TFlab

@t_TFlab

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

📝 Description BNB on H1 just swept its most recent FVG, triggering a short-term liquidity run. After this sweep, price is showing signs of distribution below HTF resistance, which opens the door for a mean-reversion move lower. Given the current structure, a pullback toward 828 looks like the natural next draw on liquidity. ________________________________________ 📈 Signal / Analysis Primary Bias: Bearish pullback Short Setup (Preferred): • Entry (Sell): 840 • Stop Loss: Above 844 • TP1: 834 • TP2: 831 • TP3: 827–828 (liquidity target) ________________________________________ 🎯 ICT & SMC Notes • Recent FVG fully swept and imbalance resolved • Price trading below H1 supply / premium • BSL failed to hold and weakness confirmed • SSL resting below current range ________________________________________ 🧩 Summary After cleaning the nearby FVG, BNB looks heavy. As long as price remains capped below the swept zone, odds favor a rotation toward 828 liquidity. Shorts after confirmation make more sense than chasing upside here. ________________________________________ 🌍 Fundamental Notes / Sentiment With broader crypto still reacting to liquidity conditions and macro headlines, continuation moves are less likely without fresh catalysts. For now, technical liquidity levels remain the best guide, manage risk and scale out near targets. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

📝 Description BTC on M15 is trading inside a short-term corrective range after a sharp impulse. Price already made a partial tap into the upper FVG (30M/15M), but the reaction was weak. With imbalance still unfilled, odds favor a deeper move toward the lower FVG before any continuation attempt. ________________________________________ 📈 Signal / Analysis Primary Bias: Short-term pullback while below 89,000–89,100 Short Setup (Reactive): • Entry (Sell): 88,950 • Stop Loss: Above 89,080 • TP1: 88,750 • TP2: 88,530 • TP3: 88,400 ________________________________________ 🎯 ICT & SMC Notes • Partial FVG fill and imbalance still open • Price reacting from premium • Liquidity resting below recent range lows • Structure favors mean reversion, not expansion ________________________________________ 🧩 Summary This is a classic partial FVG tap full fill scenario. As long as BTC stays capped below 89k, a rotation into the lower FVG is the higher-probability path. Acceptance above premium invalidates the short. ________________________________________ 🌍 Fundamental Notes / Sentiment With markets still headline-driven and liquidity tight, short-term reactions around imbalances are favored. Keep size light and manage risk around key levels. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

📝 Description BTC on M30 just made a shallow tap into the upper FVG, followed by immediate hesitation. With only a partial fill completed, it’s reasonable to expect price to seek the lower FVG for a more complete imbalance fill before any meaningful continuation. ________________________________________ 📈 Signal / Analysis Primary Bias: Short-term pullback while below 89,000–89,100 Short Setup (Reactive): • Entry (Sell): 88,800 • Stop Loss: Above 89,00 • TP1: 88,600 • TP2: 88,340 • TP3: 87,915 (30M FVG midline) ________________________________________ 🎯 ICT & SMC Notes • Price tapped 30M FVG in premium • HTF FVG H4/H1 overhead caps upside • No clean CHOCH + BOS for bullish continuation • RSI flattening → momentum exhaustion • Liquidity draw sitting below recent lows ________________________________________ 🧩 Summary This looks like impulse and pause then retrace. As long as BTC stays below 89k, odds favor a pullback to 88.4k and 87.9k. Acceptance above premium invalidates the short and opens room higher. ________________________________________ 🌍 Fundamental Notes / Sentiment With markets still headline-sensitive and liquidity tight, quick rotations around key levels are favored. Trade the reaction at FVGs and keep risk tight. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

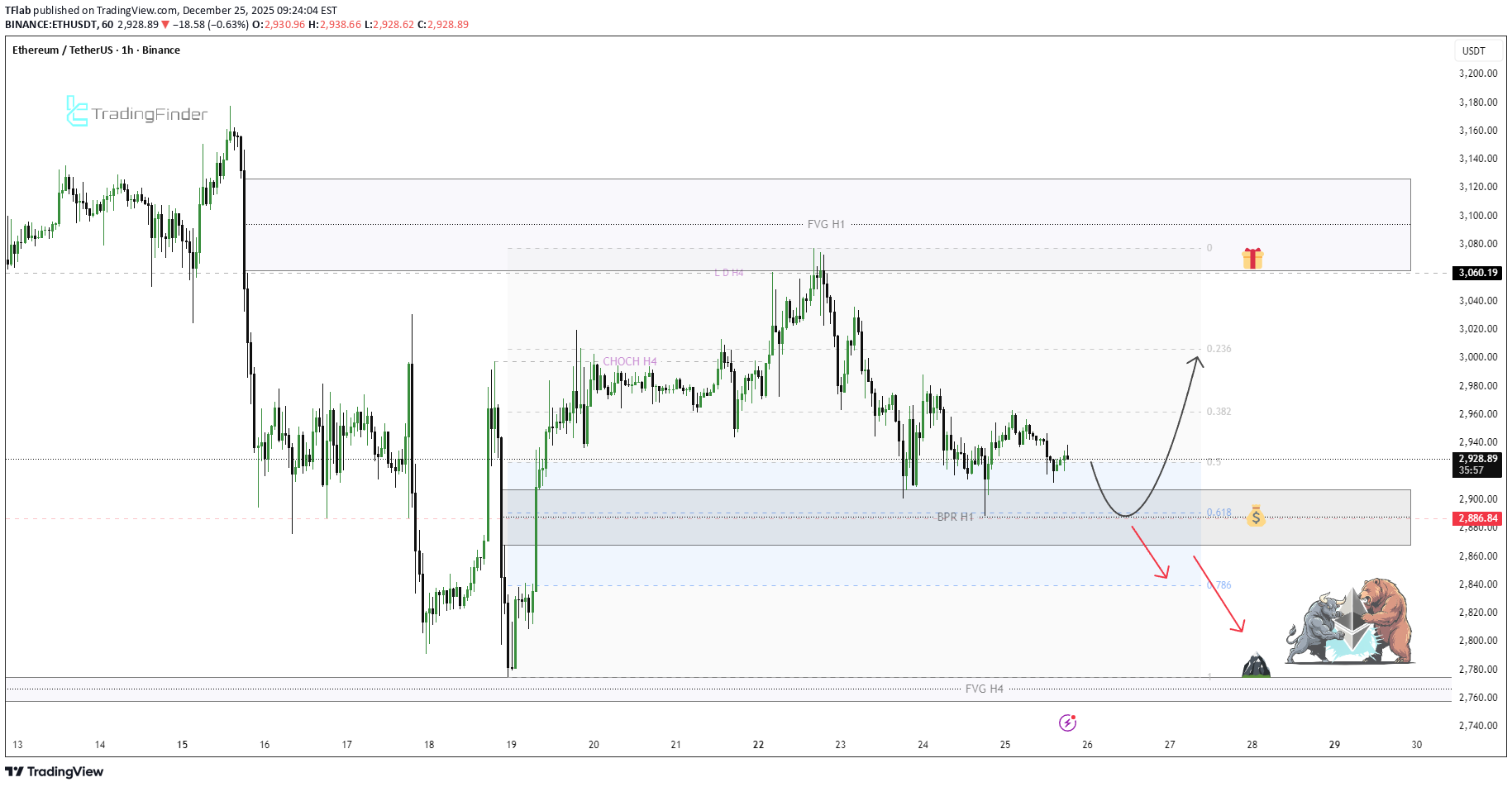

📝 Description ETH on H1 remains in a corrective / range-bound structure. A high-quality liquidity pool sits at 2,886, perfectly aligned with the BPR mid-line, making it the most logical draw-on-price for any fresh move. Markets typically seek liquidity before initiating a new leg, so a rotation into this zone is the base expectation. ________________________________________ 📈 Analysis (Scenario-Based | Non-Signal) Primary Liquidity Scenario: • Price is expected to rotate toward 2,886 to tap resting liquidity at the BPR mid-line Bullish Reaction Scenario: • A sweep of the prior low at 2,886 with acceptance can open upside toward 3,000 and 3,060 Failure Scenario: • Failure to hold 2,886 shifts the draw toward 2,840 and 2,775 ________________________________________ 🎯 ICT & SMC Notes • Strong liquidity concentration at 2,886 • Liquidity required before expansion • Sweep + hold favors mean reversion higher • Acceptance below favors continuation lower ________________________________________ 🧩 Summary This is a liquidity-mapping framework, not a trade signal. ETH is likely drawn toward 2,886 first. A clean sweep and defense there opens upside toward 3,000 and 3,060. Failure to reclaim that zone increases probability of continuation into 2,840 and 2,775. The reaction at 2,886 defines the next leg. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

📝 Description BTC on H4 is trading inside a corrective leg after a clear sell-side liquidity grab (SSL) into H4 OB. Price is now pulling back into H4 OTE (0.618–0.786) within discount, and a short-term bullish move is expected as part of a mean-reversion push toward nearby liquidity. The broader structure remains corrective unless premium is reclaimed with acceptance. ________________________________________ 📈 Signal / Analysis Primary Bias: Bullish pullback from discount. short-term upside, then decision at premium Long:: • Entry (Buy): 86,300 • Stop Loss: Below 85,750 (OB invalidation) • TP1: 88,940 • TP2: 90,127 (BSL) • TP3: 91,370 (H4/H1 FVG) ________________________________________ 🎯 ICT & SMC Notes • Clean SSL sweep into H4 OB • Price respecting OTE (0.618–0.786) in discount • H4/H1 FVG overhead as upside magnet • BSL resting above recent highs ________________________________________ 🧩 Summary This is a discount buy and premium sell environment. Long from OTE makes sense for a liquidity run, but expect reactions at BSL/FVG. Acceptance above 91.3k needed for continuation; otherwise, watch for rejection and rotation back down. ________________________________________ 🌍 Fundamental Notes / Sentiment With USD Unemployment Claims coming up, this data can act as a short-term catalyst. If the release prints above the forecast (224k), it would weaken USD and support the bullish setup. If it comes in below expectations, upside momentum may be limited—trade with tight risk management and secure profits on lower targets. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

ETH: Short Setup Below 3,175 – Premium Zone Reaction

📝 Description ETH on H1 just pushed into a HTF premium zone after a clean buy-side sweep. Structure still looks corrective, not impulsive. Price is reacting around H4 OTE (0.618–0.786) with clear signs of slowdown near HTF supply. ________________________________________ 📈 Signal / Analysis Primary Bias: Bearish below 3,175 Short Setup (Preferred): • Entry (Sell): 3,050 • Stop Loss: Above 3,080 • TP1: 3,010 • TP2: 2,980 • TP3: 2,950 ________________________________________ 🎯 ICT & SMC Notes • Clean BSL sweep into premium • Price reacting inside H4 OTE (0.618–0.786) • H1 FVG overhead acting as resistance • No valid CHOCH + BOS to confirm bullish continuation • RSI elevated → distribution vibes, not expansion • Downside H4 FVG remains unfilled ________________________________________ 🧩 Summary This looks like a textbook liquidity grab into premium. As long as ETH stays below 3.15k, odds favor a bearish rotation back into discount and lower liquidity pools. Shorts from premium > chasing longs here. ________________________________________ 🌍 Fundamental Notes / Sentiment Rising US–Venezuela geopolitical tensions increase headline risk and support a risk-off bias. With markets sensitive to energy and sanctions news, probabilities currently favor further downside over sustained upside, especially near HTF supply. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

📝 Description On the H1 timeframe, market structure remains in a corrective phase. The most recent upside leg is classified as a retracement, following a prior Sell-Side Liquidity (SSL) sweep, with no confirmed HTF CHOCH or BOS to indicate a structural trend shift. Price is currently compressing within a Premium PD Array, and the candle behavior suggests weak buy-side momentum rather than bullish displacement. ________________________________________ 📈 Analysis (Scenario-Based | Non-Signal) Projected Liquidity Scenario: • Stage 1: Weak push toward 89,500 • Stage 2: Secondary extension toward 90,500 with limited displacement • Expectation: • Formation of Buy-Side Liquidity (BSL) above equal highs • BSL Sweep without acceptance or follow-through • Failure to hold price above HTF premium Post-Sweep Outlook: • Move interpreted as External Liquidity Grab (BSL Sweep) • Anticipated shift in draw toward Internal Range Liquidity • Downside magnet: H1 Fair Value Gap (FVG) @ 86,500 ________________________________________ 🎯 ICT & SMC Notes • Upside move categorized as engineered liquidity retracement • BSL pools positioned above 89,500 and 90,500 • Sweep of these levels qualifies as External Range Liquidity • Absence of HTF CHOCH + BOS keeps bearish framework intact • H1 FVG @ 86,500 remains unmitigated is a valid Internal Liquidity Draw ________________________________________ 🧩 Summary If price advances first to 89,500 and then to 90,500 with weak momentum and subsequently fails to gain acceptance, the move can be classified as a Buy-Side Liquidity sweep / External Liquidity Grab. Under this condition, the higher-probability draw shifts from external liquidity toward internal inefficiencies, with a projected reversion into the H1 FVG at 86,500. This is a scenario-based framework, intended to model liquidity behavior rather than provide execution signals. ________________________________________ 🌍 Fundamental Notes / Sentiment Macro backdrop remains risk-off, with persistent CB policy restriction, elevated UST10Y > 4.20%, and constrained USD liquidity (DXY > 103) suppressing risk asset beta. BTC ETF net flows remain neutral-to-negative, while perpetual OI shows no sustained long build-up. Funding rates hovering near flat indicate absence of aggressive directional conviction. Without a liquidity expansion impulse or ETF inflow acceleration, upside reactions into HTF premium (OTE / OB) are structurally aligned with distribution, not accumulation. ________________________________________ ⚠️ Risk Disclosure This content is educational and scenario-based and does not constitute financial or investment advice. Market conditions can invalidate any scenario. Always apply independent confirmation, predefined risk parameters, and disciplined risk management aligned with your trading plan.Price delivered the expected BSL grab above equal highs and failed to sustain acceptance inside HTF premium. The push toward 90K showed clear signs of weak displacement and distribution, confirming the move as an external liquidity sweep rather than trend continuation. Following the rejection, draw on liquidity has shifted back toward internal range inefficiencies. As long as price remains below reclaimed BSL and no HTF CHOCH/BOS forms, downside continuation toward the H1 FVG zone remains the primary narrative.

📝 Description Market structure on M15 remains bearish within the higher-timeframe context, despite the recent bullish retracement. Price is now retracing into a premium zone, aligning with the H1 OTE (0.618–0.786) of the last bearish displacement, without any confirmed CHOCH + BOS combination to validate a bullish reversal. ________________________________________ 📈 Signal / Analysis Primary Bias: Bearish below 88,500–88,800 Short Setup (Preferred Scenario): • Entry (Sell): 88,120 • Stop Loss: Above 88,500 (above H1 swing high) • Take Profit 1 (TP1): 87,500 • Take Profit 2 (TP2): 86,900 • Take Profit 3 (TP3): 86,600 ________________________________________ 🎯 ICT & SMC Notes • Price currently reacting inside H1 OTE (0.618–0.786) • Clear Bearish Order Block (H1) acting as supply • H4 Order Block below price remains unmitigated • No valid CHOCH + BOS sequence confirming trend reversal • RSI structure aligns with corrective pullback, not momentum expansion ________________________________________ 🧩 Summary The current price action represents a corrective retracement within a dominant bearish market structure. As long as BTC remains capped below the 88,500–89,000 premium resistance, continuation toward lower HTF liquidity pools is favored. Rejection from the current OTE zone strengthens the probability of a bearish expansion toward unmitigated H4 demand and order blocks. ________________________________________ 🌍 Fundamental Notes / Sentiment Recent signals around a potential Bank of Japan rate hike have added pressure to global risk assets. A tighter Japanese monetary policy strengthens the yen and reduces carry-trade liquidity, which historically impacts crypto and equities negatively. As yen-funded positions unwind, capital flows shift toward safety, limiting upside momentum in Bitcoin. In this environment, crypto remains vulnerable to downside moves unless global liquidity conditions ease or major risk-on catalysts emerge. ________________________________________ ⚠️ Risk Disclosure Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.