SOL

Solana

| Trader | Signal Type | Profit Price/Stop Loss Price | Publish Time | View Message |

|---|---|---|---|---|

BUY | Profit Price: ۱۴۲ Stop Loss Price: Not specified | 12/10/2025 | ||

BUY | Profit Price: ۱۴۶ Stop Loss Price: Not specified | 12/10/2025 | ||

BUY | Profit Price: ۱۹۷ Stop Loss Price: ۱۲۱ | 12/10/2025 | ||

SELL | Profit Price: Not specified Stop Loss Price: Not specified | 1 hour ago | ||

BUY | Profit Price: Not specified Stop Loss Price: Not specified | 3 hour ago |

Price Chart of Solana

Profit 3 Months :

Signals of Solana

Filter

Sort messages by

Message Type

Trader Type

Time Frame

The New Architecture of Sustainable Finance In the modern global economy, sustainability has shifted from being a moral consideration to a strategic and financial imperative. At the center of this transformation lie ESG (Environmental, Social, and Governance) principles and carbon credit trading, two closely linked frameworks that are reshaping how businesses, investors, and governments measure value, manage risk, and pursue long-term growth. Together, they form the backbone of sustainable finance and climate-aligned markets. Understanding ESG: Beyond Profits ESG refers to a set of non-financial criteria used to evaluate a company’s operations and long-term resilience. Environmental (E): How a company manages its impact on nature—carbon emissions, energy usage, waste management, water conservation, and biodiversity. Social (S): How it treats employees, customers, and communities—labor practices, human rights, diversity, workplace safety, and customer responsibility. Governance (G): How it is managed—board structure, executive compensation, transparency, shareholder rights, and ethical conduct. Unlike traditional financial metrics that focus mainly on short-term profitability, ESG frameworks aim to capture long-term sustainability and risk-adjusted performance. Investors increasingly believe that companies with strong ESG practices are better positioned to handle regulatory changes, reputational risks, climate shocks, and social disruptions. Why ESG Matters in Capital Markets ESG has become a decisive factor in global capital allocation. Institutional investors, sovereign wealth funds, pension funds, and asset managers now integrate ESG scores into portfolio decisions. This shift is driven by three powerful forces: Risk Management: Climate change, social unrest, and governance failures can destroy shareholder value. ESG analysis helps identify hidden risks. Regulatory Pressure: Governments worldwide are mandating ESG disclosures, forcing companies to report sustainability metrics alongside financial results. Investor Preference: A growing base of investors prefers companies aligned with ethical, environmental, and social responsibility. As a result, ESG is no longer a “nice-to-have” feature—it directly affects stock valuations, borrowing costs, and access to global capital. Carbon Credit Trading: Putting a Price on Pollution Carbon credit trading is a market-based mechanism designed to reduce greenhouse gas emissions by assigning a monetary value to carbon dioxide and other greenhouse gases. A carbon credit typically represents the right to emit one metric ton of CO₂ (or equivalent gases). Companies that emit less than their allowed quota can sell surplus credits, while high emitters must buy credits to offset excess emissions. There are two major carbon markets: Compliance Markets: Mandated by governments (e.g., cap-and-trade systems). Companies must comply with legally binding emission limits. Voluntary Carbon Markets (VCMs): Companies voluntarily purchase credits to meet sustainability goals, net-zero pledges, or ESG commitments. By attaching a financial cost to emissions, carbon trading incentivizes businesses to innovate, adopt cleaner technologies, and improve energy efficiency. The Link Between ESG and Carbon Credit Trading Carbon credit trading is a practical tool that directly supports the Environmental pillar of ESG. Companies with strong ESG strategies often use carbon credits to: Offset unavoidable emissions Achieve carbon neutrality or net-zero targets Demonstrate measurable climate action to investors Improve ESG ratings and sustainability scores In essence, carbon markets convert climate responsibility into a tradable financial instrument, aligning environmental goals with market incentives. Carbon Credits as a Financial Asset Over time, carbon credits have evolved from regulatory instruments into tradable assets. They are now bought and sold by: Corporations managing emissions Financial institutions and hedge funds ESG-focused investment funds Commodity traders and exchanges This financialization has increased liquidity, price discovery, and global participation, while also introducing volatility and speculation. Carbon prices now respond to policy changes, economic growth, energy transitions, and geopolitical developments—much like traditional commodities. ESG Ratings and Corporate Strategy Companies are increasingly embedding ESG into their core strategies rather than treating it as a compliance exercise. Carbon credit trading plays a critical role in this shift: Operational Strategy: Firms invest in renewable energy, efficiency upgrades, and carbon offsets to reduce exposure to carbon costs. Reputation Management: Transparent use of high-quality carbon credits enhances credibility with stakeholders. Capital Access: Strong ESG performance lowers financing costs and attracts long-term investors. However, the effectiveness of ESG depends on authentic action, not cosmetic compliance. Challenges and Criticism Despite their promise, ESG and carbon credit markets face several challenges: Greenwashing: Some companies exaggerate ESG claims or rely excessively on low-quality carbon offsets. Lack of Standardization: ESG ratings vary widely across agencies, creating confusion and inconsistency. Carbon Credit Quality: Not all credits deliver real, additional, and permanent emission reductions. Market Transparency: Voluntary carbon markets still lack unified oversight and pricing benchmarks. These issues have sparked calls for stricter regulation, better disclosure standards, and improved verification mechanisms. The Role of Technology Technology is accelerating trust and efficiency in ESG and carbon markets: Blockchain: Ensures traceability and prevents double-counting of carbon credits. AI and Data Analytics: Improve ESG scoring, emissions tracking, and risk assessment. Satellite Monitoring: Verifies forest conservation, renewable energy output, and land-use projects. These innovations are helping transform ESG and carbon trading into more reliable and scalable systems. Future Outlook: ESG and Carbon Trading as Economic Pillars Looking ahead, ESG and carbon credit trading are expected to become central pillars of the global financial system. As climate risks intensify and governments tighten emissions regulations, carbon prices are likely to rise, making sustainability a competitive advantage rather than a cost burden. Key future trends include: Integration of carbon pricing into mainstream financial models Expansion of regulated carbon markets across emerging economies Greater convergence of ESG reporting standards Increased investor scrutiny of carbon offset quality Conclusion ESG and carbon credit trading represent a fundamental shift in how markets define value, risk, and responsibility. By embedding environmental and social costs into financial decision-making, they bridge the gap between economic growth and planetary limits. While challenges remain, their evolution signals a future where sustainability and profitability are no longer opposing goals—but interconnected drivers of long-term success. In this new financial architecture, companies that adapt early and authentically will not only comply with regulations but also gain strategic, reputational, and financial advantages in a rapidly changing world.

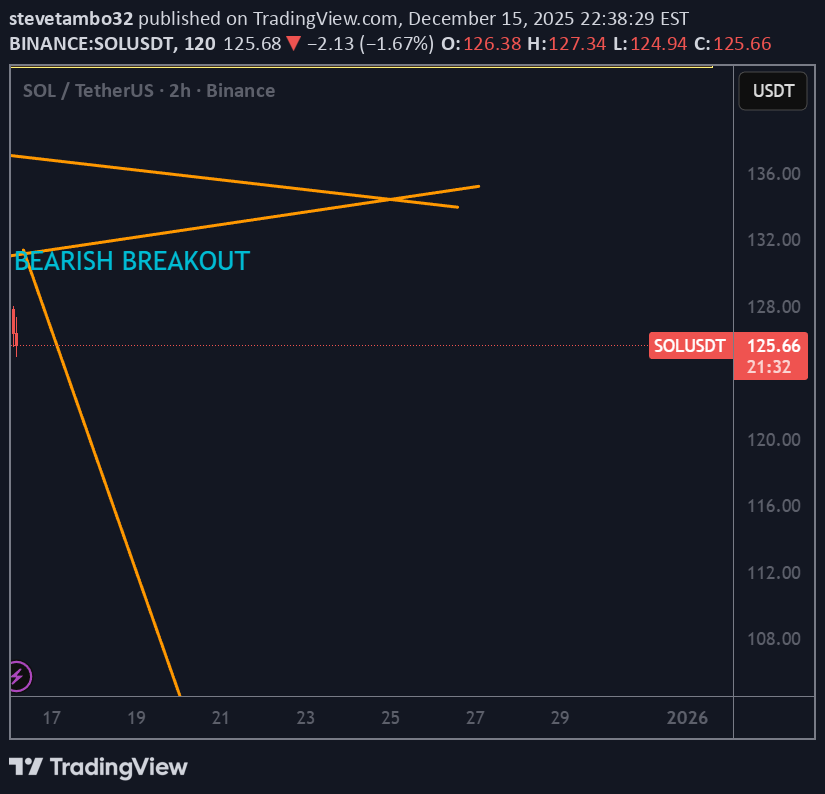

Trend Check: SOL is continuing its slow bleed lower with no bullish MSB and a persistent downtrend. Structure has remained bearish with no demand being respected. Indicators: RSI: 42 (bearish zone) MACD: Bearish, deep cross with momentum growing Structure: Lower highs and lower lows define SOL’s movement. Failed retest of $155–$160 zone confirmed sellers still control the market. Position: Short bias Entry Idea: Short under $128 Stop: Above $134 Targets: $118 → $105 Reasoning: No structural shift, MACD and RSI agree with bearish momentum. Clean setup for continuation lower.

Price has tested an extreme demand zone at around $124 where it bounced from and showed bullish reaction. It is expected to keep pushing upwards and liquidate the high at $146.87 before filling the imbalance above it.

Hi! SOL remains in a clear descending channel, indicating sustained bearish momentum. After a period of consolidation within the rectangular range, the price recently rejected the upper boundary, forming a potential continuation pattern. The RSI sits near 40, signaling slight oversold conditions but no strong reversal yet. Price action suggests a likely retest of the channel’s lower boundary near $117.48, aligning with the support zone highlighted. Traders should watch for confirmation of a bounce at this level or continuation lower. Short-term pullbacks may occur, but the dominant trend remains bearish. Conclusion: Trend-following strategy favored; bearish continuation likely, $117 support key.

مرحباً بالجميع، معكم دوميك، على الإطار الزمني 4 ساعات، كسر SOL بشكل حاسم منطقة الدعم 130–132 وتراجع سريعاً نحو 125–126 مع شموع هابطة طويلة مصحوبة بارتفاع في أحجام التداول. هذا السلوك السعري يوضح بجلاء أن ضغط البيع النشط بات يسيطر على السوق. ما يحدث هنا ليس مجرد هزّة مؤقتة، بل تأكيد واضح على أن الاتجاه الهابط أصبح هو المسيطر. بعد موجة الهبوط، تحرك السعر بشكل جانبي لفترة قصيرة فقط لإعادة توازن السيولة، دون ظهور قوة شراء واضحة أو نموذج انعكاس صريح. هذا النوع من البنية غالباً ما يظهر قبل استئناف الاتجاه الرئيسي. السيناريو المفضل هو ارتداد تقني نحو منطقة 130–132، يتبعه هبوط جديد باتجاه 123–125. وإذا تم كسر هذه المنطقة، فقد يمتد التراجع إلى نطاق 118–120. النظرة السلبية لا تُلغى إلا في حال أغلق SOL شمعة 4 ساعات بشكل واضح فوق مستوى 136. وحتى ذلك الحين، ينبغي التعامل مع جميع الارتدادات على أنها فرص للبيع بما يتماشى مع الاتجاه السائد. أتمنى لكم تداولاً موفقاً!

Hello everyone, this is Domic, On the 4H timeframe, SOL has decisively broken below the 130–132 support zone and dropped quickly toward 125–126 with long bearish candles accompanied by rising volume. This price action clearly shows active selling pressure taking control of the market. This is not a minor shakeout, but a confirmation that the downtrend is now dominant. After the sell-off, price has only moved sideways briefly to rebalance liquidity, without any strong buying response or clear reversal pattern. This type of structure typically appears before the primary trend resumes. The preferred scenario is a technical rebound back toward the 130–132 zone, followed by another leg down toward 123–125. If this area is breached, the decline could extend further toward 118–120. The bearish outlook would only be invalidated if SOL prints a clear 4H close above 136. Until then, all rebounds should be viewed as selling opportunities in line with the prevailing trend. Wishing you successful trading!

Lingrid | SOLUSDT Consolidation Phase Then Bearish Continuation

SOLUSDT continues to trade beneath the descending trendline, with repeated failures around the 135–138 supply band reinforcing a sequence of lower highs. Price remains compressed inside a narrow consolidation zone, suggesting distribution rather than accumulation as momentum fades. The structure still leans bearish, as buyers struggle to reclaim broken support levels with conviction. If price breaks below the upward trendline, SOL could roll over toward the 110 region, where prior demand and the lower channel boundary intersect. That zone may act as a temporary pause, but acceptance below 135 would keep downside risks dominant. ➡️ Primary scenario: rejection from 135 → continuation toward 110. ⚠️ Risk scenario: a decisive reclaim above 138–140 could disrupt the bearish structure and force a reassessment toward 150. If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

SOL-USDT

It has reached its reliable bottom at $123. It has bounced off this level several times, so it can be counted on📊✔️ If it stays above this level, it could rise up to the upward trend line🔼💲

This trade is using technical only Before enter the trade, we must wait for confirmation Bullish Engulfing on OB / FVG Area then Enter. 1. Target Profit is 300++ pips 2. Set Stoploss on LL or under OB

SOL price breaks below lower channel of symmetrical triangle. Bearish continuation confirmed? Price in favour of shorts now with next support around $85-97

Disclaimer

Any content and materials included in Finbeet's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.