illuminati_K027

@t_illuminati_K027

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

illuminati_K027

Quantum Will Break Crypto First

Personally, I believe that once quantum computers reach practical power, the first assets to collapse won’t be banks or credit card networks— it’ll be Bitcoin and most cryptocurrencies. Banks can upgrade their encryption overnight inside closed, centralized servers. Users won’t even notice. But Bitcoin can’t. Every address that has ever made a transaction already has its public key permanently exposed on the blockchain. Quantum computers can reverse that and steal the private key directly. And Bitcoin can’t fix this fast. A security upgrade requires global consensus, node updates, exchange updates, wallet updates, and millions of users moving funds. Banks need hours. Bitcoin needs years. Quantum needs a day. That’s why, in a true quantum era, the first systems to fall aren’t traditional finance—they’re Bitcoin and 99% of all cryptocurrencies. When the cryptography breaks, the asset doesn’t drop in value— it disappears.The real solution is simple: move crypto to quantum-resistant encryption before quantum hits.If crypto can’t become quantum-resistant, even Bitcoin and Ethereum won’t survive. The quantum era will erase today’s rankings and create a completely new crypto world.To be clear, everything above is simply my personal warning about the challenges crypto may face. But I don’t think crypto is doomed — far from it. If this industry adapts, evolves, and becomes truly quantum-resistant, it can survive, scale, and even thrive. And if crypto ever wants real adoption — real utility, real monetary use, and real global value — then reaching half of gold’s market cap, or even surpassing it, isn’t impossible. It may take decades, but I believe it can happen.

illuminati_K027

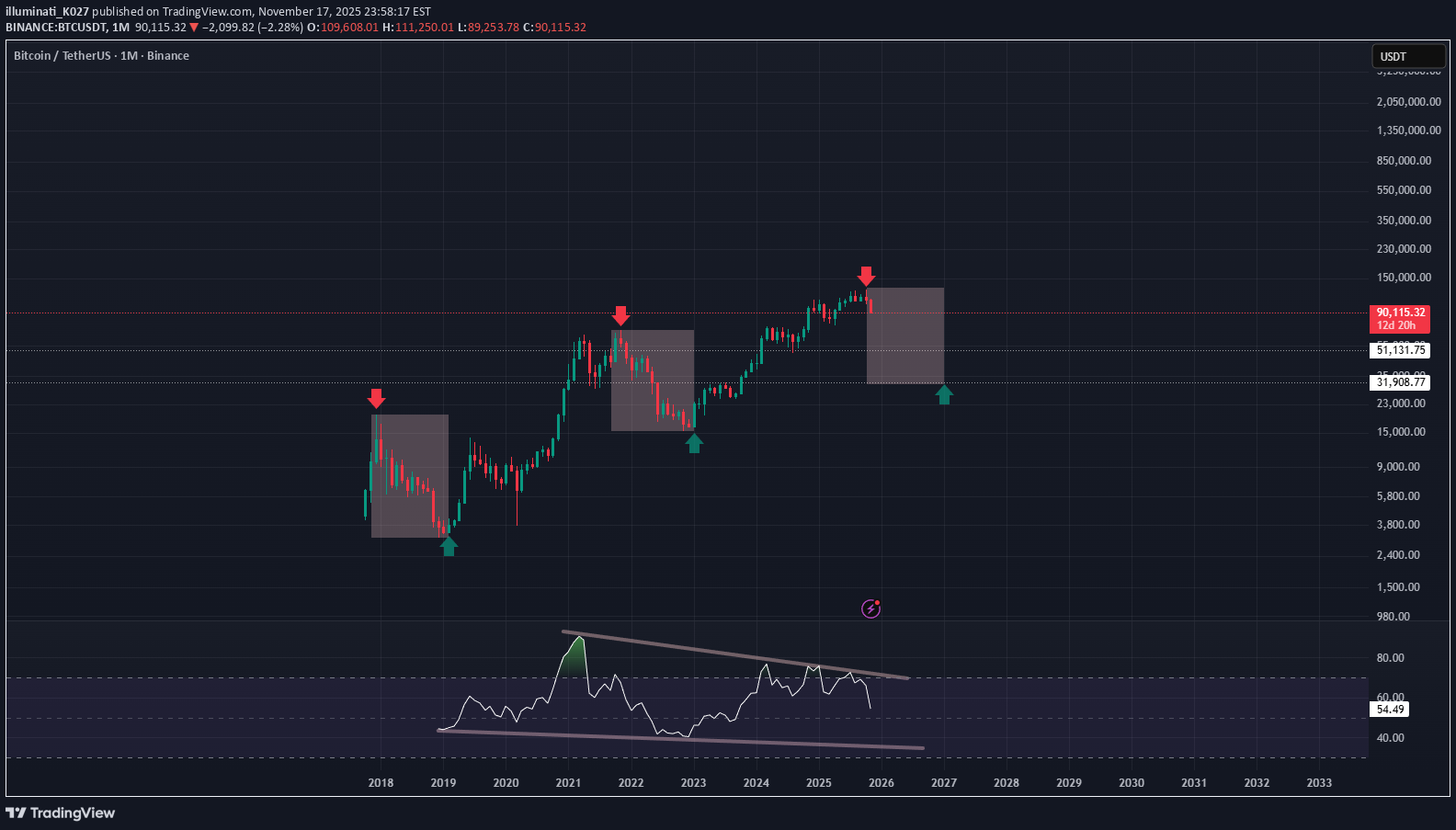

Bitcoin’s Downtrend Cycle: Where the Real Bottom Could Form

1/ Bitcoin has entered a clear downtrend cycle. Historically, BTC experiences a time-based correction lasting 12–18 months after each major multi-year bull run. 2/ In this cycle, two major bottom zones matter the most: • $50K range — if fundamentals remain strong • $30K range — if a typical cycle-style washout occurs 3/ Even strong cycles have produced deep corrections. So both price levels must be considered realistic accumulation zones. 4/ The ideal entry strategy? Wait for the market to complete a full time correction into 2027+, form a clear bottom structure, and then show a confirmed green monthly candle close. 5/ When that monthly trend reversal appears after a long consolidation, that’s when high-conviction positioning makes sense.In the next halving cycle, the so-called “big players” or large market participants have likely already anticipated and analyzed the current downturn. Using AI models and various market indicators, they would have detected early signs of a bearish shift and adjusted their positions accordingly—either by selling a portion of their spot holdings or by opening short positions for hedging. Rather than selling their entire holdings during this decline, these players tend to lower their average entry price, secure liquidity, and prepare for the next major upward cycle. Near the market bottom, they may even accumulate additional positions to strengthen their long-term strategy. In the next bullish phase, narratives promoting targets such as $200,000 could emerge, amplifying market optimism and driving sentiment. Their strategy is not driven by short-term gains but by a long-term perspective, continuously positioning themselves across multiple cycles. The current downturn is likely just another phase they’ve accounted for within their broader long-term plan.In conclusion, they no longer see this market as a simple investment—it has become a “game” to them. And in this game, they are far from satisfied. After countless cycles, they haven’t escaped the thrill; if anything, they’ve become addicted to it. So when a downturn comes, they prepare. When the next round approaches, they position themselves again. They don’t think the game is over, and they have no intention of stepping away from it. To them, it’s just another stage of the cycle—another chance to play.

illuminati_K027

Here’s my analysis on Solana

While Bitcoin has been forming a major bullish impulse, Solana has been building a B-wave — a fake, corrective rebound rather than a true uptrend. From the current structure, SOL looks likely to drop together with BTC. The chart I posted is my forecast scenario.

illuminati_K027

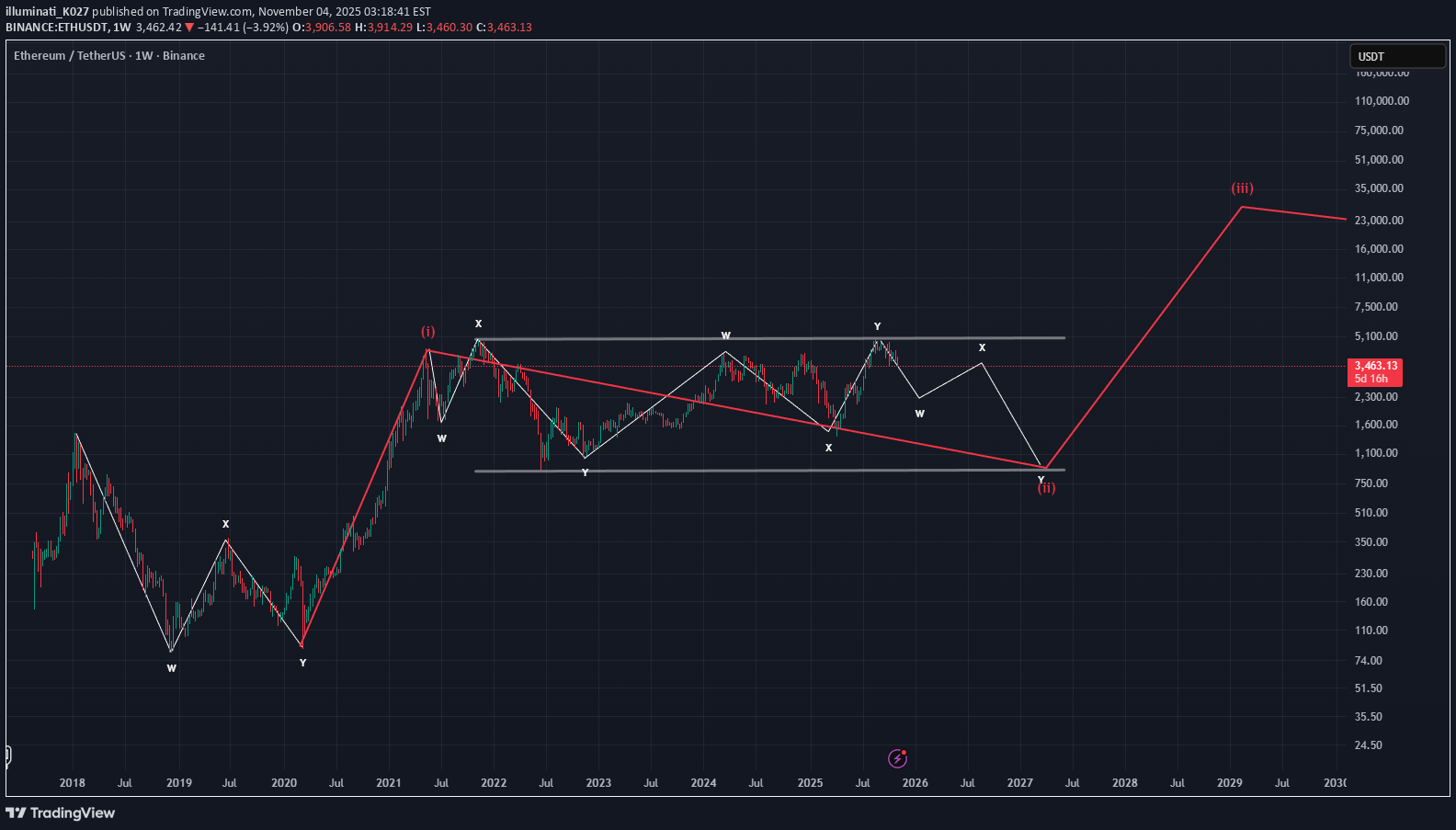

ETH Failed to Join BTC Rally — Now Entering Wave 2 Downtrend?

While Bitcoin has been in a major bullish wave, Ethereum has only formed an X-wave (a corrective bounce, not a true impulse). ETH now appears to be entering the early stage of a Wave 2 decline alongside BTC. Don’t get fooled by short-lived rebounds.

illuminati_K027

Bitcoin Entering Early Bear Market: Expected Bottom at ~60% Dec

Bitcoin is currently entering the early stage of a bear market, and based on its historical downturn cycles, I expect the bottom to form at around a roughly 60% decline, which would be the minimal drop compared to past cycles.

illuminati_K027

Analysis

While Bitcoin was pumping, Solana was busy forming its B-wave. Now the C-wave begins.

illuminati_K027

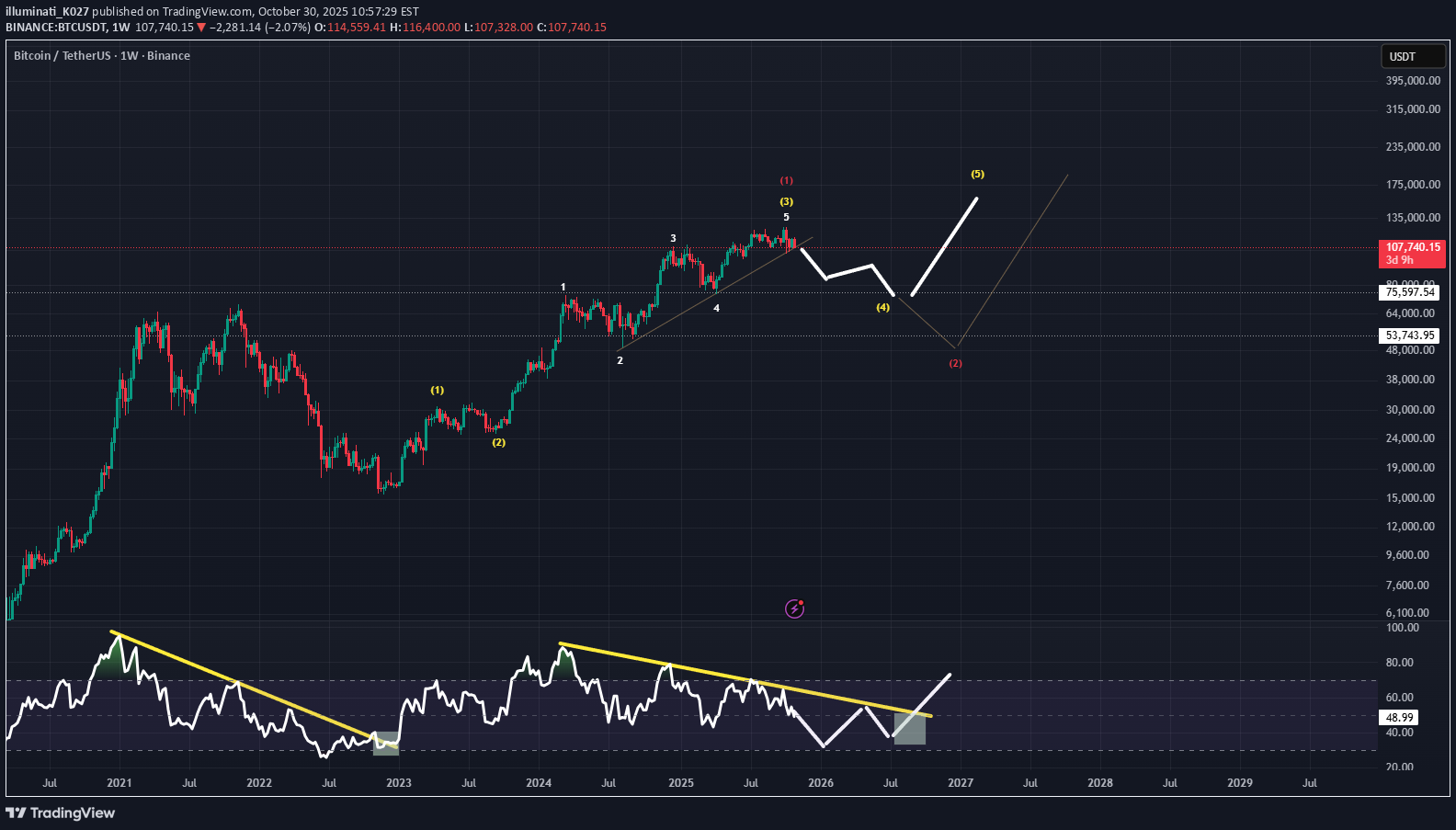

Bitcoin: The Next Down Cycle?

I believe Bitcoin is entering a downward cycle. But unlike the past — where we saw 90%, 80%, even 70% drawdowns — this one could be around 60%. I’m convinced the top is already in.If Ethereum drops around 80% from its peak, then Bitcoin’s correction around 60% feels fair. Different assets, different volatility — same cycle logic.I believe the winds of a new bull cycle may start blowing in 2027. Until then, we’re still in consolidation — building the base for the next wave.

illuminati_K027

When Will Ethereum’s True Impulse Bull Run Begin?

Ethereum feels sluggish — price action lacks momentum while the ecosystem keeps building. Why is ETH moving this way, and when will the impulse-level bull cycle finally start? Here’s my view on the upcoming cycleA move toward $1,000? Maybe. In my view, Ethereum’s long stagnation isn’t a collapse — it’s part of a broader integration and consolidation phase. We’re still in a major corrective cycle within the grand structure. Real change may not come until after 2027.

illuminati_K027

Analysis

I see a 70% chance that Bitcoin has already completed its 5th wave of this bull cycle and is heading downward — or at least for a major correction. The other 30% is a scenario where RSI bounces from the bottom at key support, breaks its resistance trendline, and starts a new 5th wave.

illuminati_K027

Analysis

It’s either going to pump a bit or dump like hell.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.