The_Alchemist_Trader_

@t_The_Alchemist_Trader_

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

The_Alchemist_Trader_

Dogecoin (DOGE) Breakdown — New Yearly Low at Risk

Dogecoin has broken below major structural levels, losing the $0.16 region and dropping into an untested price zone. Sellers are firmly in control as momentum continues to weaken. With no clear support beneath current levels, DOGE is edging closer to its yearly low at $0.08. Bearish candle structure and sustained selling pressure suggest downside risk remains elevated. Key Points - DOGE trades below previous structure with momentum heavily bearish - Price enters a zone with little historical support - Selling pressure dominates as market confidence fades What to Expect If DOGE fails to reclaim lost levels, a move toward the $0.08 yearly low becomes increasingly likely. A meaningful reversal would require strong volume and a shift in market structure.

The_Alchemist_Trader_

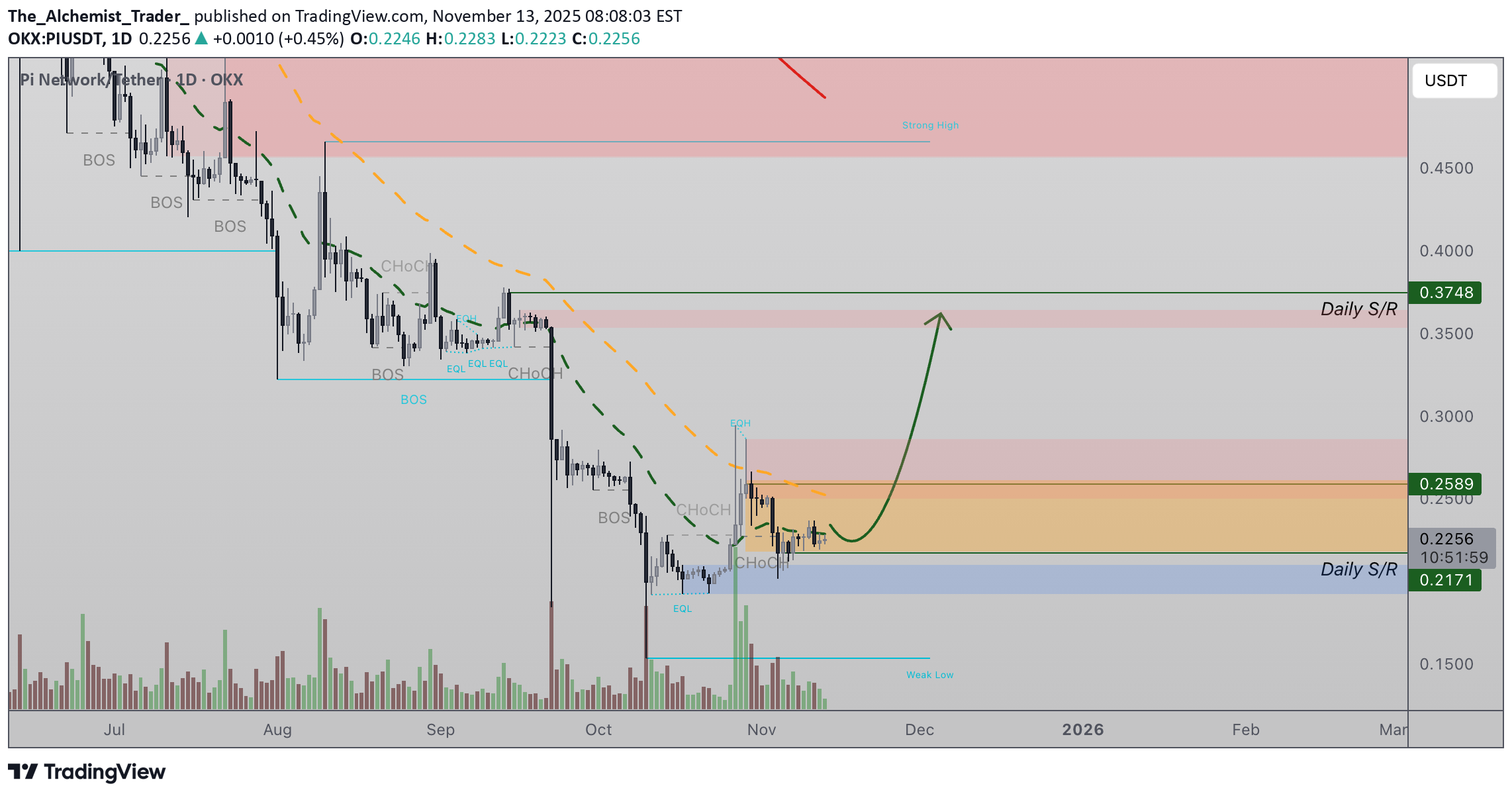

Pi Network (PI) Update — Adam & Eve Pattern Forming

Pi Network is developing a rare Adam and Eve bullish reversal pattern, with price holding firmly above the Point of Control. This behaviour signals early accumulation and improving sentiment at current levels. As PI pushes toward the neckline between $0.21 and $0.28, the rounded bottom structure continues to strengthen. Buyers are becoming more active, suggesting the market may be preparing for a breakout attempt. Key Points - Rare Adam and Eve reversal structure forming - Price holding above the Point of Control showing demand - Neckline at $0.21–$0.28 is the major breakout zone What to Expect If PI breaks above the neckline with strong volume, a move toward $0.35 becomes likely. Losing the POC would weaken the setup and delay the reversal.

The_Alchemist_Trader_

Ethereum Bearish Price Action Suggests Lower to Come

Ethereum’s price action is weakening as downside pressure accelerates. ETH has broken through several major support levels and is now trading below the $3,500 zone, which has flipped into a high-time-frame resistance area. This region also aligns with the 200-day moving average, adding to the bearish confluence. The correction has pushed price toward the $2,600 area, where an oversold bounce may occur. However, any rebound from this level would likely form a lower high within the broader downtrend, as Ethereum continues to print consecutive lower lows. From a structural perspective, the key downside target remains the $2,100 range low, which serves as the next major support zone. With ETH now finding acceptance within a lower trading range, the probability of price rotating toward this level has increased. While a short-term bounce is possible, market structure currently favors continued bearish movement unless Ethereum can reclaim former support levels with strong momentum.

The_Alchemist_Trader_

XRP Consolidation Above $2.00 Hint Accumulation

XRP continues to consolidate above the key $2.00 support, a level that previously produced a strong bounce. Price action is showing signs of forming a pennant-style structure, often a precursor to a major expansion phase. If XRP confirms another bounce from this level, momentum may shift toward a bullish breakout targeting higher resistance zones such as $3.00 and beyond. As long as $2.00 holds, the broader outlook remains constructive. Key Points Price consolidating above major $2.00 support Pennant-style structure beginning to take shape Break above consolidation opens targets toward $3.00 What to Expect If $2.00 continues to hold, XRP may build pressure for a breakout toward $3.00. Losing this level would delay bullish continuation.

The_Alchemist_Trader_

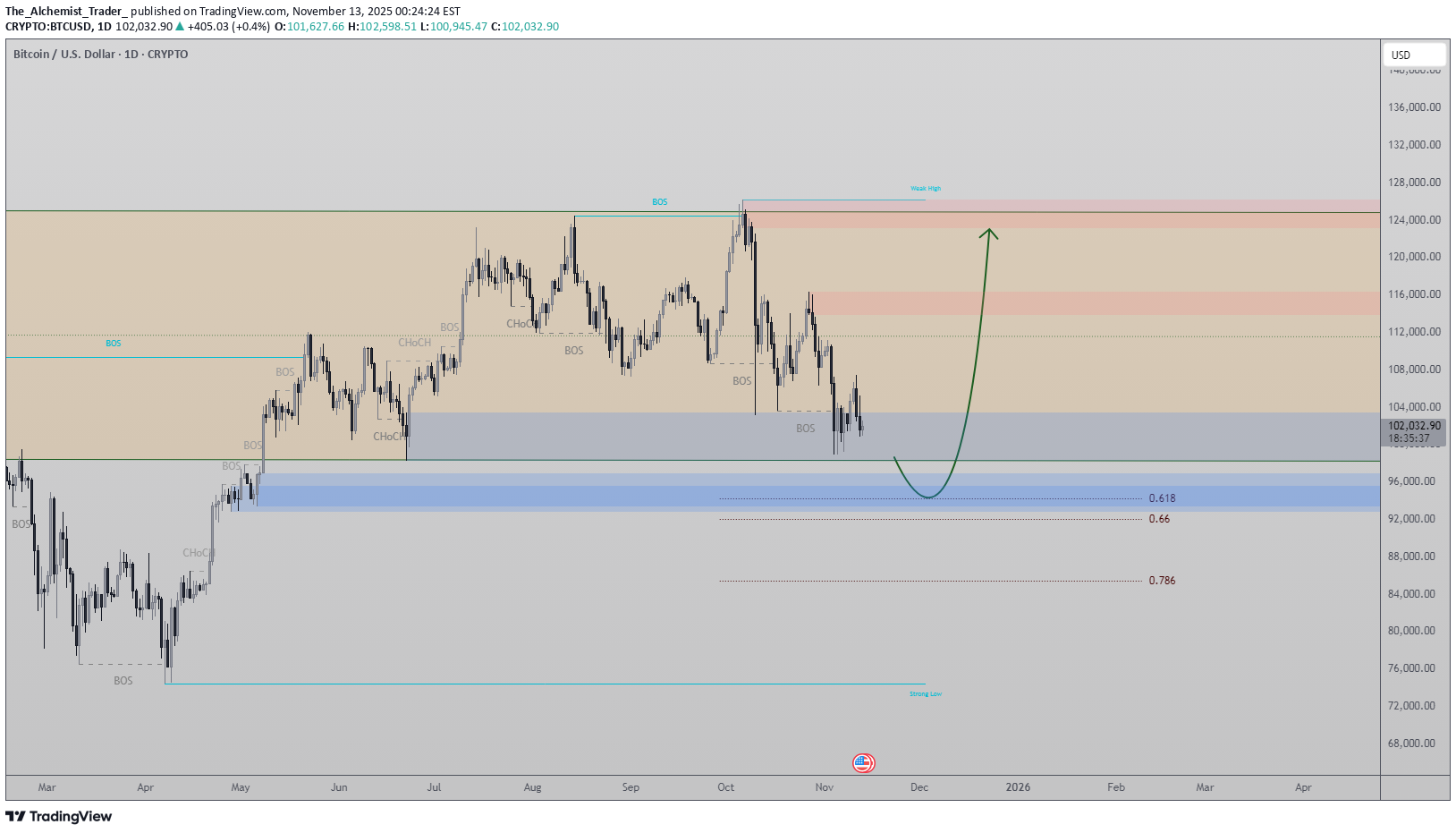

Bitcoin Channel Low Support, Bottom Forming?

Bitcoin is currently testing the $90,000 channel support, a historical level that previously marked major cycle lows. Holding this region keeps price inside a strong higher-time-frame range. If BTC maintains this support on a closing basis, the probability of a rotation toward $135,000 increases, setting up conditions for a potential attempt at new all-time highs. Key Points - $90,000 acting as major channel support from previous market bottom - Holding support keeps BTC within higher-time-frame bullish structure - Break above resistance opens path toward $135,000 and beyond What to Expect As long as Bitcoin holds above $90,000, a rebound toward $135,000 becomes the likely next move. A breakdown would delay the bullish continuation.

The_Alchemist_Trader_

Dogecoin (DOGE/USDT) — 3 Drives Pattern Near Completion

Dogecoin price action is currently trading within a developing 3 Drives pattern, signaling that the market is nearing a potential exhaustion phase. This structure opens the probability of a $0.14 retest in the immediate short term before a possible reversal. Key Technical Points: - Support: $0.14 (potential completion of 3 Drives pattern) - Resistance: $0.21 key breakout level - Bias: Bullish reversal if $0.14 holds As long as price continues to respect the $0.14 region, the pattern remains valid and structurally intact. A third and final drive into this zone would confirm the 3 Drives formation, completing the corrective leg before a potential rotation higher. If a reversal reaction occurs from this area with a strong reclaim candle, it would likely initiate a new impulsive wave targeting $0.21 and beyond. However, failure to defend $0.14 would invalidate the pattern and risk extending the decline. From a technical perspective, Dogecoin is approaching a key inflection zone — maintaining the $0.14 base could mark the beginning of a broader bullish rotation as the 3 Drives setup completes.

The_Alchemist_Trader_

Solana (SOL/USDT), Critical Support at $146 Needs to Hold

Solana is currently trading above the $146 support, a region that has historically held price through multiple retest attempts. The recent failed rally above $167 resulted in an engulfing candle, highlighting weakness and renewed selling pressure. Key Technical Points: - Support: $146 key daily level - Resistance: $167 recent rejection zone - Downside Target: $112 if support fails The $146 level now acts as a make-or-break zone for Solana’s short-term structure. If price continues to respect this region, a rebound back toward $167 remains possible; however, a confirmed breakdown below support would open the probability for a deeper corrective move toward $112, aligning with previous demand and liquidity zones. The rejection at $167 combined with weakening volume suggests the upside momentum has faded, and market participants are cautious near current levels. Maintaining structure above $146 is essential for Solana to avoid transitioning into a broader bearish phase. From a market structure standpoint, Solana is at a key trade location — holding $146 keeps the chart neutral-to-bullish, while a loss of this level would likely accelerate downside continuation.

The_Alchemist_Trader_

XRP is struggling to reclaim the 200 MA

XRP is showing clear weakness as price continues to struggle reclaiming the 200 Moving Average, a key level that typically signals trend strength. The recent retest resulted in a failed reclaim, trapping breakout traders and shifting momentum back toward local resistance. This bounce is occurring on low volume, indicating that buyers lack conviction. As long as XRP trades below the 200 MA, the probability of another rejection remains high, increasing the likelihood of continuation in the local downtrend. If bearish pressure persists, XRP is likely to rotate toward the $2 support, where the next reaction will determine whether a deeper breakdown or a short-term relief bounce follows.

The_Alchemist_Trader_

Pi Network Accumulation Signals Building Toward $0.37

Pi Network is currently trading above the $0.21 support, showing early signs of a potential accumulation phase. This region has acted as a structural foundation in recent sessions, and as long as price continues to print multiple candle closes above $0.21, the probability of a developing bottom increases significantly. - Accumulation Zone: Holding $0.21 supports the idea of a base forming for higher prices. - Key Requirement: Price must avoid closing below $0.21 to maintain the bullish accumulation outlook. - Upside Objective: A sustained hold could fuel a rally toward the $0.37 resistance region. From a technical perspective, Pi Network is currently positioned at a key trade location that will determine its next directional move. Maintaining strength above support would validate the accumulation structure and open the path toward higher resistance levels in the coming days and weeks.

The_Alchemist_Trader_

Bitcoin Tests Range Low, Reclaim Setup at $96K?

Bitcoin price action continues to trade near the range low of its high-time-frame structure, hovering around the sub-$96,000 region. This area represents a critical point where a deviation / failed auction setup could form — a scenario where price briefly breaks below support, captures liquidity, and then reclaims the level to initiate a strong rotation back into the established range. - Range Low Test: Bitcoin is sitting near $96K, the bottom boundary of its macro range. - Key Confluence: The zone aligns with the 0.618 Fibonacci, increasing its technical importance. - Deviation Potential: A sweep below $96K followed by a strong reclaim could form a swing-low reversal setup. For this scenario to materialize, Bitcoin needs to show bullish volume support as price interacts with or reclaims the level. Without that influx, the risk of breakdown and continuation lower remains present. If volume confirms and price reclaims the $96K region, Bitcoin could establish a new swing low and rotate back toward the mid-range and upper boundaries.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.