Juliia

@t_Juliia

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

Juliia

— Multiple resistance tests, decreasing volatility, price compression under the level — Entry: Conditional order (NOT market) Trigger: $2.356 Limit buy: $2.358 — Stop: $2.265 — 3.5% is the price movement from entry to stop, NOT the loss percentage — Target: $2.55 Risk per trade: 0.5% of the total account — this is the percentage of potential loss Position size: 15% of the total account, 10x leverage RR: 1:2.25

Juliia

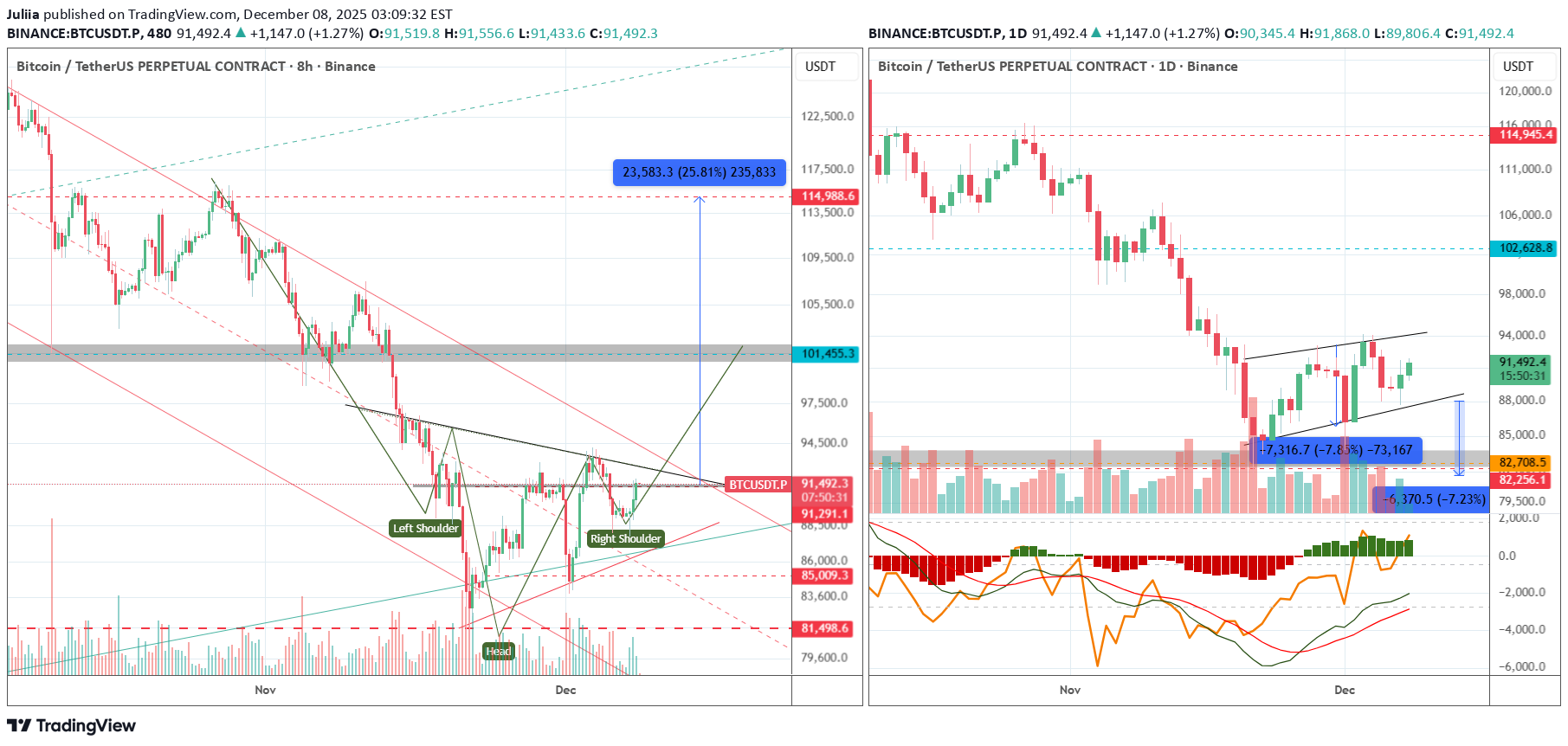

I’m assuming we’re seeing a reversal Head and Shoulders forming on BTC, with a potential retest of 106k. In that case, there’s a strong chance of seeing a new all-time high. I opened a few scout positions and still believe the bulls are in control. A retest of the local low (around the 80k zone) is possible, but I’m staying in long positions for now. The price action from here will be telling: if we can move up right away, the probability of a new high increases sharply. Stepping away from the hourly charts — now we wait.

Juliia

XRP/USDT Long — Trading Idea

— A falling wedge pattern is forming (a reversal technical formation), supported by bullish convergence on the 4D/3D timeframes. Price is sitting under resistance but right at the lower boundary of the range formed after the previous rally, which makes a consolidation before continuation of the broader trend quite possible. — Entry: $2.03 (market buy) — Stop: $1.91 — 5.5% is the price distance from entry to stop, NOT the percentage loss — Target: $2.55 Risk per trade: 0.8% of the total account — this is the actual percentage loss Position size: 15% of the total account, 10x leverage RR: 1:4.5

Juliia

ETC/USDT Long Set-up

— Technical formation: wedge, supported by divergence on higher timeframes, dangerously close to the level, but the movement has not developed for almost a month. Strong short signal on Bitcoin has already played out. — Entry: $13.125 Market buy — Stop: $12.55 – 4.5% (this is the percentage of price movement from entry to stop, NOT percentage of loss) — Target: $16.5 Risk per trade: 1% of total deposit – this is the actual percentage of loss Position size: 20% of total deposit, leverage 10x RR 1:6

Juliia

UNI/USDT Long Set-up

- Return into the range with a false breakout; potential move toward the next resistance level. — Entry: $6.10 (Market buy) — Stop: $5.92 — a 2.8% price move from entry to stop (NOT percentage loss) — Target: $6.75 Risk per trade: 1% of total account — this is the actual loss percentage. Position size: 35% of total account, 10x leverage. RR: 1:4

Juliia

BTC target is $100K

BTC is technically forming a double bottom on the daily timeframe (a trend-reversal pattern). The target sits around 100K. With the upcoming Fed meeting and a potential rate cut, we could break out toward 105K, and I wouldn’t rule out a move to 110K — a test of the 50/200-day MAs — as the market shifts into short-trend expectations.

Juliia

BCH/USDT Long Set-up

— Multiple approaches to the resistance level, reclaim of the 50/200 MA on the daily timeframe, strong and prolonged accumulation that formed after the previous rally. High probability of breaking through the $560 resistance area. — Entry: $533 (Market buy) — Stop: $510 — 4.5% price movement from entry to stop (NOT percentage loss) — Target: $580 Risk per trade: 1% of total account — this is the percentage of potential loss. Position size: 10% of total account, 10x leverage RR: 1:2Stop moved to BE

Juliia

BTC, ETH, XRP market snapshot

BTC — key levels: $82,000 and $98,000. If we break above $98K, a new all-time high becomes likely. If we move below $82K, there’s a high probability of revisiting the $60K area and entering a crypto winter. For now the market looks uncertain today, so I want to see how things develop. The monthly close is crucial. ETH — possible local H&S pattern, target around $3,500 (which also aligns with the daily MA50/200 — a trend-change signal). It’s important to hold $2,960 to continue the move. Strong resistance is at $3,800. Support sits in the $2,500–2,700 zone, which has already been tested — if we revisit it again, the next level opens up around the $2,000 area. There’s a divergence forming on the 4h timeframe, so a local trend break is possible. For now I’m watching my long positions, with the stop moved to breakeven around $2,800. XRP still hasn’t played out the divergence on the monthly timeframe. There’s a strong risk of forming a double top if we close below $2, although market makers are still fighting here and we can see a long signal on the daily. But I still have the feeling we may see another low — and not only on XRP.

Juliia

Key growth drivers for ETH

Next week and early December come with several crypto-relevant events worth watching. On December 9–10, the Federal Reserve (FOMC) meeting will take place. The market currently prices in roughly an 80% probability of a –0.25% rate cut, which could boost overall liquidity and risk appetite, indirectly supporting the crypto market. On December 3, Ethereum will ship its “Fusaka” upgrade to mainnet. This update introduces PeerDAS and significantly improves network throughput, marking one of ETH’s major scalability milestones. BlackRock recently filed for the iShares Staked Ethereum Trust (November 19), signaling institutional interest in a future staked-ETH ETF and in ETH staking yield in general. Chainlink is expected to expand its Staking v0.3 program in December, increasing staking capacity and strengthening the network’s security and economic model — an event the market views as broadly bullish. Overall, December opens with macro shifts, a major Ethereum upgrade, and structural developments around ETH and LINK that could influence sentiment and capital flows across the crypto market.

Juliia

CAKE Short Setup

CAKE/USDT — Long — The price moved far away from the support level despite Bitcoin dropping. CAKE is now testing a resistance level with a strong approach; there may be attempts to break above it and potentially flip the trend around the MA50/200 on the daily timeframe. The setup looks strong, and Bitcoin shows signs of a slowdown. A possible bullish wedge is forming. — Entry: $2.345 (Market buy) — Stop: $2.23 (-5% price movement from entry to stop — NOT percentage loss) — Target: $2.64 Risk per trade: 0.5% of total deposit (this is the percentage loss) Position size: 10% of total deposit, leverage 10x RR: 1 : 2.4

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.