XTrendSpeed

@t_XTrendSpeed

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

XTrendSpeed

On the 4-hour chart, XAUUSD has retreated from its highs. Currently, watch for support around 4257. If it doesn't break below 4257, it may resume its bullish trend. However, if the price breaks below 4257, it will continue to fall, with further support around 4191, a potential buy point for a bullish bat pattern.

XTrendSpeed

LTCUSD has formed a potential head and shoulders bottom pattern

On the 4-hour chart, LTCUSD has formed a potential head and shoulders bottom pattern. Currently, watch for support around 79.6; a pullback that holds above this level could lead to further upward movement. Resistance is seen around 87.7, with a break above this level targeting the 94.2-97.5 area.

XTrendSpeed

BTCUSD SELL 104400

On the daily chart, ETHUSD has stabilized and rebounded, with bulls holding the upper hand in the short term. Currently, attention should be paid to the resistance around 104400, a potential shorting entry point for a bearish bat pattern, which also falls within the previous supply zone.

XTrendSpeed

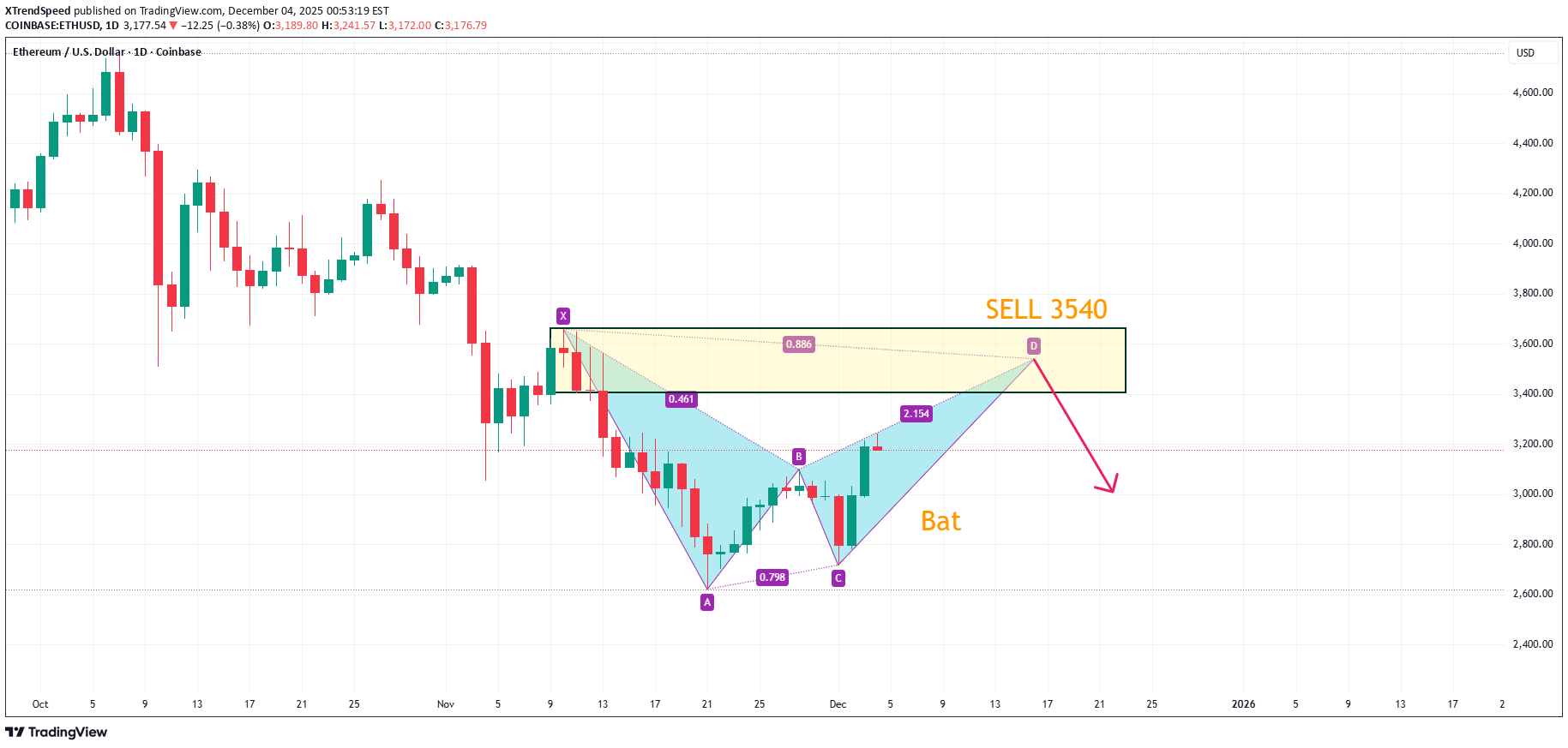

ETHUSD SELL 3540

On the daily chart, ETHUSD has stabilized and rebounded in the short term, with bulls in control. Currently, attention should be paid to the area around 3540, which is a potential shorting entry point for a bearish bat pattern, and it also falls within the previous supply zone.

XTrendSpeed

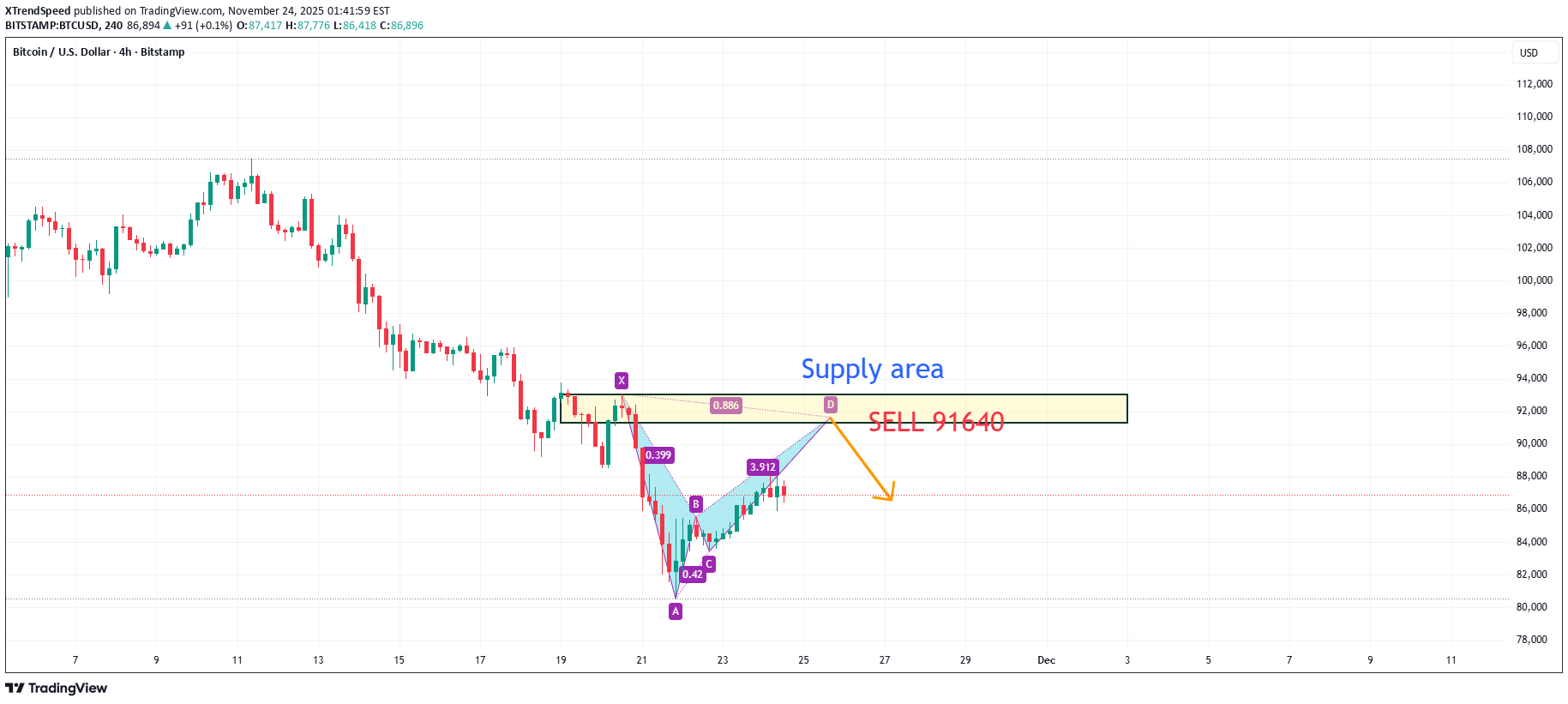

BTCUSD SELL 91640

On the 4-hour chart, BTCUSD rebounded after a sharp drop. Currently, attention should be paid to the resistance around 91640, which is a potential shorting point for a bearish bat pattern, and it is also located within the previous supply zone.

XTrendSpeed

ETHUSD BUY 2442

On the daily chart, ETHUSD is trending downwards, with the bears in control. The price is expected to continue lower, with support around 2442, a potential buy point for a bullish bat pattern, which also falls within a previous demand zone.

XTrendSpeed

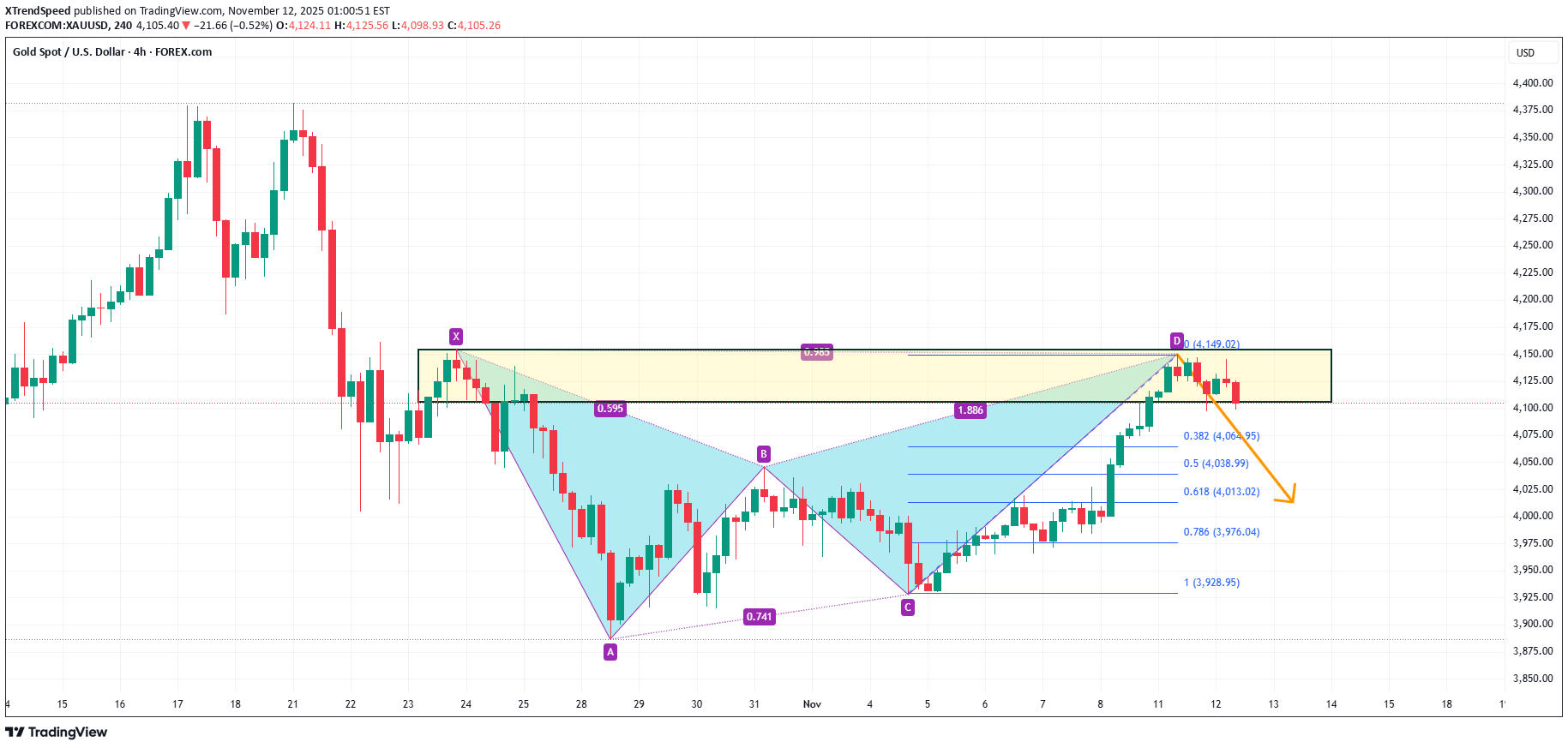

XAUUSD downside target: 4013

On the 4-hour chart, XAUUSD encountered resistance and fell back after testing the previous supply zone, forming a bearish bat pattern in the short term. Currently, attention should be paid to the resistance around 4149. If the rebound fails to break through, the short-selling strategy should be maintained, with a target of around 4065 (0.382 of CD) and a second target of around 4013 (0.618 of CD).

XTrendSpeed

LTCUSD SELL 119.2

On the daily chart, LTCUSD has stabilized and rebounded in the short term. At present, attention can be paid to the resistance around 119.2, which is a potential shorting position for a bearish Gartley pattern. At the same time, this position is within the previous supply zone.

XTrendSpeed

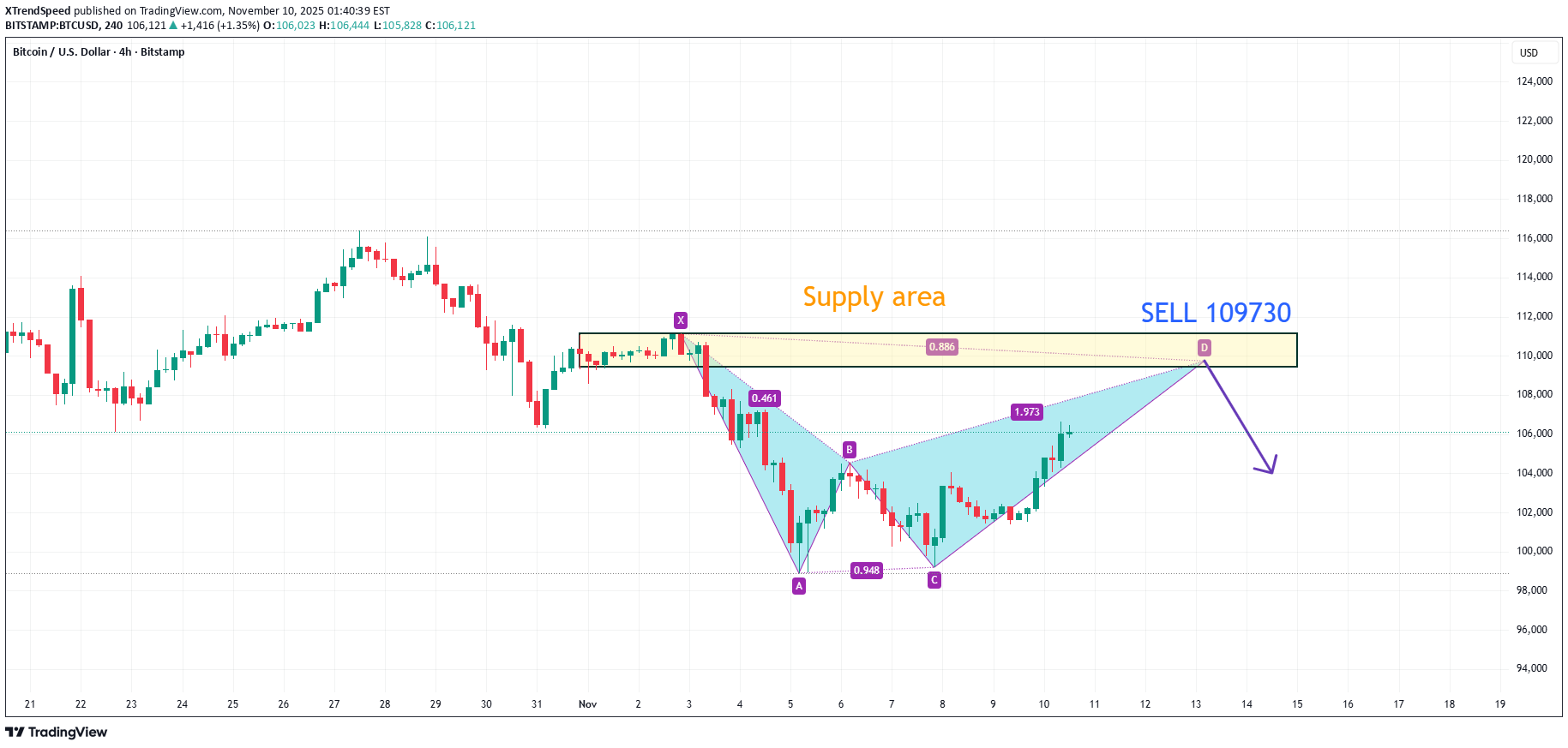

BTCUSD SELL 109730

On the 4-hour chart, BTCUSD has stabilized and rebounded, and the short-term trend is expected to continue upward. Currently, pay attention to the area around 109730, which is a potential shorting entry point for a bearish bat pattern, and it also falls within the previous supply zone.

XTrendSpeed

LTCUSD has formed a head and shoulders bottom pattern

On the 1-hour chart, LTCUSD has formed a head and shoulders bottom pattern. Currently, watch for support around 85.2; if it retraces but doesn't break below this level, it's likely to continue its upward trend, targeting the 98.0-102.0 area.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.