SergioRichi

@t_SergioRichi

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

SergioRichi

There's also an interesting entry point on Optimism

There's also an interesting entry point on OP #Optimism. The trade is almost 1 to 5. Entry: $0.4059 Take Profit: $0.5015 Stop Loss: $0.3849 It looks a lot like a false breakdown downward and growth along with Bitcoin and Ethereum is quite possible. Short traders' liquidity has already accumulated. #Crypto #Trading #DayTrading

SergioRichi

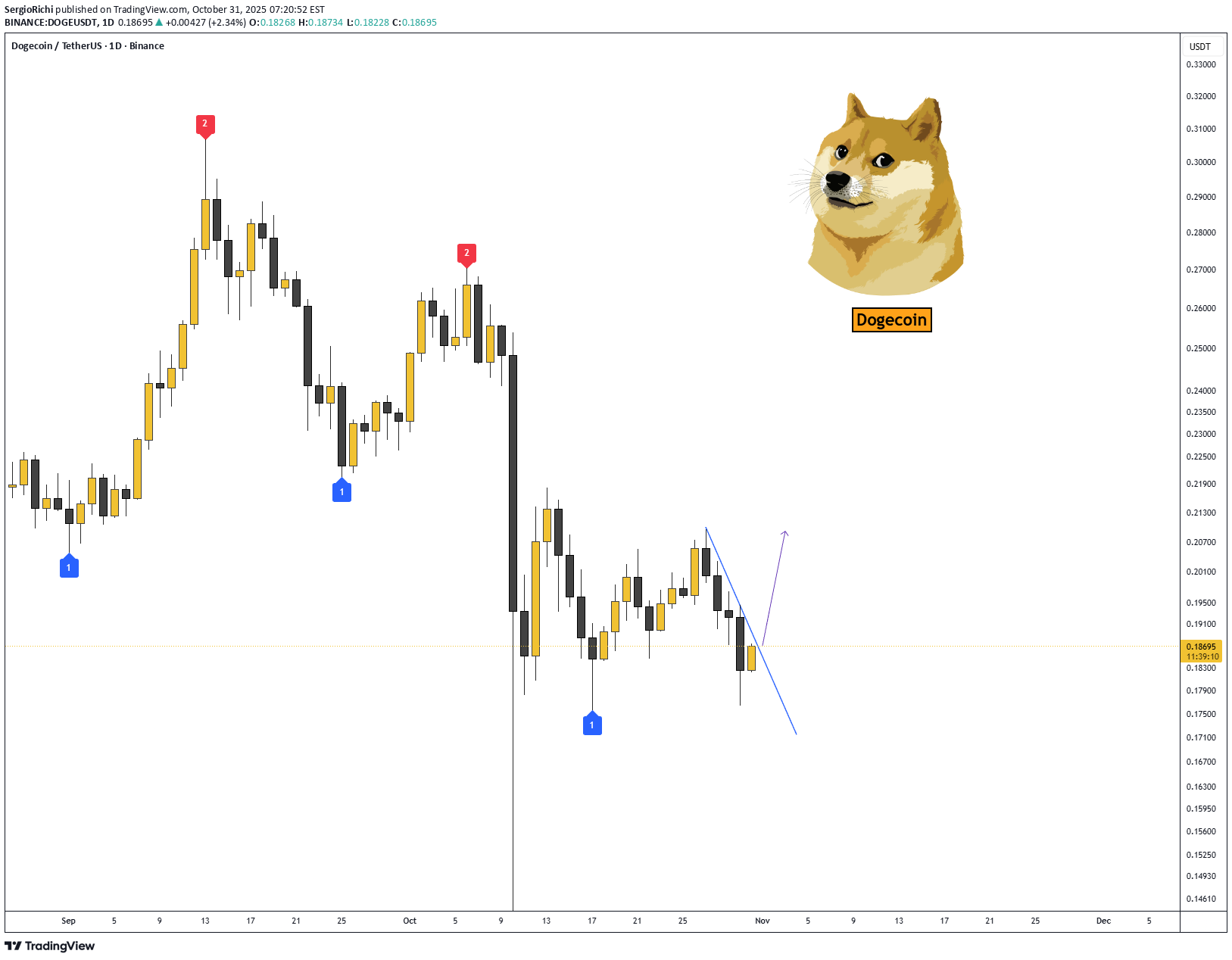

Elon Musk's favorite coin DOGE

Elon Musk's favorite coin DOGE #DOGE 🪙 also has a pretty good long setup. The trade is 1 to 2. Entry: $0.18684 Take Profit: $0.20940 Stop Loss: $0.17540 Based on the liquidation map, the trade is justified. A lot of liquidity has piled up above.

SergioRichi

Fed Rate Cut Looms: BTC Dip to 95K-100K = Prime Entry Before Moo

BTC / #Bitcoin 🪙 Fed Rate Cut Looms: BTC Dip to 95K-100K = Prime Entry Before Moonshot? (October 29, 2025 ) I've been away from the market for a good long while. In essence, nothing much happened during that time. We're just hanging out in a sideways range, waiting for the big events: 1. Fed Interest Rate Decision 2. FOMC Press Conference 3. Trump and Xi In just a couple of hours, we'll see that 0.25% interest rate cut. And there'll be a key speech from Jerome Powell. For today, trader sentiment looks mostly positive, from what I can tell. But I've got this gut feeling the market's gonna dip again. The sweet spot for entry on Bitcoin should be 95k to 100k. They'll sweep the long liquidity once more, and then we'll head higher. That's how I see this event shaking out. Charts: ➖ On the 5-day timeframe, that key level around 95k is still holding. Once it's tested, it'll clear the way for a push up to 145k to 200k (the final leg up). ➖ Chart from Coinglass Legend, which shows long trader liquidations stacking up below from $93k to $98k on the Bybit exchange. I figure they'll clear out that liquidity first before we rally. ➖ Big cluster of orders right nearby on the Coinbase crypto exchange at 93k and 100k, which backs up this zone as a hot spot. Whale money's piling in, partly by scooping up those trader liquidations. As you know, messing with leveraged trades is a risky game. The smart play is limit orders, and stick to spot only 😀🔥. #Crypto #Trading #Coinbase #FED #FOMC #STOCK

SergioRichi

ETH / #Ethereum 🔹 Donald Trump and Xi Jinping (October 19, 2025) A positive outlook is shaping up for Ethereum, and it sure looks like a classic W reversal is in the works. There's a ton of negativity swirling right now, with a lot of folks expecting prices to dip even lower (I was bracing for that final flush-out myself, but it looks like they scooped up the dip and are busy forming this reversal setup). During that Ethereum drop on October 10-11, BitMine Immersion Technologies beefed up its reserves with 104,336 ETH worth $417 million. As of this writing, the company's sitting on 3.03 million ETH valued at $12.18 billion, making it the biggest corporate whale holding Ethereum. Whales and public companies are aggressively snapping up Ethereum and stacking their bags. All that's left is to speculate where Ethereum's gonna top out and where they'll start dumping all this volume 8k? 10k? I've pulled together some screenshots that back up the bullish signal: 1️⃣ Liquidations on the Hyperliquid exchange: As you can see on the chart above, once we break $5,000, a massive wave of short traders are gonna get wrecked that could spark another leg up in price momentum. 2️⃣ Coinbase order book: Check it out—above $5,000, there are limit orders lined up for profit-taking, so Ethereum might follow a similar path straight up to $8,000. 3️⃣ Current big orders on Binance and Coinbase exchanges. 4️⃣ OKX ETH/USDC liquidation heatmap. Wrapping it up: On the daily chart, we're seeing a reversal pattern forming as a W (I call it the "pirate reversal" myself), and keep in mind that after the chaos on October 10-11, more than 1.6 million traders got absolutely rekt. I doubt everyone's gonna pile back in buying or flipping to long positions anytime soon that plays right into the hands of the big market puppeteers and market makers. They'll pump the price higher, whip up the hype, and offload their Ethereum stacks at the top. Snapshot:ETH / #Ethereum 🔹 Ethereum is entering a correction before further growth (October 29, 2025) We're awaiting the current major events: ➖ Fed Interest Rate Decision ➖ FOMC Press Conference ➖ Trump and Xi Regarding Ethereum, there aren't big changes; it seems the correction will drag on and it's more likely they'll collect liquidity from long traders, and only after that we'll head into growth. Chart: 1. Marked on the 5-day chart the liquidation levels $3100-$3400 from where an Ethereum reversal could occur. 2. On the Coinbase exchange, whales have placed a grid of orders all the way down to $3000. 3. On the Binance exchange, large orders at 3000, 3100, 3200, 3300, 3400, 3450, 3500. Let's see how everything plays out today and tomorrow. Volatility will be high. 🤔🔥

SergioRichi

DOGE #Crypto #Memecoin #ElonMusk — September 24, 2025. Price (Sept 24, 2025): $0.24700 Chart (1D): • • 💡 Entry & Exit: Entry: $0.24700 🎯 Take Profit: $0.8900 (+260.32%) My View: Dogecoin pulled back nicely, but the overall uptrend is still intact. We’re seeing that rounded base start to tilt toward acceleration. Remember, this is Elon Musk’s meme coin = and it’s also tradable on Robinhood. Looking at Coinbase order books, there’s a grid of buy orders stacked all the way up to $2.50. If we factor in a light breakout and the 1.618 Fibonacci extension, the $0.90–$1.00 range looks like a logical zone to lock in gains and move on from this coin. The recent dip across crypto definitely shook a lot of people = myself included.

SergioRichi

Sergio Richi Premium ✅ $GRIFFAIN #Crypto #AI — September 21, 2025. Price (Sept 21, 2025): $0.03920 Chart (1D): • bybit.com/trade/usdt/GRIFFAINUSDT?affiliate_id=46971&group_id=1472844&group_type=1 💡 Entry & Exit: Entry: $0.03920 🎯 Take Profit 1: $0.10900 (50%) (+178.06%) 🎯 Take Profit 2: $0.60000 (+1430.61%) My View: Griffain, a coin from the AI sector. I showed a chart comparing Virtuals Protocol and Griffain. Locally, they cleared out the nearest long trader stop losses, and it looks like the growth phase is just kicking off. This coin is also trading on Hyperliquid and is in market maker Wintermute’s portfolio. Worth a shot.

SergioRichi

DYDX #Crypto — September 16, 2025. Price (Sept 16, 2025): $0.6250 Who’s in the Ring? DYDX's Top Competitors 🥊 DYDX rules the perp DEX space with its Ethereum L2 speed and zero-gas trades, but it's not alone in the octagon: • GMX (Key Strengths) : Low fees, multi-chain (Arbitrum/Avalanche), real-yield model ➖ Why DYDX Edges Them Out: DYDX offers better leverage (up to 20x) and governance perks; GMX lacks spot markets. • Hyperliquid (Key Strengths) : Lightning-fast execution, high-leverage perps, ecosystem grants ➖ Why DYDX Edges Them Out: DYDX's Telegram integration and ETP could steal retail thunder; Hyperliquid's still niche. • Vertex Protocol (Key Strengths) : Cross-margin, orderbook DEX, low latency. ➖ Why DYDX Edges Them Out: DYDX's community governance and upcoming upgrades give it broader utility; Vertex is newer. • ApeX Protocol (Key Strengths) : Privacy-focused, zk-rollups for speed. ➖ Why DYDX Edges Them Out: DYDX crushes on volume ($ billions traded) and institutional backing like the new ETP. • Drift (Key Strengths) : Solana-based, fast perps and lending. ➖ Why DYDX Edges Them Out: DYDX's Ethereum roots mean better DeFi composability; Solana outages hurt Drift's rep. If DYDX nails its upgrades, it could lap the field. Insider Scoops and Big Catalysts on Deck 🕵️♂️ • Telegram Trading Launch: Slated for late September 2025 – trade perps right in Telegram with seamless cross-platform execution and a growth incentive program. This could onboard millions of retail users, spiking volume like we saw with TON's mini-apps. • Major Chain Upgrade This Fall: Expect spot markets, $8M grants relaunch for devs, and Coinbase integration to supercharge liquidity. • Broader DeFi Boom: CEO's predicting a September surge, with DYDX positioned as the derivatives king amid rising institutional interest. Chart (1D): • bybit.com/en/trade/spot/DYDX/USDT?affiliate_id=46971&group_id=1452401&group_type=1 💡 Entry & Exit: Entry: $0.6250 🎯 Take Profit 1: $1.2500 (50%) (+100.00%) 🎯 Take Profit 2: $4.0800 (+559.13%) ⚠️ Risks: Regulatory Heat: DeFi's in the SEC's crosshairs; any perp trading crackdown could spook volumes. Plus, competition from GMX/Hyperliquid eroding market share. Portfolio Allocation Recommendation: Keep it tight – no more than 5-10% of your crypto bag in this trade. My View: Super interesting project. It’s been in accumulation for months. The recent correction wiped out long traders’ stop losses, and I think the path is clear for a rally.

SergioRichi

$FARTCOIN #Crypto #Memecoin — September 15, 2025. Price (Sept 15, 2025): $0.8260 Asset Overview: Fartcoin (FARTCOIN) is a Solana-based meme coin launched in October 2024, known for its humorous, viral branding and community-driven hype. It emphasizes fun, decentralized finance with no real utility beyond speculation and memes, but has gained traction through social media buzz. FARTCOIN is available for trading on major exchanges like Coinbase, where it supports spot trading in pairs like FARTCOIN/USD, making it accessible for U.S. users with real-time pricing around $0.82-$0.87. • Broader Hype: Featured in top meme coin lists for 2025, with patterns suggesting accumulation phase post-April-June consolidation Chart (1D): • bybit.com/trade/usdt/FARTCOINUSDT?affiliate_id=46971&group_id=1451358&group_type=1 💡 Entry & Exit: Entry: $0.8260 🎯 Take Profit 1: $2.7300 (+230.51%) 🎯 Take Profit 2: $4.8300 (+484.75%) My View: The recent drop was tied to market manipulation and the liquidation of long traders. ➖ On Hyperliquid, it’s clear the price tanked right into a zone with heavy long trader liquidation density for Fartcoin. ➖ On OKX, there’s a big cluster of liquidity above, targeting short trader liquidations. ➖ Looking at Coinbase order books, the profit-taking zones of interest are around a new high of $2.7300 +/- and in the $4.80-$5.00 range. ➖ Smart money and big wallets are accumulating or have already bought this coin. The risk on this trade is huge—don’t forget that. There’s no 100% guarantee Fartcoin will rocket to new highs from here. We’re working off current data and building probabilities.

SergioRichi

#DayTrading #Gold GOLD trade with a tight stop loss. Risk/Reward 29. I ignored gold’s uptrend for a while but decided to try a long position with a short stop loss. Looking at the 6-month chart, there’s still room to climb. Entry: $3,642 Stop Loss: $3,609 First Take Profit: $4,600 Risk/Reward: 29.03 Chart:

SergioRichi

Sergio Richi Premium ✅ TRX #Crypto #Tron 🪙 — TRX: Justin Sun’s Play | September 08, 2025. Price (Sept 8, 2025) : $0.3323 Asset Overview: Tron (TRX) is a high-throughput blockchain platform focused on decentralizing the internet through dApps, smart contracts, and content sharing. Founded in 2017, it supports fast, low-cost transactions (up to 2,000 TPS) and powers ecosystems like DeFi, NFTs, and stablecoins (e.g., $79B USDT supply). TRX is used for fees, staking, and governance, positioning Tron as a scalable alternative to Ethereum. Key News (Sep 1-7, 2025): • Treasury Boost: Tron Inc added 312.5M TRX (~$110M) to holdings, doubling to $220M for grants, liquidity, and AI/DeFi growth—echoing MicroStrategy's BTC strategy. • Ecosystem Hype: High engagement outpaces rivals; WLFI token unlock ties to Sun spark interest. Institutional Accumulation: • Tron Inc leads as a "MicroStrategy of TRX," filing for $1B securities to accumulate TRX (never sell) via Nasdaq listing/reverse merger with SRM Entertainment. • XRP whales shifting to TRX pre-ETF hype; VanEck offers TRX ETP for exposure. Market Maker Wintermute 💡 Entry & Exit: Entry: $0.3323 (spot long) 🎯 Take Profit: $0.6646 (+100%) My View: After the correction, Tron is looking solid for continuing its uptrend. Big players holding long positions on TRX/USDT are showing strong metrics, and market maker Wintermute doubled its investment in Tron over the past week, which boosts confidence for further growth.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.