iMoneyTeam

@t_iMoneyTeam

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

iMoneyTeam

BAT Analysis (1D)

The structure of BAT is bullish, but we should not forget that it is approaching a key level. BAT is getting close to a strong liquidity pool. If price reaches the LP zone, we will look for sell / short positions toward the marked targets. A daily candle close above the invalidation level will invalidate this analysis. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

iMoneyTeam

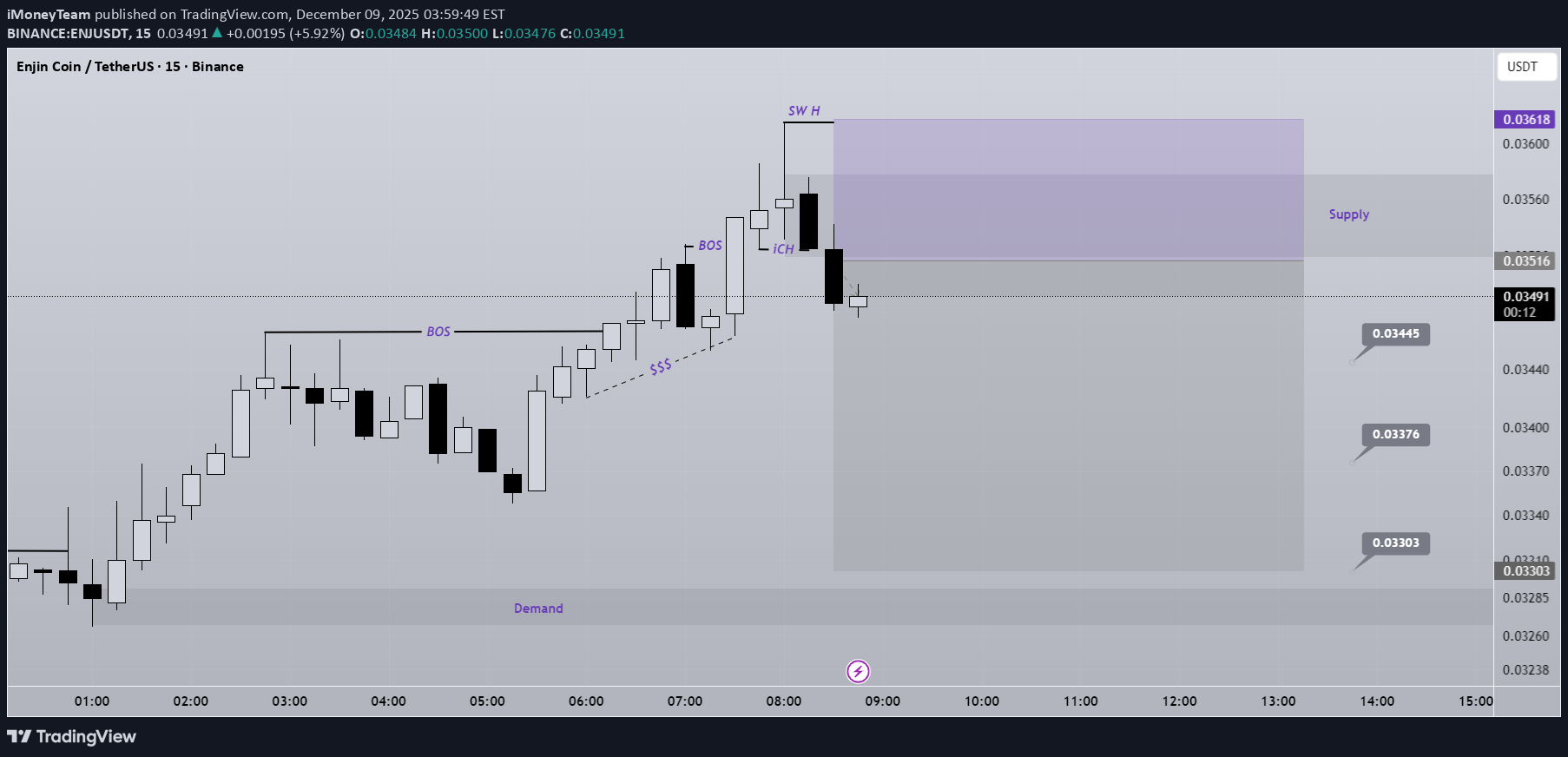

It seems the market is waiting for the FED news on October 10. That’s why market volatility has decreased, and we are forced to trade on lower timeframes. The stop loss, entry zone, and targets are marked on the chart. If you enter this position earlier, the risk-to-reward ratio will be lost. If price returns to the entry zone, we can enter the trade. Please note that if the final target is hit and then price comes back to the entry zone, we will not enter again. Do not enter the position without capital management and stop setting Comment if you have any questions thank youConsidering that the previous setup was stopped out with a 2% stop loss, the next setup we are looking for on ENJ is as follows: Entry zone: 0.0355 – 0.0422 Targets: 0.03449 – 0.03001 – 0.02521 Stop loss: 0.04480

iMoneyTeam

It seems the market is waiting for the FED news on October 10. That’s why market volatility has decreased, and we are forced to trade on lower timeframes. The stop loss, entry zone, and targets are marked on the chart. If you enter this position earlier, the risk-to-reward ratio will be lost. If price returns to the entry zone, we can enter the trade. Please note that if the final target is hit and then price comes back to the entry zone, we will not enter again. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

iMoneyTeam

BNB has cleared an important resistance level (12H)

We have a shift in outlook for BNB. Price has cleared a key supply zone, and now we can look for potential buy/long positions around the demand area. The targets are marked on the chart. A daily candle closing below the invalidation level would invalidate this analysis. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

iMoneyTeam

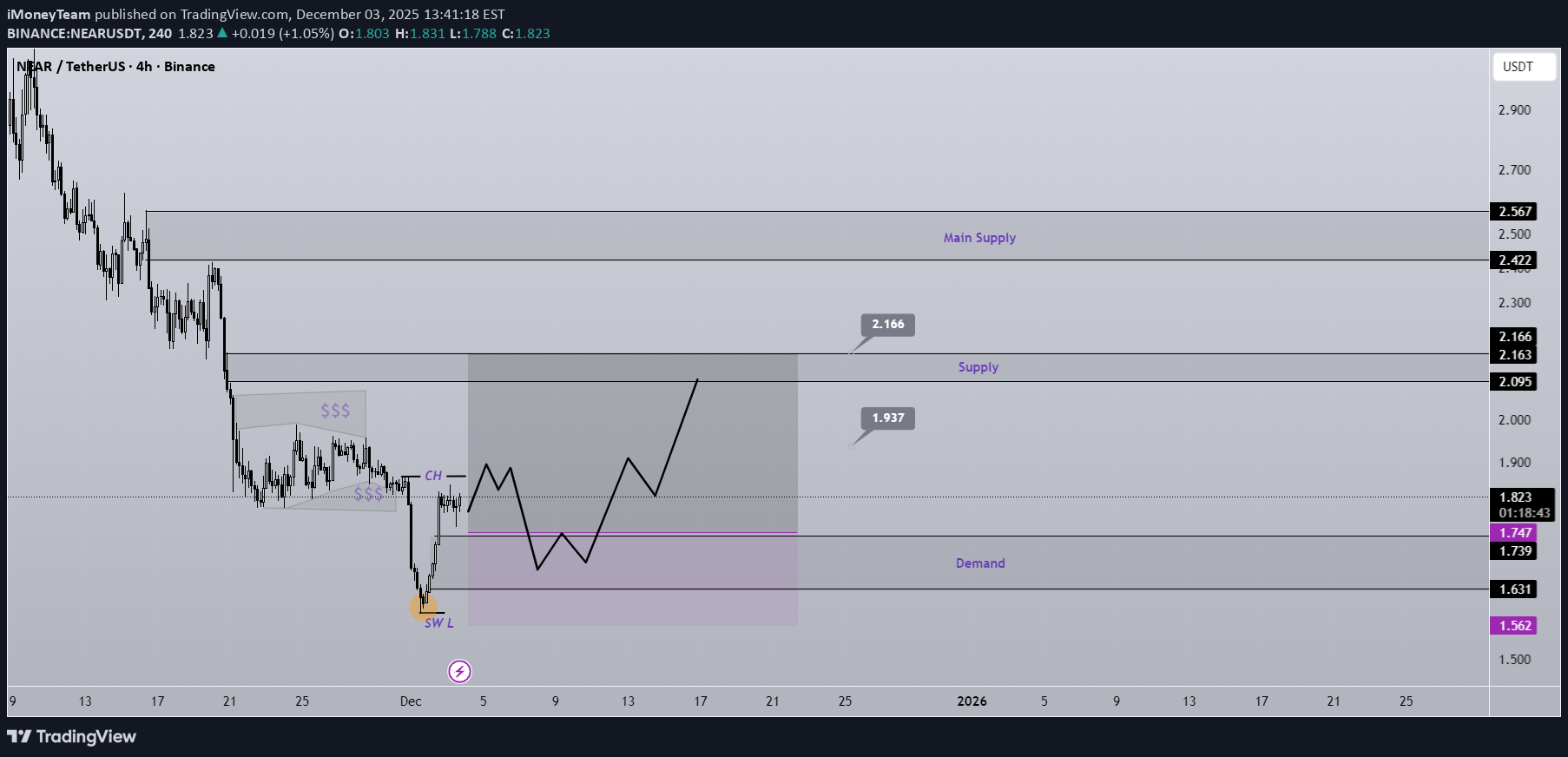

NEAR Looks Bullish (4H)

In the orange circle, liquidity has been swept, and the price has reacted to a strong historical demand zone. After the change of character (CH), we can enter a buy/long position on the pullback. The targets are marked on the chart. If the stop-loss is touched, the setup will be invalidated. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

iMoneyTeam

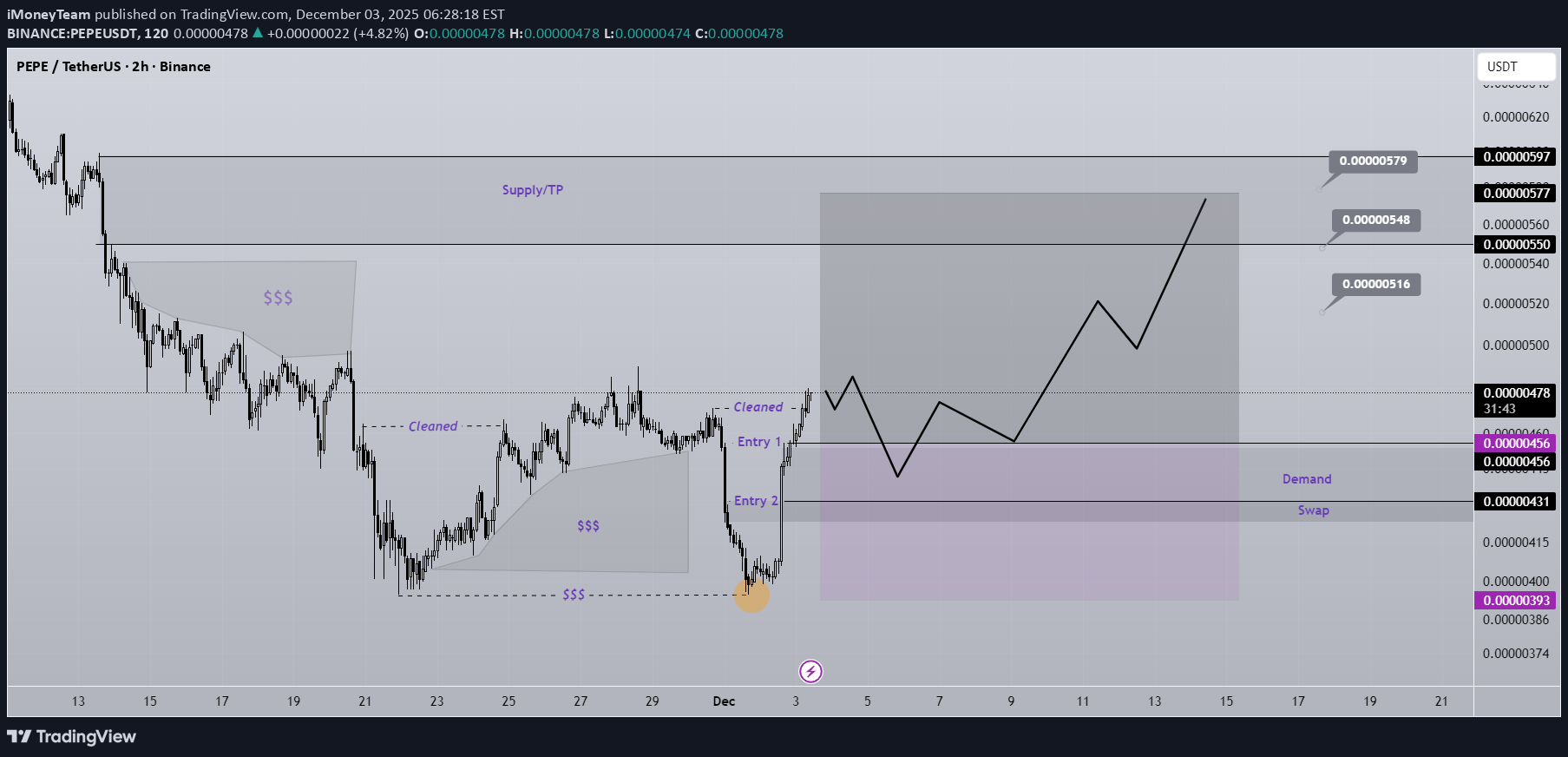

PEPE Buy/Long Signal (2H)

PEPE has reached a strong support zone at the bottom of the hourly timeframe. After the first sweep, it moved downward again, collected liquidity, and then swept the key level. We have marked two entry points on the chart, which are our intended entries. We expect the upper liquidity pool to be taken out, or at least for the first target to be hit after the entries are triggered. The targets are marked on the chart. If the stop-loss is touched, this setup will be invalidated. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

iMoneyTeam

FARTCOIN buy/long setup (4H)

Considering the strong bullish CH and BOS, the liquidity formed below the pivots, and the creation of a QM pattern, we can look for buy/long positions in the zone below the liquidity, which overlaps with the QM level. Since the stop level is far, it is recommended to trade this setup on spot. The targets have been marked on the chart. A daily candle closing below the invalidation level will invalidate this analysis. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

iMoneyTeam

Bitcoin new update (1D)

Bitcoin has not yet fully absorbed the buy orders in the marked support zone. This time, upon tapping the support area again, we can expect the price to form a stronger bullish move, at least toward the identified supply zone. A daily candle closing below the invalidation level will invalidate this outlook. Do not enter the position without capital management and stop setting Comment if you have any questions thank youWe were expecting the price to react from the marked upper demand zone, but it reversed upward slightly before reaching it. Now the price can move from the upper demand zone toward the supply box, which would be a move of more than 6%.

iMoneyTeam

BNB Analysis (12H)

As you can see, the Binance Coin structure has turned bearish, but we should not forget that the BNB support zone is not far away. In the demand zone, we can look for buy/long positions. The targets are marked on the chart. A daily candle closing below the invalidation level will invalidate this analysis. Do not enter the position without capital management and stop setting Comment if you have any questions thank youGiven that another major resistance has been cleared, we are no longer waiting for a deeper support. Our buy zone has shifted. New analysis:

iMoneyTeam

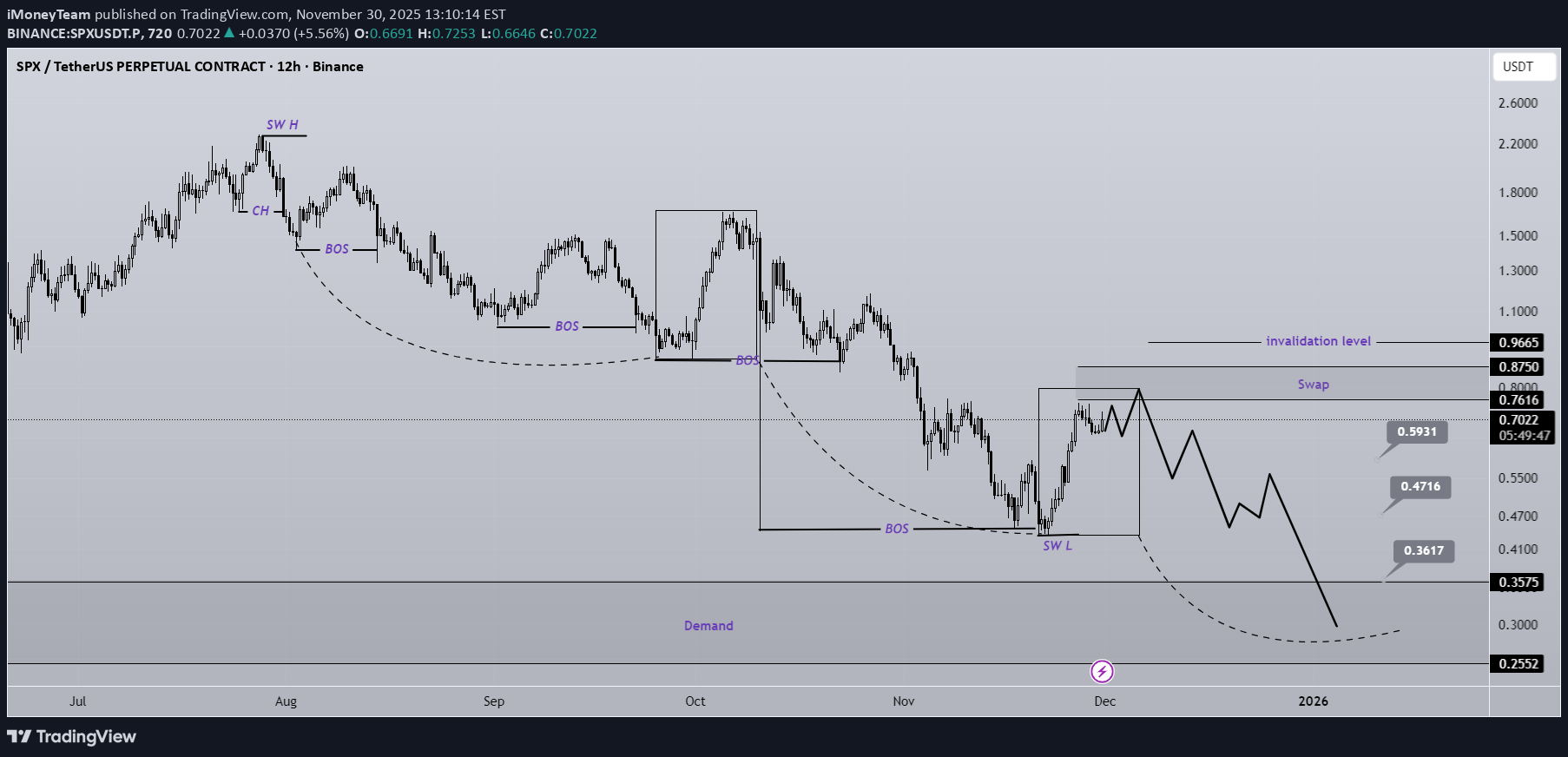

SPX Analysis (12H)

As shown on the chart, the SPX structure is bearish because we have bearish CH (Change of Character) and BOS (Break of Structure). Based on the fractals indicated with dashed lines and the drawn rectangles, we should expect one more bearish leg in this timeframe. We are looking for sell/short positions around the swap zone. The targets have been marked on the chart. A daily candle closing above the invalidation level will invalidate this analysis. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.