miljedtothemoon

@t_miljedtothemoon

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

miljedtothemoon

ETHUSDT.P - November 17, 2025

Price has broken below the rising trendline from the ~3,000 area and is now likely to retest it from underneath, showing potential continuation toward the next support near 3,020. A rebound remains possible if price reclaims 3,140, with major resistance sitting at 3,240. Overall, the market is trading between 3,020 support and 3,240 resistance, with momentum currently favoring the downside unless the trendline is regained.

miljedtothemoon

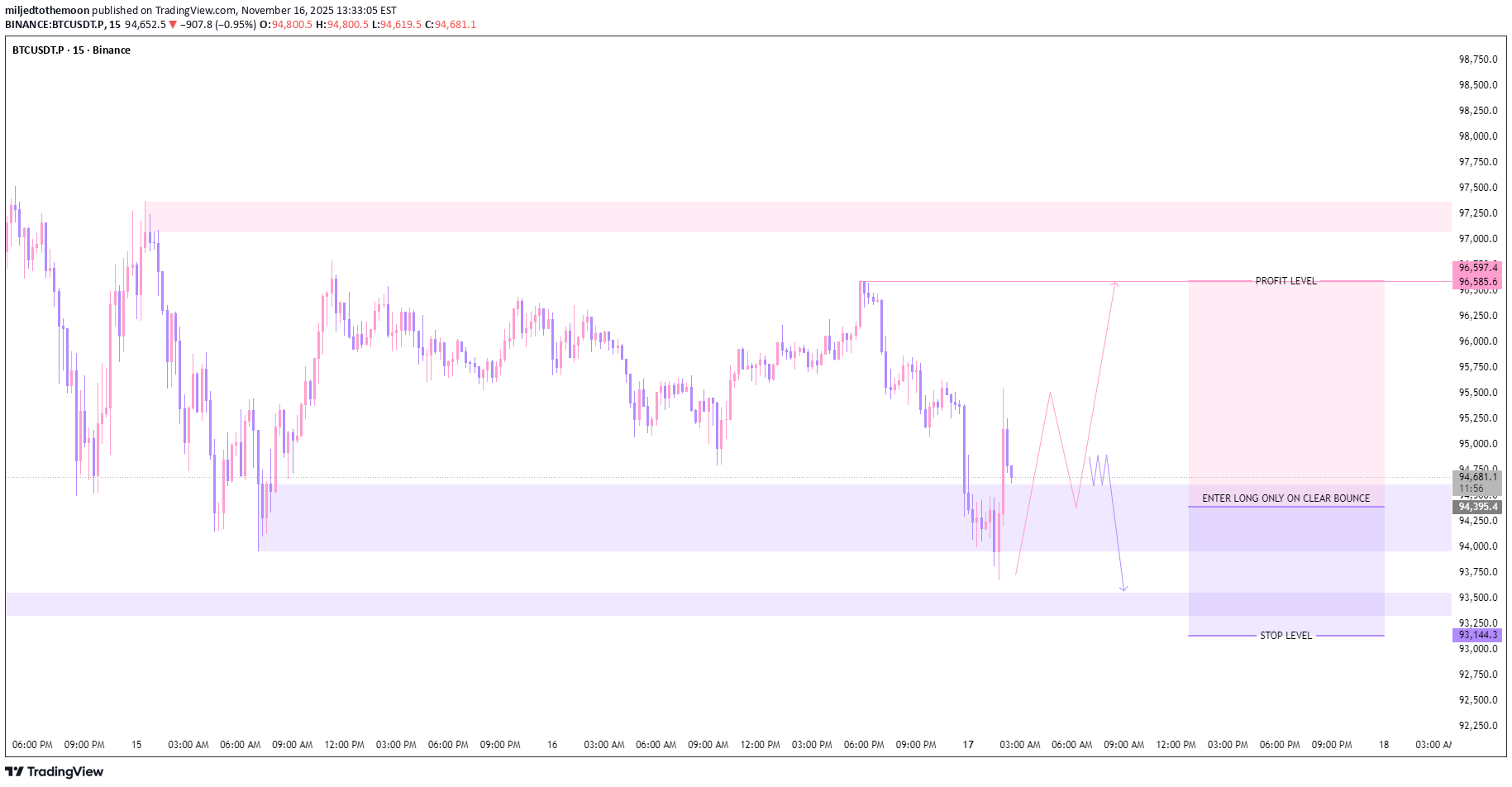

BTCUSDT.P - November 17, 2025

BTCUSDT is still in a short-term downtrend, but price is holding above the support zone around $94,300–$94,500 while the next major resistance sits near $96,500–$96,600. The chart suggests a potential rebound toward resistance if support continues to hold, but a break below $94,300 would likely send price back toward the lower support near $93,250. With a stop level around $93,250 and a target near $96,600, the setup offers a favorable reward-to-risk profile, but remains moderate-risk due to the prevailing downtrend.

miljedtothemoon

BTCUSDT.P - November 16, 2025

BTCUSDT.P remains in a clear downtrend, with lower highs forming beneath a descending resistance line. Momentum looks weak, and if the current support area fails to hold, the chart suggests a potential continuation toward the lower support zone.

miljedtothemoon

STRKUSDT.P - November 15, 2025

STRKUSDT.P is consolidating below a key 0.1840–0.1860 resistance zone, with price showing hesitation and potential for either a breakout toward the 0.1980 profit level or a breakdown toward the 0.1388 support zone. A decisive close above 0.1860 would confirm bullish continuation, while failure to hold the 0.1650 support trigger could open a sharper move toward 0.1400. Risk Assessment: Moderate — Structure shows balanced risk with clear breakout and breakdown triggers; traders may consider adjusting stops near 0.1760 once price tests the upper resistance to reduce exposure.

miljedtothemoon

DASHUSDT.P - November 15, 2025

Price has been climbing in a steady uptrend, supported by a rising trendline, and is now stalling inside a key resistance zone where sellers have previously been active. A clean break above this area could open the move toward the 88–90 level, while rejection here may trigger a pullback toward the 72–70 support zone where buyers last defended.

miljedtothemoon

ZECUSDT.P - November 15, 2025

Price is in a strong short-term uptrend, but momentum is stalling just beneath the immediate resistance zones where sellers has previously stepped in. A clean break and hold above this area could open the path toward the next resistance around 720–740, while rejection here may trigger a pullback toward the 600–580 support zone where buyers last showed strength.

miljedtothemoon

XRPUSDT.P - November 15, 2025

XRPUSDT is trading around $2.28 on the 15-minute chart, still moving within a short-term downtrend under a descending trendline. Price is currently reacting inside a $2.25–$2.29 support zone, showing early signs of compression near trendline resistance. Immediate horizontal resistance sits at $2.31–$2.34, which must be reclaimed for bullish momentum to develop. A clean breakout and retest above this zone could open a move toward the $2.49 resistance level. Failure to break the trendline and rejection from the $2.31–$2.34 support may trigger another leg down, with downside targets at $2.21–$2.24 and possibly the deeper support around $2.14–$2.16. Overall short-term outlook remains bearish to neutral, pending a confirmed breakout above near-term resistance.

miljedtothemoon

ETHUSDT.P - November 15, 2025

The price is currently below the trendline and seems to be consolidating. If the price breaks upwards 3,276.75, consider buying long with the first target at 3,441.72. Partial profits can be taken at this level, and the stop loss should be adjusted to break-even. If the price breaks below 3,168.65, consider entering a short position, with the next potential target near 3,100.

miljedtothemoon

BTCUSDT.P - November 15, 2025

Price has been in a clear downtrend, confirmed by a descending trendline that price continues to respect. Recently, momentum has slowed, and price is forming a short-term rebound from the lower trading range. The market is now approaching the descending trendline, which is the first obstacle. A clean break and close above this trendline would suggest that bearish pressure is weakening. There is a horizontal resistance zone around $97,000, where price has reacted before. If price manages to break above the trendline and push into this area, there is room for a short-term continuation upward. If the trendline holds, price may pull back toward the lower range around $94,000–$93,500, where buyers recently stepped in.

miljedtothemoon

XRPUSDT.P - November 14, 2025

XRPUSDT on the 15-minute chart is stabilizing after a sharp decline, forming a short-term base above $2.26. Price is currently compressing beneath a clear intraday resistance band around $2.34–$2.35, which aligns with the marked breakout level. A decisive push and sustained hold above this zone would signal bullish momentum returning, opening room for a continuation move toward the $2.50–$2.52 profit target. Failure to break higher keeps price vulnerable to another retest of the lower support region, and a breakdown below $2.26 would invalidate the bullish setup and expose further downside.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.