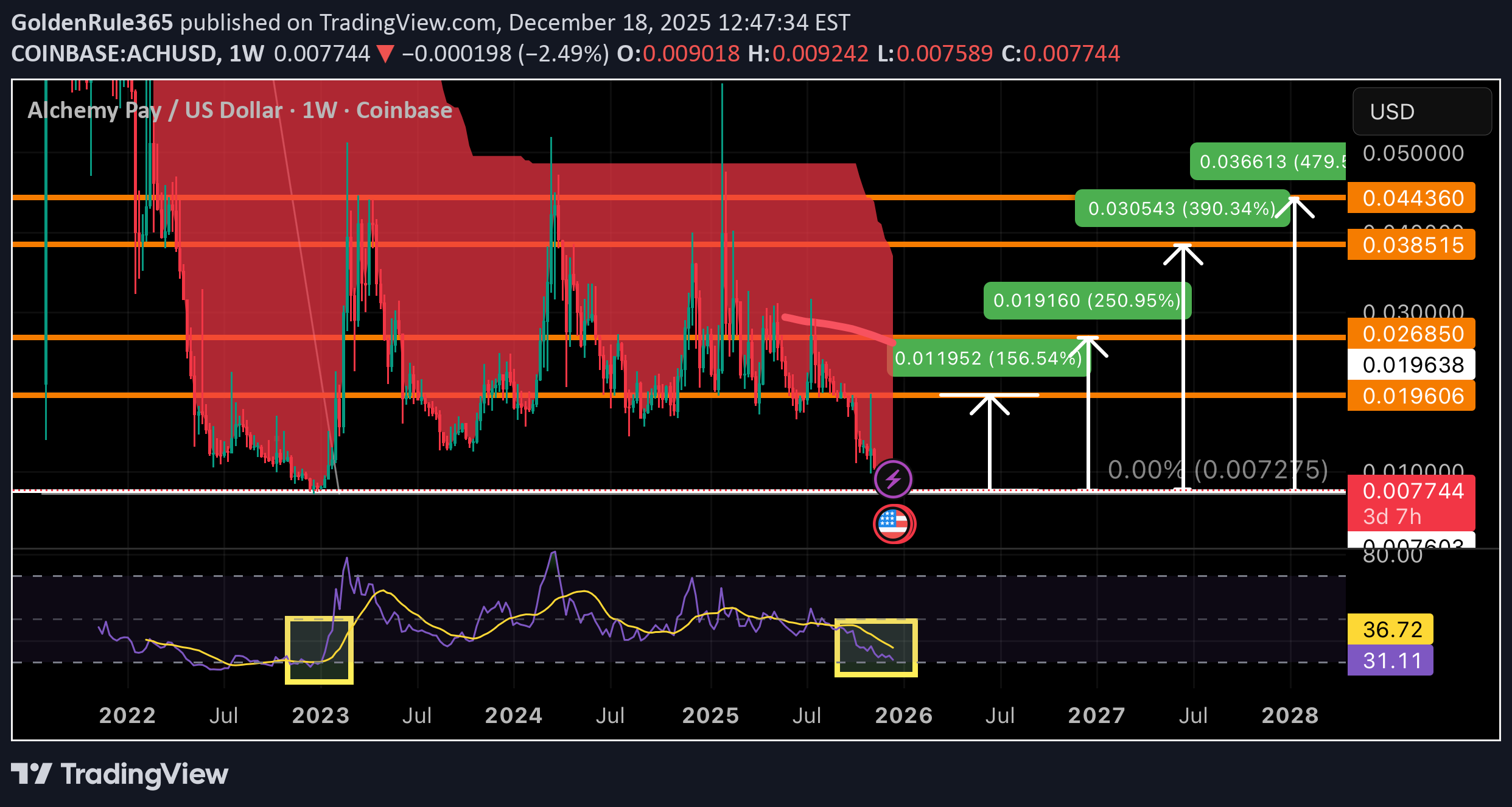

Looking at RSI Weekly timeframe we see the same RSI range like it was back in January 2023 that produced a bullish wave with almost a 500% gain shortly after. I plotted 4 possible take profit zones for us. Alchemy Pay’s price trajectory hinges on executing its compliance-driven roadmap while navigating a cautious market. Short-term volatility is likely, but successful Alchemy Chain adoption or RWA traction could reverse the 60% annual decline. Watch the Q4 2025 blockchain launch: Will it catalyze transactional demand for ACH , or face scalability hurdles?

GoldenRule365

Looking at technicals & fundamentals NKN (no current AI news) has been consolidating. At a decent entry level. I plotted Several take profits targets for us monitor closely.

GoldenRule365

Thats over a 70% gain that took just barely 2 months of patiently waiting! Congratulations to all that followed!

GoldenRule365

Monitor closely for your take profit if manually trading. Ideally a limit sell order would be beneficial in case it goes parabolic Congratulations to those that are following

GoldenRule365

Congratulations to those that followed along. Its not done yet, expect some profit taking with some support / consolidation near $0.25, tiny at $0.25 but its there. Stronger support at $0.18-$0.20. Careful if trading perps due to the bullish gaps getting filled. Dont get liquidated, watch and set tight stop losses and adjust those trailing stop losses and brackets carefully

GoldenRule365

Respecting the ascending parallel channel...for now. Not a bad idea to take profits. MKR’s rally combines exchange-driven FOMO around its SKY migration, whale-driven liquidity shifts, and technical momentum. Watch for sustained volume above $200M (current: $207M) to confirm continuation, or profit-taking near $2,300 (161.8% Fib extension). Will the SKY transition sustain demand post-swap, or trigger a “sell the news” reversal?

GoldenRule365

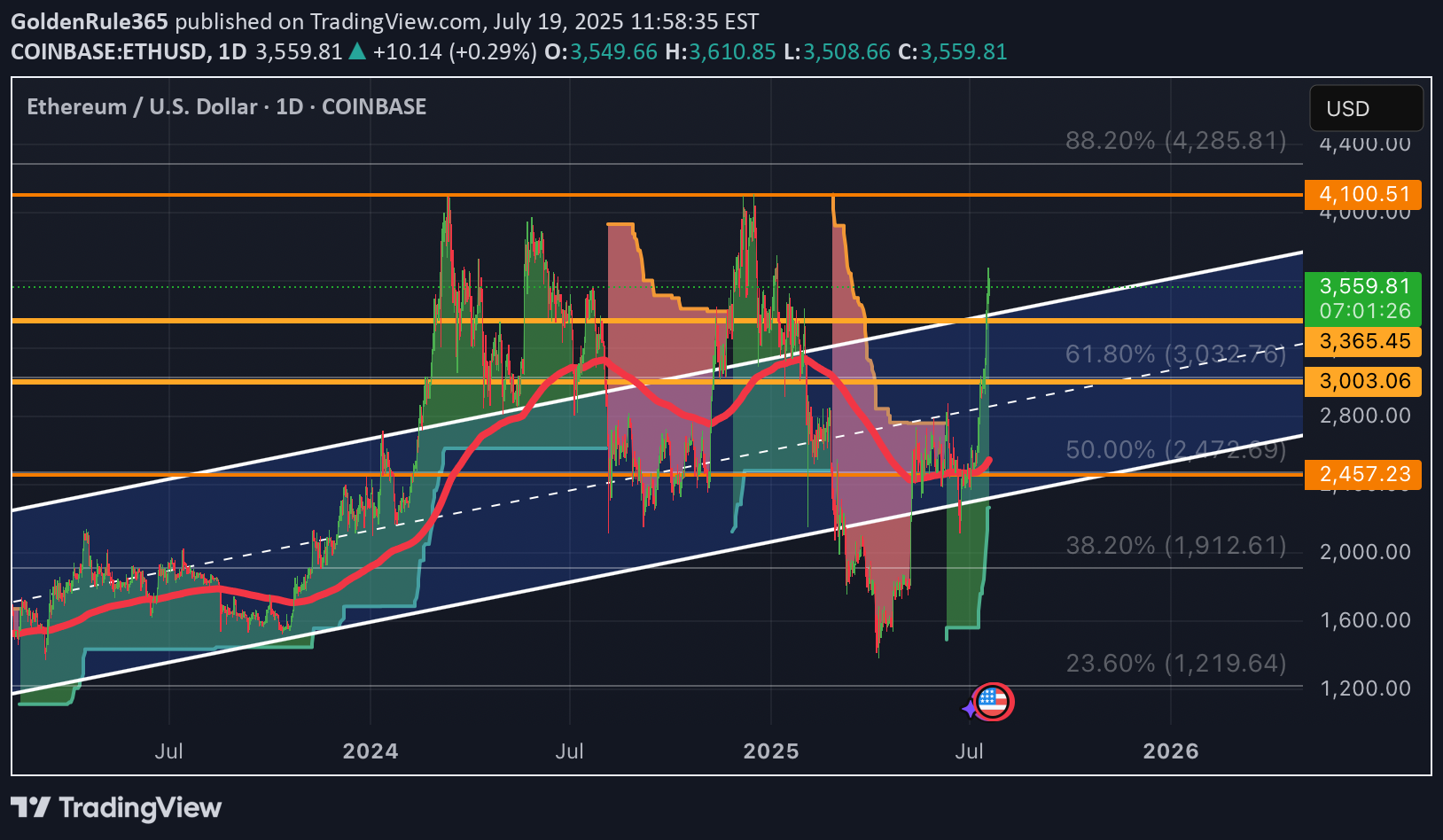

Took some time after the big dip down to $1500 in April to get back into the ascending macro parallel price channel to eventually hit our goal of $3300. Totally worth the wait.

GoldenRule365

Entry was at $0.27, made a dip below this support line then recovered. Macro retest would be 100% Fibonacci Correction back to $1.00. First we shall break thru the $0.50 Resistance (will be a 86% gain). Then push up past 50% Fibonacci at $0.6725, then $0.7835.

GoldenRule365

The took 5 months but we are up 50% so far. Patience has paid off as price action breaks through resistance as it retest Fibonacci levels back towards 100% Fib Correction. CRO surged after Trump Media & Technology Group filed for a “Crypto Blue Chip ETF” on July 8, allocating 5% to CRO. The ETF would track BTC (70%), ETH (15%), SOL (8%), XRP (2%), and CRO, with Crypto.com’s custodial arm securing assets. Approval would funnel passive institutional flows into CRO, driving demand. Institutional tailwinds: SEC closed its Crypto.com review, boosting confidence.

GoldenRule365

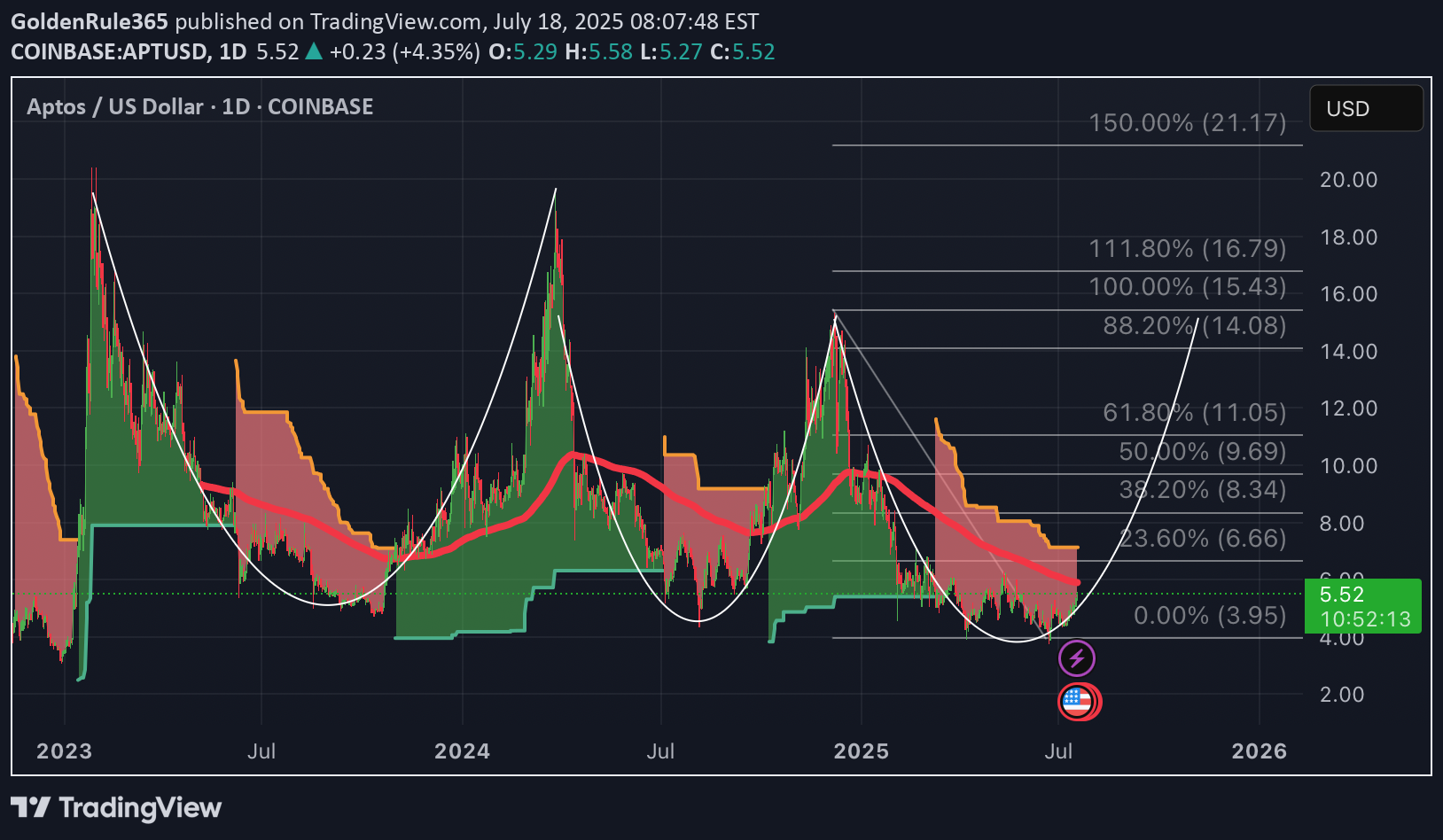

Strictly looking macro time frames we can see APT is setup for another bullish swing to retest 100% Fibonacci near $14.90 Super Trend still flashing bearish red signals but this looks to be reverting soon as price ticks up closer to a 200MA convergence. Breakout above $5.24 pivot: APT closed above the 23.6% Fibonacci retracement ($4.99), turning it into support. Bullish indicators: MACD histogram at +0.076 (strongest since July 12) and RSI14 at 65.43 (neutral-bullish). Liquidation clusters: A push above $5.60 could trigger $4.2M in short liquidations (next key resistance at $5.80 Fibonacci extension). Supporting factors : Hyperion’s RION tokenomics, The Aptos-based decentralized mapping project unveiled its token distribution (30% liquidity incentives), driving speculation about airdrop farming. Shelby network growth: Aptos Labs’ partnership with Jump Crypto for decentralized storage saw $1.3B in stablecoin inflows and record DEX volumes ($5B/month). Conclusion: APT’s rally reflects a blend of macro tailwinds, technical momentum, and ecosystem developments – though its 79.78 RSI7 suggests overheating risks.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.