MrWhale

@t_MrWhale

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

MrWhale

Ethereum is looking pretty decent right now. Price is currently sitting inside a key weekly support zone. Within this broader weekly range, there are several important daily levels acting as sub-structures. A clean breakout above these daily resistances would likely trigger a larger breakout on the weekly timeframe. ETH is now approaching the apex of this weekly structure, which seems to converge around the end of the year / first week of January. **Bullish scenario:** A local breakout here could send price back to retest the weekly level at ~$3,000. If momentum is strong enough to break and hold above it, we could see an extension toward the monthly resistance at ~$3,700. To get there, ETH will need to clear the daily resistances marked on the chart — these can be used as progressive targets or entry zones for longs. **Bearish scenario:** If the current daily uptrend fails and we lose underlying support, price would likely fall back to the weekly support around $2,800. A hold there keeps the structure intact. A break below would open $2,600 next, with the final monthly support at $2,500. Trade accordingly and manage risk. I'll update if the setup changes significantly. Note: this analysis remains valid only until the apex resolves with a breakout. Not financial advice — DYOR.

MrWhale

Zcash Analysis: $615 next?

In my view, the recent high around $750 marks the local top for Zcash in this cycle. I don't expect it to retest or surpass its all-time highs (far above current levels) unless Bitcoin turns strongly bullish and kicks off a rapid altcoin season.The major gains from this run seem largely realized, and what we're seeing now resembles a classic "dead cat bounce" after the sharp pullback from the November peak (~$744).That said, locally, Zcash still looks constructive. Price is approaching a potential apex in its current structure and could be setting up for a short-term upside breakout — provided overall market sentiment stays positive (i.e., Bitcoin breaks higher to provide the necessary momentum).As shown on the chart:Multiple daily resistance levels are marked — these make ideal potential sell zones for taking profits. Ultimately, how far you let it run depends on your greed tolerance. In the most bullish local scenario, I could see ZEC pushing to the weekly resistance around $615. All the daily levels en route would need to be cleared for that to play out, acting as intermediate hurdles. Trade safe, and manage risk!

MrWhale

Kaspa (KAS) stands out for its strong fundamentals and passionate community – one of the best in crypto. Since peaking at its all-time high around August 2024, KAS has been in a prolonged downtrend. I've been patiently waiting for price to reach the key monthly support zone between $0.033–$0.039, where I've accumulated heavily, anticipating a potential bullish resolution from the monthly apex (highlighted in yellow) sometime in Q1 2026. Realistically, with the current price action and significant structural damage on the monthly timeframe, I don't expect a retest of all-time highs anytime soon. There's a lot of overhead resistance to overcome – price would need to convincingly hold and trade above the $0.12 region for me to shift to a more bullish long-term perspective. For now, I'm treating this as a solid mid-term trade setup, watching for signs of reversal at this critical support. Stay vigilant – these levels could set the tone for 2026. Trade safe! 🚀

MrWhale

TRX has been one of the most resilient altcoins throughout 2025, especially since the major altcoin pumps earlier in January. While many alts experienced explosive spikes followed by severe retracements (some wiping out 90-100% of their gains), TRX has maintained a remarkably steady upward grind with minimal volatility – a pattern that's always stood out to me as a sign of underlying strength. Currently, TRX is firmly holding a key weekly support zone. Price is approaching the apex with resolution likely timed around mid-to-late January 2026. As long as this weekly support holds, we stay in the current range-bound setup. A clean break below, however, would delay the apex further and open up deeper downside – targeting the highlighted monthly support in the $0.25–$0.26 area. Watching for a decisive move soon. Steady hands win in markets like this. Trade responsibly! 🚀

MrWhale

XLM is currently holding a critical monthly support zone. As long as this range holds, the downside remains limited. However, a clear break and close below this support would open the door to a move toward $0.15, and a subsequent break of that level could lead to $0.09–$0.10 area. Price is now approaching the apex of a long-term monthly triangle/symmetrical consolidation, which makes the coming weeks particularly interesting – a decisive breakout direction is likely soon. As always in the crypto market, Bitcoin leads the way. If BTC manages to break upward from its current local apex/range, it should provide the momentum needed to lift altcoins, including XLM. Long-term outlook: I don't expect XLM to retest its all-time high anytime soon – that cycle top appears intact for now. There's significant overhead resistance and structural damage from the multi-year downtrend that would take considerable time and volume to overcome. Near-term upside potential: In a bullish scenario, I see $0.35–$0.41 as realistic targets (previous monthly resistances). A convincing break and hold above $0.41 would invalidate my current bearish-to-neutral bias and force me to reassess. Watching closely for the resolution of these key levels. Trade safe! 🚀

MrWhale

**Chainlink (LINK) Daily Setup – Retesting Key Support** Chainlink is currently retesting its 3-month support zone on the daily timeframe as price approaches a local apex, potentially resolving late December or early January. **Bullish Outlook** - Hoping for a successful hold and bounce from this 3-month level. - A strong defense here could lead to upside resolution as the apex tightens. **Bearish Risks** - Watching closely for daily candle closes below the 3-month support. - The more consecutive daily closes below, the higher the probability of breakdown. - Invalidation of the support could open significant downside, targeting as low as **$10**. - Additional monthly support sits around **$11**, which could come into play on a deeper pullback if the current 3-month region is lost. **Key Levels to Monitor** - Immediate support: 3-month daily zone - Downside targets: $10 (major low), $11 (monthly support) Staying vigilant for confirmation of hold vs. breakdown in the coming sessions.

MrWhale

**XRP Monthly Update – Risk of Losing Key Support** XRP is currently threatening to lose its long-held monthly support level. With ~14 days remaining until the December monthly close, a swift recovery is critical. **Bullish Requirement** - Need consecutive daily candle closes back above the monthly support as soon as possible. - If price fails to reclaim and hold this level within the next 7–8 days, the monthly support will likely be fully lost, opening the door to a significant downside move. **Bearish Scenario (Increasingly Likely)** - First potential temporary support: Daily level around **$1.49** region. Expect this to act only as short-term relief (likely holding on 1H or lower timeframes) before giving way. - Next major target: **$1.10–$1.20** zone – this aligns with the descending weekly trendline and should produce a local bounce. - If the weekly trendline respects (acts as resistance on the bounce), XRP will continue forming lower lows, ultimately driving price toward the **macro apex** (highlighted in yellow) around mid-2026. **Key Levels to Watch** - Immediate: Monthly support (must reclaim quickly) - Downside: $1.49 (daily), then $1.10–$1.20 (weekly trendline) - Macro target: Yellow apex box (mid-next year) Bias shifts strongly bearish on confirmed monthly close below current support. Monitoring closely for either reclamation or breakdown confirmation.

MrWhale

**Daily Timeframe Local Setup** Price is currently approaching the local apex while respecting the daily uptrend line. - As long as the uptrend holds, expect a volatile breakout/move sometime late this week or early next week. - If price breaks below the uptrend line, a retest of the 3-month support (marked in green) becomes the high-probability outcome. Watching closely for confirmation on either scenario.

MrWhale

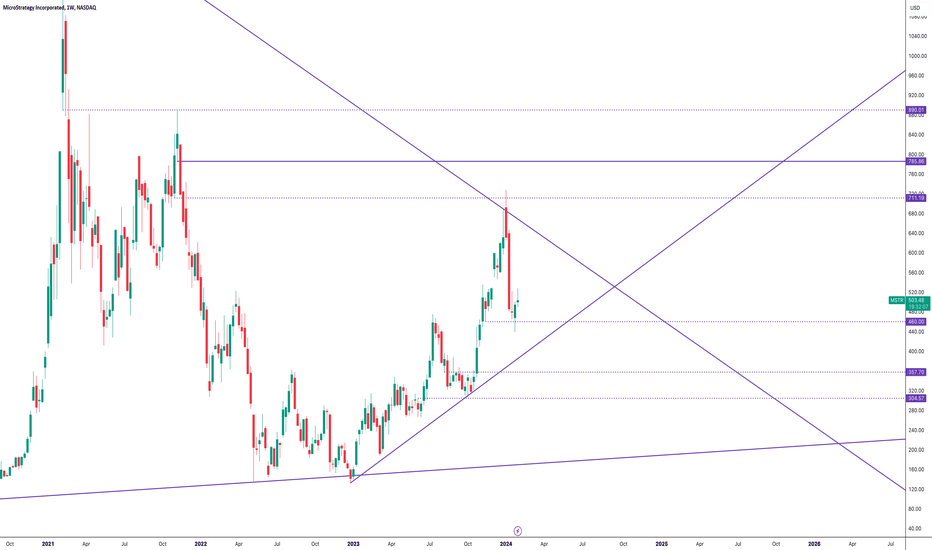

The weekly apex is not until ~June (Q2) of this year. The entire structure is being held by a weekly uptrend marked back in October 2023. Although current price is being held by a weekly support at $460, the uptrend is what important here. Breaking below the uptrend will result in a drop the following tested supports at $304-$360 A break OUT of the apex will result in a move up to the tested resistance at $711, then $785 if $711 breaks. considering $711 has already been tested there is a chance that it will likely reject hard at $785.

MrWhale

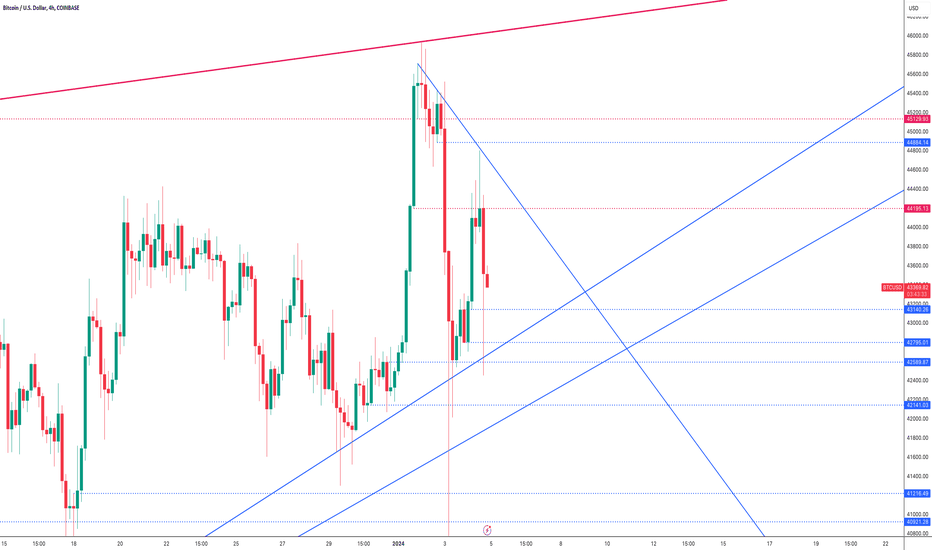

BTC looks good. It is holding the 4hr uptrend and retesting origin daily resistances. BTC to the moon!

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.