cryptodailyuk

@t_cryptodailyuk

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

cryptodailyuk

🔎 Market Structure Main Trend: Down → Series of lower highs and lows → Breakout below the downtrend line (which has already happened) Currently, the price is consolidating low, with no trend reversal signal. 📉 Price Action After a strong upward impulse (pump), the market: failed to maintain the structure gave back most of the gains Current price ~9.3 USDT No clear demand – small candles, weak momentum 🧱 Key Levels (very important) 🔴 Support 9.00–9.30 → local, weak ~8.00 → demand zone / lower consolidation range 5.94 → HARD SUPPORT Loss = possible further decline / capitulation 🟢 Resistance 12.36 → nearest Sensible resistance (flip level) 14.98 → strong structural resistance 19.59 – 22.77 → distribution zone (very difficult to break) 26.74 – 27.58 → local ATH/supply zone 📊 Stoch RSI indicator Currently emerging from oversold territory This is not a long signal per se It only gives: short-term bounce if volume appears 🧠 Scenarios 🟡 Baseline scenario (most likely) Consolidation 8–10 USDT Lack of strength for a breakout The market is waiting for: BTC move or news/volume 🔴 Bearish scenario Loss of ~8 USDT Test of 5.94 If 5.94 falls → new Lows 🟢 Bullish scenario (conditional!) D1 close above 12.36 Retest as support Targets: 14.98 19.59 Without this → no medium-term longs

cryptodailyuk

1️⃣ Main trend • Long-term trend: upwards The black trend line is respected - the market moves in a higher highs / higher lows structure. • The recent upward move was expansive and parabolic → it was not a healthy growth, just FOMO. ➡️ Correction was inevitable. ⸻ 2️⃣ Current price situation • Current price ~ USDT 840 • The market rejected the 1020-1160 zone very aggressively (long wick = smart money distribution) This does NOT look like: • continuation of impulse ❌ • only for local peak and market cooling ✅ ⸻ 3️⃣ Key levels (most important) 🟢 Resistances • 911–920 → first hard resistance • 1020–1030 → distribution zone • 1160 → ATH / extreme (unrealistic without long consolidation) 🔴 Support • 780–800 → KEY This is: • previous resistance • psychological level • place of price reaction • 600–620 → strong HTF support • ~520–550 → the last line of defense of the trend ⸻ 4️⃣ RSI Stochastic (bottom) • RSI in the oversold zone • BUT: • on W1 RSI may stay in oversold for a long time • this is NOT yet a buy signal in itself We are waiting for: • RSI turn up • preferably bullish cross + price reaction

cryptodailyuk

🔍 Market structure • Local trend: it was upward (black trend line), it was broken down • This means lost momentum for the bulls and a transition into correction/consolidation • No higher low structure yet → the trend is not rebuilt ⸻ 📉 Price vs levels (key zones) 🔴 Support: • 12.20 – upcoming, very important • 12.00 – psychological + technical • 11.74 – last line of defense for the bulls 👉 Going below 12.20 increases the chances of 11.74 🟢 Resistances: • 12.61 – currently strong resistance (flip S/R) • 12.95 – local peak • 13.21 – main target when the trend returns ⸻ 📊 Momentum – Stochastic RSI • Indicator close to the oversold zone • Possible: • short technical bounce • BUT without trend confirmation (no HH/HL) ⚠️ Rebound ≠ trend change ⸻ 📌 Scenarios (Highlights) 🟡 Scenario A – corrective reflection • Weapon price 12.20 • Move up to 12.61 • Perfect place for supply response 👉 If 12.61 is rejected → further consolidation or decline ⸻ 🔴 Scenario B – continued decline • 4H close below 12.20 • Movement towards 12.00 → 11.74 • Only there is reasonable demand ⸻ 🟢 Scenario C – bulls return (least likely now) • Breakout and holding above 12.61 • Structure confirmation (HH + HL) • Targets: 12.95 → 13.21

cryptodailyuk

🔎 Market Structure Medium-term trend: downward The price is moving within a descending channel (orange lines). Each upward breakout has been corrected lower so far. Current: consolidation after a strong rebound from the low. 📉 Key Levels 🔴 Support 2925 USDT – very important local support (currently being tested). 2756 USDT – strong support from the previous reaction. 2600 USDT – last line of defense (structural low). 🟢 Resistance 3057 USDT – key resistance + near the moving average (SMA). 3225 USDT – strong supply reaction level. 3346 USDT – upper range of the structure, very strong resistance. 📐 Moving Average (green) Price below the SMA → market still under supply control. Until the 4-hour period closes clearly above ~3057, any upward move is a correction, not a trend change. 📊 Stochastic RSI There was an overheating (80+), now a downward turn. This is a cooling signal, possible: a sideways correction, or another decline to support. 🧠 Scenarios 🐻 Baseline scenario (more likely) Rejection from the downward channel. Retest of 2925 → if it breaks: 2756 and in an extreme case, 2600. 🐂 Alternative scenario (bullish) Breakout of 3057 + close of the 4-hour candle above. Targets: 3225 3346 Condition: Breakout from a descending channel (not just a wick).

cryptodailyuk

BTC/USDT 1H Chart Review

📌 MARKET CONTEXT Higher timeframe trend (H4/D1): correction in an uptrend Current (1H): consolidation below resistance after a strong rebound Price is squeezed between: descending trendline (blue) local support ~87.5–88k This is a classic decision zone. 🟦 PRICE STRUCTURE What we see: Strong rebound from ~85.4k Higher lows (orange line) → local uptrend Price fails to break: ~88.7–89.0k (green zone) ➡️ Rising low + ceiling = triangle / compression 🟥 KEY LEVELS 🔴 Support: 88,130 – local micro-support (now being tested) 87,477 – very important (H1 structure) 86,880 – critical (loss = bias change) 85,447 – impulse low (bulls' last line of defense) 🟢 Resistance: 88,770 – first hard resistance 89,934 – key (range high) 90 770 – only after the structure is broken 📉 TRENDLINES Blue (downtrend): still respected ❗ Orange (uptrend): acts as dynamic support ➡️ Breaking these two lines = strong move (up or down) 📊 STOCH RSI Was overbought Now reversing down No bullish divergence ➡️ Short-term: cooling / possible pullback 🧠 SCENARIOS (specific) 🟢 SCENARIO 1 – BULLISH (less likely, but strong) Conditions: H1 candle close above 88,800 Breakout and hold above the blue trendline Targets: 89,900 90,770 Retest 88.7k = perfect long 🔴 SCENARIO 2 – BEARISHES (more likely now) Conditions: Rejection of 88.7k H1 close below 87,470 Targets: 86,880 85,450 This would be a healthy pullback to the structure, not the end of the bull market.

cryptodailyuk

📉 Trend and Structure H4 Trend: Downtrend / Downtrend Consolidation Sequence of lower highs + lower lows from around 95k Currently, the price is below key resistance levels; the market has not regained its upward structure. 🟩 Key Chart Levels Resistance 94,596 – Very strong resistance (upper range zone) 91,600 – Local resistance / consolidation center 90,748 – Flip level (former support → resistance) Support 88,385 – Short-term support (already tested) 85,226 – Current price reaction zone 83,596 – Key structural support 80,646 – Last line of defense (if 83.6k falls) 📊 RSI (14) RSI ~40–45 → Lack of strength Buyers No bullish divergence RSI has not returned above 50 → trend remains bearish 📉 Stochastic RSI Recently in the overbought zone → downward trend This confirms a correction/further weakness No confirmation of an upward impulse 🧠 What does price action say? Last candle: strong upward rejection No follow-through after bounces Any upward breakout is sold 📌 Scenarios 🔴 Baseline scenario (more likely) Consolidation / further decline to: 83,600 and with market weakness even 80,600 Shorts have an advantage below 88,400 🟢 Alternative scenario (bullish) Conditions: H4 close above 88,400 Then breakout and hold at 90,700 Only then: Targets: 91,600 → 94,600 Without this = only corrections in a downtrend

cryptodailyuk

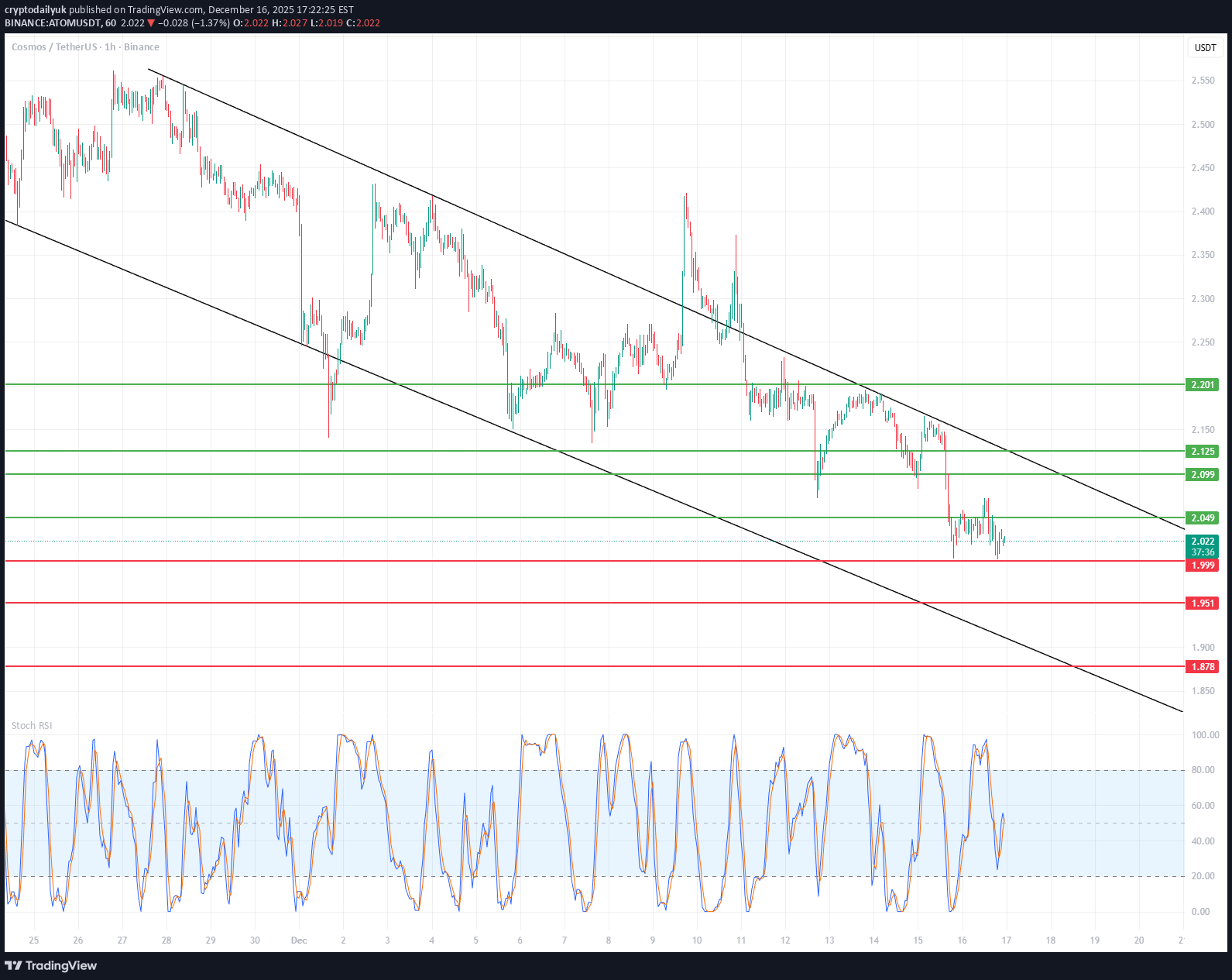

🔍 Market Structure Clear downtrend – price is moving within a descending channel (lower highs and lows). Each bounce is sold at the upper band of the channel. No signal of a change in structure yet (no HH + HL). 📉 Current Price Status Price is at the lower end of the channel. Consolidation after a downward impulse → typical bearish continuation or short technical rebound. Current Zone: ~2.02–2.05 USDT – local support + demand reactions. 🟢 Key Levels Support 2.049 – local support (current reaction) 1.999 – strong psychological support 1.951 1.878 – lower demand zone (important!) Resistance 2.099 2.125 2.201 – key resistance / S→R flip. Upper channel line (~2.20–2.23) 📊 Stochastic RSI Oscillator often in oversold territory. Currently recovering from the low → possible short rebound. BUT: in a downtrend. The Stoch RSI is not a long-term signal. ➡️ More likely a pullback, not a trend change. 🧠 Scenarios 🔴 Baseline scenario (most likely) Bounce to: 2.09 → 2.12 Rejection + further decline: 1.99 then 1.95 / 1.88 ➡️ Short at resistance levels in line with the trend. 🟢 Alternative scenario (less likely) Breakout of 2.20 + close of the 1H candle above the channel Retest from above Then targets: 2.28 2.35–2.40 ➡️ Only then can we talk about a change in structure.

cryptodailyuk

🔎 Market Structure (4H) Medium-term trend: still up, but clearly weakening Price has broken out of the local uptrend channel (black line broken) Currently, we have a downward impulse + attempted demand reaction This looks like a distribution → SL breakout → seeking demand lower 🧱 Key Levels (from your chart) 🟢 Resistance (now selling) 89,255 – first local resistance (now S/R flip) 91,857 – strong resistance, previous consolidation 93,713 – supply zone / last LH 94,700–95,000 – very strong resistance (high range) 👉 Until we return and close the 4H period above 91.8k, longs are counter-trend 🔴 Support (most important) 87,621 – currently being tested / very important 84,216 – key HTF support (must-hold for bulls) 81,308 77,820 – deep range low 📉 Momentum & price action Last candle: strong decline + long lower wick = demand reaction, but no confirmation No 4H HH/HL structure yet This looks like a dead cat bounce or a retest of the breakout 📊 Stoch RSI Was heavily oversold Now a sharp upward move ⚠️ But: In downtrends, the Stoch RSI often gives false long signals Price confirmation is needed, not just an oscillator 🧠 Scenarios (specific) 🟡 Scenario 1 – Base case (most likely) Pullback → further decline Bounce to 89.2k – 90k Rejection Down to 84.2k Market decision there 👉 This is a textbook retest of a broken structure 🟢 Scenario 2 – Bullish (less likely, but possible) Conditions: 4-Hour Close > 91,857 Then a retest of the high-low Then targets: 93.7k 94.7–95k Only above 95k does the full uptrend resume 🔴 Scenario 3 – Bearish (if demand breaks) If: 4-Hour Close < 87.6k Then: A quick move to 84.2k Breakout = 81.3k Extreme: 77.8k

cryptodailyuk

ETH/USDT 1D CHart Long-Term

. 🔍 Market Structure (Price Action) 1️⃣ Trend Long-term: The uptrend has been broken (a downward breakout from the black trend line). Medium-term: A sequence of lower highs and lower lows → a downtrend. The current rebound is a correction in the downtrend, not a confirmed reversal. 📐 Key Levels (very well marked) 🔴 Support 2768 USDT – key support (current local bottom). 2157 USDT – final support from the previous structure (if 2768 breaks → a very real pullback). 🟢 Resistance 3506 USDT – current nearest resistance (retest after a downward breakout). 4101 USDT – strong supply zone + former support. 4477 USDT – main structural resistance (region of previous highs). 👉 Price is now exactly in the decision zone between 2768 and 3506. 📉 Trendline Breaked and rejected (retest ended with a decline). This is a classic signal of a downtrend continuation. Until the price returns above 3506 and sustains, there is no uptrend. 📊 Stochastic RSI The oscillator frequently reaches the 80–100 zone. Currently: Moving out of overbought → signal of weakening upward momentum. No bullish divergence → no confirmation of a trend change. 🧠 Scenarios 🐻 Baseline scenario (more likely) Rejection of 3506 Return to around 3000 → 2768 Breakthrough of 2768 = open path to ~2150 🐂 Alternative (conditional) scenario Daily close above 3506 Retest of 3506 as support Only then is a move towards 4100 possible 🎯 Final conclusions This is not a market for longs without confirmation. The current rebound looks like a pullback in a downtrend. Safeest: Short at resistance (3506 / 4101) Long only after a breakout and holding of 3506

cryptodailyuk

1️⃣ Market Structure and Trend The chart shows a long-term uptrend, confirmed by a very clean ascending trendline (orange), which has been acting as dynamic support for over a year. After a strong breakout to ~1380, the price began a correction but still hasn't broken the higher low structure → the uptrend is intact. 2️⃣ Key Levels (exactly from your chart) 🟢 Resistance Levels (green): ~1018 USDT ~1150 USDT ~1249 USDT These are potential targets for a renewed uptrend. 🔴 Support Levels (red): ~879 USDT – the closest important support ~838 USDT – a key defensive level ~683 USDT – deep support / last HTF trendline The price is currently trading directly above the first support level. 3️⃣ Trendline (orange) Your trendline is: strong, multi-point drawn on the D1 timeframe currently around 850–880 USDT ➡️ If the price falls, the trendline perfectly aligns with the 838–879 zone, strengthening this zone as a "must defend." 4️⃣ Oscillators – Stoch RSI (bottom) Currently: The oscillator is in a high zone (above 80) → indicating local overbought However, there is no clear downward crossover yet. Meaning: 👉 Upward momentum is still active, but we are closer to a local high than a low. 5️⃣ Scenarios 🟢 Upside scenario (more likely as long as the trendline holds) Condition: Maintaining the 879/838 levels and the trendline. Targets: 1018 USDT – first resistance 1150 USDT – important medium-term resistance 1249 USDT – main HTF target The longer the price consolidates above the orange trendline, the greater the chance of a renewed attack on 1150–1249. 🔴 Downside scenario (less likely, but crucial) Condition: Downside breakout of 838 USDT and closing of the D1 candle below the trendline. Then: the market could enter a deeper correction phase the target would be the 683 USDT level – this is also the main support level, where reactions were previously strong This is a "capitulation" scenario, but it doesn't seem to be dominant given the current price action. 6️⃣ What can we see on the chart "here and now"? ✔️ The price has rebounded from the local low ✔️ It is still between support at 879 and resistance at 1018 ✔️ The uptrend is intact ✔️ A potential HTF higher low has formed ✔️ The Stoch RSI shows momentum, but caution is warranted ➡️ The market is consolidating within the uptrend, with a high chance of a breakout upwards – provided support is maintained.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.