Technical analysis by SroshMayi about Symbol PAXG: Sell recommendation (11/3/2025)

SroshMayi

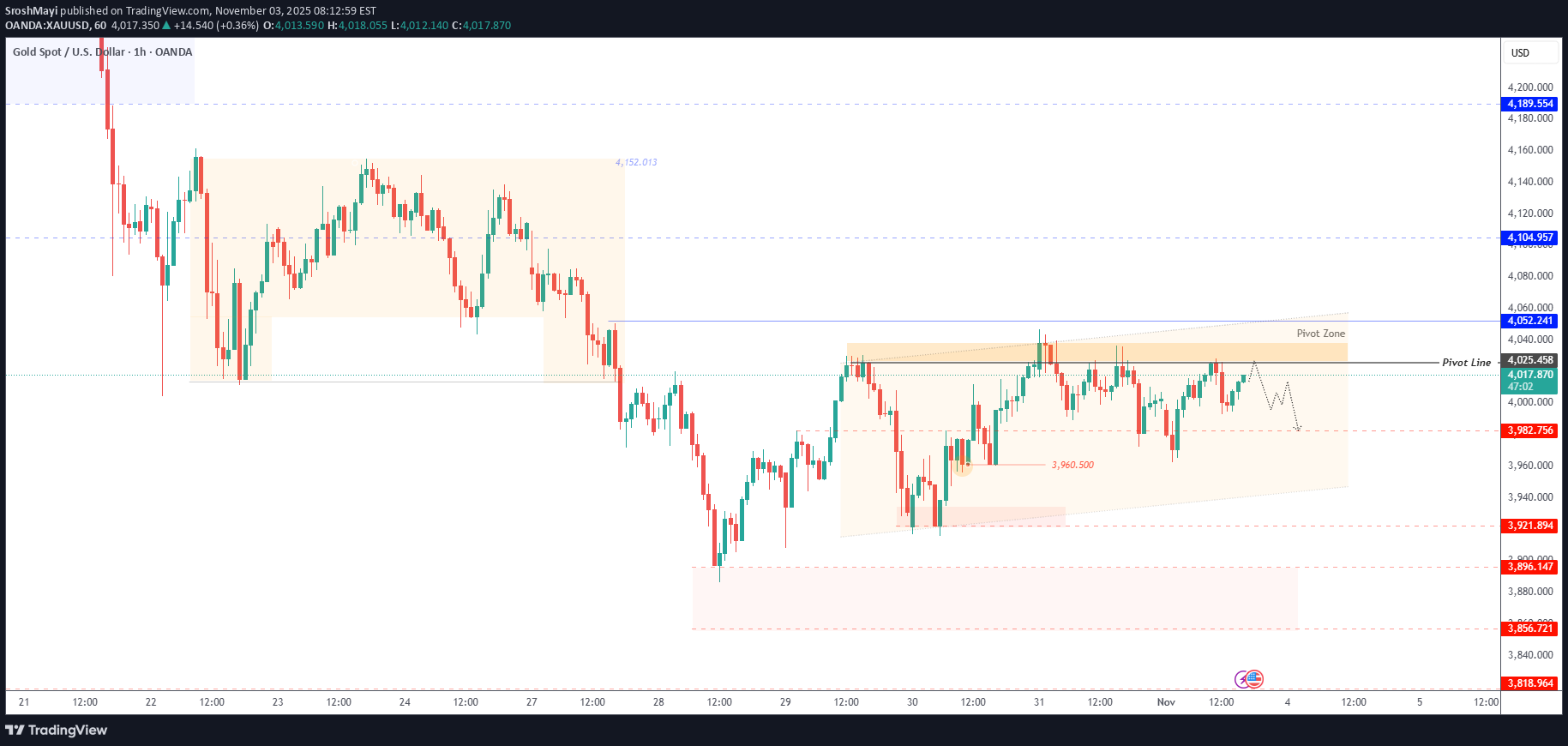

GOLD | Gains Capped by Trade Uncertainty and Fed Expectations

GOLD – MARKET OUTLOOK | Gains Capped by Trade Uncertainty and Fed Expectations Gold futures rose slightly but gains remain limited as investors assess the U.S.–China trade deal and potential Fed rate cuts. Market sentiment stays cautious, with traders awaiting key U.S. data for direction. Below 4,025: Bearish bias toward 3,982 → 3,960 → 3,921. Above 4,025: Bullish recovery toward 4,053 → 4,104. Pivot: 4,025 Support: 3,982 · 3,960 · 3,921 Resistance: 4,053 · 4,080 · 4,104 Gold remains bearish below 4,025, but a confirmed break above 4,053 could shift sentiment to bullish in the near term. PREVIOUS IDEA:GOLD – MARKET OUTLOOK | Bearish Momentum Holds After $43 Drop Gold moved exactly as projected, dropping from 4,025 to 3,982 — a decline of about $43. The metal remains under bearish pressure while trading below 3,998, with momentum still favoring the downside. 🔽 Below 3,998: Bearish continuation toward 3,982 → 3,961 → 3,921. 🔼 Above 3,998: Short-term recovery toward 4,010 → 4,025 → 4,052. Pivot: 3,998 Support: 3,982 · 3,961 · 3,921 Resistance: 4,010 · 4,025 · 4,052 Gold remains bearish below 3,998, but a close above this zone could trigger a short-term bullish correction before the next move.GOLD – MARKET OUTLOOK | Gains Over 1% as Dollar Eases and Risk-Off Mood Lifts Demand 🪙 Gold rose over 1% on Wednesday, supported by a weaker U.S. dollar and increased safe-haven demand as investors turned risk-averse. 🔽 Below 3,982: Bearish momentum expected toward 3,961 → 3,921 → 3,897. 🔼 Above 3,983: Bullish continuation possible toward 3,997 → 4,025. Pivot: 3,961 Support: 3,947 · 3,921 · 3,897 Resistance: 3,982 · 3,997 · 4,025 Gold remains bearish while below 3,982, but a 1H close above this level could trigger a short-term bullish reversal toward 4,025.