SroshMayi

@t_SroshMayi

What symbols does the trader recommend buying?

Purchase History

Trader Messages

Filter

Message Type

SroshMayi

Bitcoin Bearish Below 87.3K as ETF Outflows Intensify

Crypto Selloff Accelerates Amid ETF Outflows The cryptocurrency market downturn has intensified as spot Bitcoin ETFs recorded nearly $900 million in outflows, led by the iShares Bitcoin Trust. This wave of selling has added significant pressure across the market. Bitcoin has fallen about 26% this month, dropping from the 110.3K area and now trading below 87K, reflecting sustained bearish sentiment. Technical Outlook Bitcoin continues to look weak in the short term under current conditions. As long as price remains below the 87.3K pivot, downside pressure is expected to continue toward 76.68K, and a break lower may extend the decline to 72.6K. In the case of a bullish recovery, Bitcoin would need to close a daily candle above 87.3K to signal a corrective move toward 95.5K and potentially higher. Pivot Line: 87.3K Support: 76.68K, 72.6K, 66.4K Resistance: 95.5K, 100K

SroshMayi

Gold Falls as Rate-Cut Bets Fade | Bears Take Control

GOLD | Overview Gold extends its decline for the fourth straight session as traders scale back expectations for further Fed rate cuts this year. Several Fed officials have signaled caution, pushing rate-cut odds below 50%, while investors wait for delayed U.S. economic data to gauge the economic outlook. This shift in sentiment continues to pressure gold in the short term. Technically: Gold remains in a bearish structure while trading below the 4054 pivot level, with downside momentum targeting 4015 and 3983. A break below 3983 would extend losses toward 3962. A bullish recovery would require a 1H candle close above 4055, which could lift the price toward 4083 and 4105, with further extension to 4135 if buying strength increases. Key Levels Pivot Line: 4054 Support: 4015 · 3982 · 3962 Resistance: 4083 · 4105 · 4135

SroshMayi

GOLD BEARISH MOMENTUM BELOW 4084

GOLD – MARKET OUTLOOK Gold traded sideways between 4103 and 4055 on Monday as investors awaited key U.S. economic data for clues on the Federal Reserve’s rate path, following a sharp 2% decline in the previous session. Below 4055: A 1H close beneath this support is expected to trigger further bearish momentum toward 4013 → 3979, confirming continuation of the downside bias. Above 4103: A break and 4H close above this level would shift momentum to the upside, opening the way toward 4148. Pivot: 25010 Support: 4055 · 4013 · 3979 Resistance: 4103 · 4148 Gold is currently consolidating within its pivot range — maintaining pressure below 4055 keeps the bearish outlook intact, while a stable move above 4103 would signal a bullish recovery.

SroshMayi

Gold Hits 3-Week High on U.S. Debt Concerns & Fed Rate-Cut Bets

GOLD | Overview Gold Hits 3-Week High on U.S. Debt Concerns and Fed Rate-Cut Expectations Gold extended gains to a three-week high as growing concerns over U.S. debt levels and renewed expectations for Federal Reserve rate cuts fueled demand for the safe-haven asset. Volatility is likely to remain elevated as traders position ahead of key U.S. data and central bank commentary. Technically: Gold maintains a bullish bias, but a clear 1H candle close above 4238 is required to confirm the next bullish leg toward 4254, 4267, and 4300. While trading below 4238, the price may stage a short-term correction toward 4222 and 4207 before resuming its upward move. A 15-minute close below 4207 would invalidate the bullish setup temporarily and could extend losses toward 4186. Pivot Line: 4238 Resistance: 4254 · 4267 · 4300 Support: 4222 · 4207 · 4186

SroshMayi

Shutdown Deal in Focus | Gold Prices Pause Before Key Vote

GOLD | Overview Gold steady ahead of U.S. House vote on government reopening. Gold prices remained steady on Wednesday as investors awaited a U.S. House of Representatives vote on a deal to reopen the federal government, an outcome that could restore economic data visibility and shape expectations for future Federal Reserve rate cuts. Technically: Gold maintains a bearish bias while trading below the 4132–4144 pivot zone, with downside potential toward 4104, and a break below this level could extend losses to 4083 and 4053. However, a 1H close above 4145 would shift sentiment to bullish, targeting 4168 and 4190, with further extension possible toward 4207. Pivot Zone: 4132 – 4144 Resistance: 4168 · 4190 · 4207 Support: 4104 · 4083 · 4053

SroshMayi

Geopolitical Shock Hits Bitcoin | Traders Eye 106.20K Key Level

BITCOIN (BTCUSD) | Overview China Accuses U.S. of Seizing $13B in Bitcoin as Tensions Escalate. A long-running Bitcoin mystery from 2020 has resurfaced — this time involving a geopolitical twist. China has accused the United States of secretly taking control of 127,000 stolen Bitcoins, valued at roughly $13 billion, in what could become one of the most controversial crypto disputes to date. The allegation has added fresh strain to the already tense relationship between the two largest global powers, fueling uncertainty in both crypto and broader risk markets. Technically: Bitcoin shows signs of bearish momentum, with price action likely to retest 102.64K. A confirmed break below this level could extend the decline toward 98.94K and 95.50K. However, if the price closes a daily candle above 106.20K, it would signal renewed bullish momentum, targeting 110.36K, and potentially 113.80K on further strength. Pivot Line: 106.20K Resistance: 110.36K · 113.80K · 116.40K Support: 102.64K · 98.95K · 95.50K Outlook: Bitcoin remains bearish while below 106.20K, with downside potential toward 102.64K – 98.95K. A confirmed daily close above 106.20K would shift momentum to bullish, opening the way toward 110.36K – 113.80K previous idea:BTCUSD LIVE UPDATE Dropped about -8% Take a look at the chart to understand the next directionBTC is moving strongly, gaining more than +15%. EXACTLY AS WE MENTIONED The price has reached the target we mentioned earlier and is still pushing lower. If BTC closes a daily candle below 87.2K, it will increase the probability of extending the move toward 84K and 77K.

SroshMayi

Gold Steadies Near 2-Week Highs | Traders Watch 4168 Breakout

GOLD | Overview Gold’s outlook remains positive in the near term, as the precious metal extended its rally this week amid optimism over an imminent end to the U.S. government shutdown and expectations of continued monetary easing from the Federal Reserve. Technically: Gold has stabilized above 4130, indicating solid bullish momentum, with potential to reach 4155 and 4168. A sustained move above 4168 would further strengthen the uptrend, targeting 4190 – 4207. However, if the price closes a 1H candle below 4130, it would suggest a shift to bearish momentum, exposing downside targets at 4105 and 4085. Pivot Line: 4130 Resistance: 4155 · 4168 · 4207 Support: 4105 · 4085 · 4055 Outlook: Gold remains bullish while above 4130, with momentum favoring a move toward 4155–4168 and potential extension to 4207. A confirmed 1H close below 4130 would signal the start of a bearish correction toward 4105–4085

SroshMayi

Gold – Holding Below 4102 | Key Breakout Zone to Watch

GOLD | Overview Gold soars on Fed rate-cut bets despite government shutdown progress. Prices jumped in early trading, supported by rising expectations of further interest rate cuts in December after U.S. data revealed a surge in October layoffs and weakening consumer sentiment — the highest concern level in over two weeks. Signs of a slowing U.S. economy outweighed optimism over progress in ending the record-breaking government shutdown, keeping demand for safe-haven assets elevated. Technically: Gold remains under bearish momentum as long as it trades below 4102, with downside targets at 4056 and 4025. However, a temporary correction toward 4090–4102 is possible before resuming the bearish move. On the other hand, a 1H close above 4102 would shift bias to bullish continuation, targeting 4155 and 4189. Pivot Line: 4102 Resistance: 4102 · 4155 · 4189 Support: 4056 · 4025 · 4004 Outlook: Gold remains bearish while below 4102, with potential for correction toward 4090–4102 before resuming its decline to 4056–4025. A confirmed 1H close above 4102 would invalidate the bearish bias and support a bullish reversal toward 4155–4189.

SroshMayi

Gold – Bearish Momentum Builds | Key Support at 3983

GOLD | Fundamental & Technical 💎 🔻 Fundamental: Gold climbed back above $4,000 as traders weigh the impact of recent U.S. labor data on the Federal Reserve’s rate path. 🟢 With the Fed’s final 2025 meeting approaching and key data delayed by the U.S. government shutdown, markets face heightened uncertainty over the next policy move. 🟢 Despite the recovery, the broader trend remains technically sensitive near a key resistance zone. 🕯 Technically: Currently, gold is testing the 4025 resistance area. 🔽 As long as price remains below 4025, bearish pressure may continue toward 3983 → 3961. 🔼 A 1H close above 4025, however, would confirm renewed bullish momentum, targeting 4055, with an extended upside path toward 4105 if momentum accelerates. Key Levels Pivot Line: 4025 Resistance: 4053 · 4076 · 4105 Support: 3984 · 3961 · 3925GOLD | Overview Gold continues to consolidate within the 4025–3978 range, showing signs of indecision as traders await a clear breakout. The broader structure remains bearish, with sellers maintaining control while the price trades below 4009. As long as gold stays under 4009, the market is expected to remain in a bearish trend, targeting 3990 and 3978. However, a 15-minute close above 4009 would likely trigger a move toward 4025, and a confirmed break above 4025 would shift the bias to bullish, targeting 4056 and 4083. Pivot Line: 4009 Resistance: 4025 · 4056 · 4083 Support: 3983 · 3961 · 3921 Outlook: Gold remains bearish while below 4009, with consolidation expected until a decisive breakout occurs. A confirmed close above 4025 would shift sentiment toward a bullish continuation targeting 4056–4083.

SroshMayi

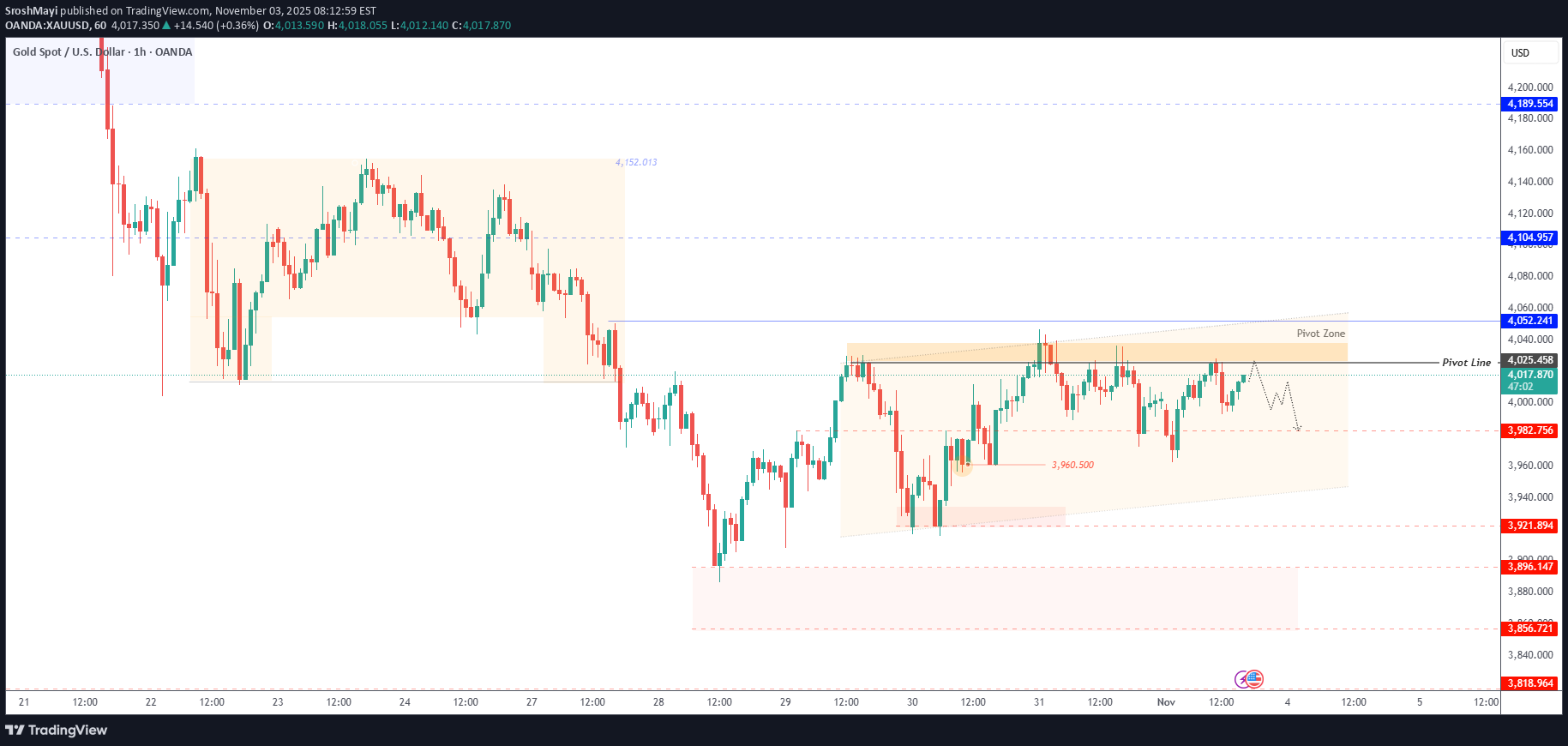

GOLD | Gains Capped by Trade Uncertainty and Fed Expectations

GOLD – MARKET OUTLOOK | Gains Capped by Trade Uncertainty and Fed Expectations Gold futures rose slightly but gains remain limited as investors assess the U.S.–China trade deal and potential Fed rate cuts. Market sentiment stays cautious, with traders awaiting key U.S. data for direction. Below 4,025: Bearish bias toward 3,982 → 3,960 → 3,921. Above 4,025: Bullish recovery toward 4,053 → 4,104. Pivot: 4,025 Support: 3,982 · 3,960 · 3,921 Resistance: 4,053 · 4,080 · 4,104 Gold remains bearish below 4,025, but a confirmed break above 4,053 could shift sentiment to bullish in the near term. PREVIOUS IDEA:GOLD – MARKET OUTLOOK | Bearish Momentum Holds After $43 Drop Gold moved exactly as projected, dropping from 4,025 to 3,982 — a decline of about $43. The metal remains under bearish pressure while trading below 3,998, with momentum still favoring the downside. 🔽 Below 3,998: Bearish continuation toward 3,982 → 3,961 → 3,921. 🔼 Above 3,998: Short-term recovery toward 4,010 → 4,025 → 4,052. Pivot: 3,998 Support: 3,982 · 3,961 · 3,921 Resistance: 4,010 · 4,025 · 4,052 Gold remains bearish below 3,998, but a close above this zone could trigger a short-term bullish correction before the next move.GOLD – MARKET OUTLOOK | Gains Over 1% as Dollar Eases and Risk-Off Mood Lifts Demand 🪙 Gold rose over 1% on Wednesday, supported by a weaker U.S. dollar and increased safe-haven demand as investors turned risk-averse. 🔽 Below 3,982: Bearish momentum expected toward 3,961 → 3,921 → 3,897. 🔼 Above 3,983: Bullish continuation possible toward 3,997 → 4,025. Pivot: 3,961 Support: 3,947 · 3,921 · 3,897 Resistance: 3,982 · 3,997 · 4,025 Gold remains bearish while below 3,982, but a 1H close above this level could trigger a short-term bullish reversal toward 4,025.

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.