reiiss7

@t_reiiss7

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

reiiss7

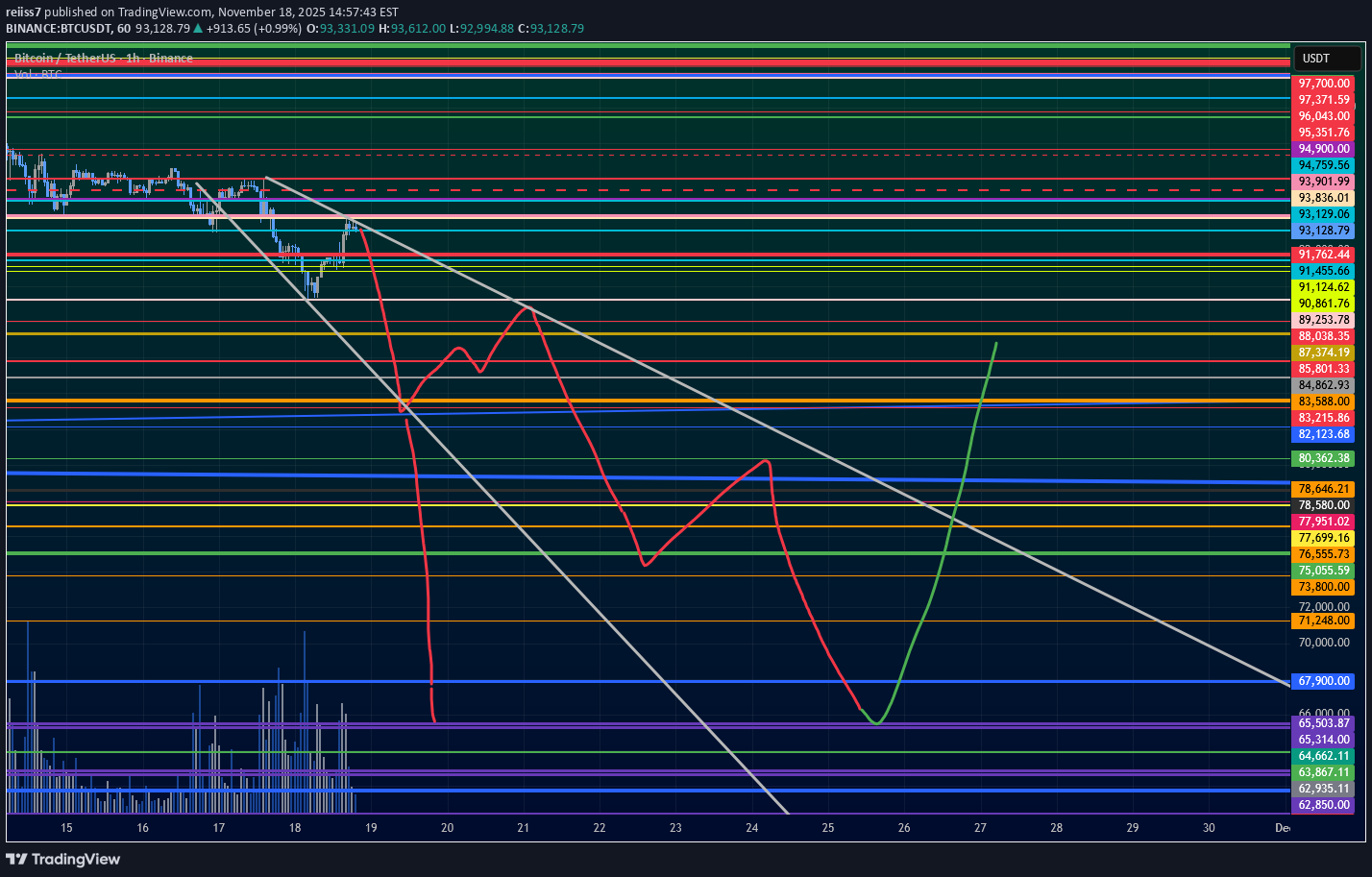

Road to 65k

In the Markdown phase, price usually holds each supply zone, without any major liquidity grabs. As such, I believe 96k Shorts will be safu, and SL above 96.1k is good. Looking for the next level - 83k! P.S. the liquidity grab above 96k isn't done in this case so bears don't get filled.

reiiss7

ETH 1k to 3.4k

Today the market has shown its hand, I think it will drop now. There was some local accumulation, but only up to the supply zone. It was a difficult situation to predict. Anyway, for ETH, many will buy at 1200's , 1300's , 1400's and be forced to sell at the bottom. It may even go under 1k but this is low enough for low leverage or spot.

reiiss7

LTF Accumulation into Final Supply TEST

I believe this happens frequently, the trendline area tests, it drops a bit then the real fake pump happens. A huge obnoxious 8 hour candle with potential ltf buying. I think we had some good news and a random dump, it usually doesnt happen this easily (usually)In my opinion we will hold this zone until February/MarchI am short still on the 115k order still in case it tanks and I'm wrong But at the moment we still have to wait to see what happens. There is a good chance it may have only been local accumulation. But after seeing the 8 hour, it feels trappy. Let's seeLooks like it's over now. No final pump.

reiiss7

Accumulation into Final Pump

I believe this happens frequently, the trendline area tests, it drops a bit then the real fake pump happens. A huge obnoxious 8 hour candle with potential ltf buying. I think we had some bad news and dump never happens this easily (usually)

reiiss7

Potential LTF Accumulation

I believe this happens frequently, the trendline area tests, it drops a bit then the real fake pump happens. A huge obnoxious 8 hour candle with potential ltf buying. I think we had some bad news and dump never happens this easily (usually)

reiiss7

Potential LTF Accumulation

A huge obnoxious 8 hour candle with potential ltf buying. I think we had some bad news and dump never happens this easily (usually)

reiiss7

First Major Bounce 81.1k

The last Short was clearly premature, and was based purely on a technical level. Volume bust through it. Had I have waited for a stall and confirmed Distribution, the situation would have been better. Now that Shorts have been wiped, and the majority of the market is in a Long, I believe we can now drop to the first major bounce at 81.1k. When one side starts winning for an extended period of time, the losing side becomes "Unfavourable". Many who opened a Short and lost, fear opening another.

reiiss7

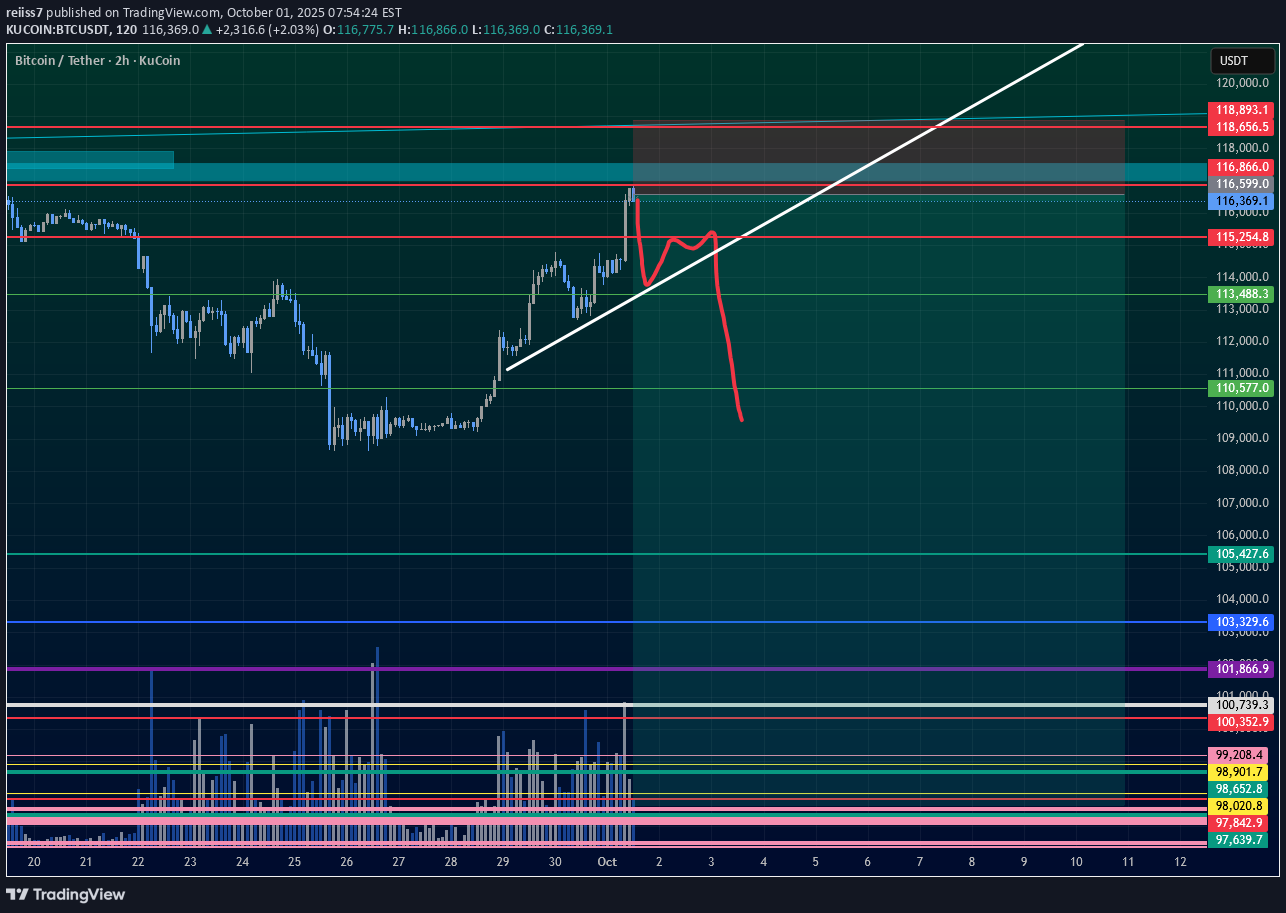

116,888 Supply hit already

I didn't think this supply level would hit this quickly. 116,888 was the previous supply level, and BTC strongly rejected here after a "bullish" 4h close. It seems likely the drop can happen now. It could also liq grab to 118.6k but less likely now. SL 118.9k!

reiiss7

After today, it is in my opinion that the drop will be DELAYED! I believe we will visit around 110k or lower, get everyone shorting and then 116.8k-117.4k will be revisited for a "BULLISH OCTOBER" before 100k breaks down The majority loses

reiiss7

Both BTC and ETH and lots of other coins are done. There will be some outliers. A new range with breakouts and breakdowns above and below 4k would make a lot of people lose money. I expect sideways in this range for some time. Levels of interest are 3606, 3839, 3865

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.